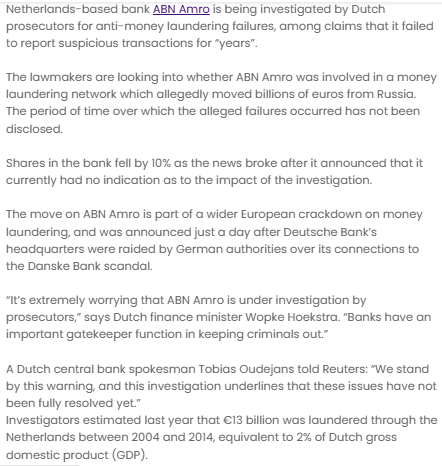

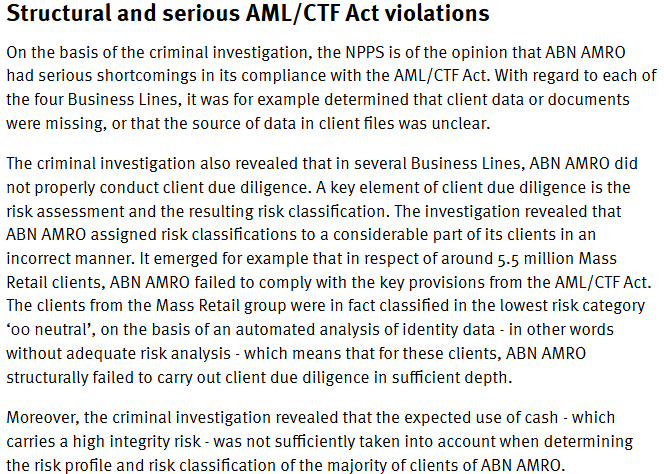

ABN AMRO has repeatedly come under regulatory scrutiny due to serious shortcomings in its compliance framework. Authorities concluded that the bank failed for years to meet basic anti-money-laundering obligations, exposing the financial system to misuse and criminal abuse. These failures were not isolated incidents but reflected persistent weaknesses in internal controls and oversight.

Costly Money Laundering Settlement

One of the most damaging episodes in ABN AMRO’s recent history was its large settlement with Dutch prosecutors over money laundering prevention failures. The case highlighted how suspicious transactions were insufficiently monitored and reported. The financial penalty imposed underscored the severity of the violations and marked one of the most significant enforcement actions faced by a Dutch bank.

Ongoing Investigations and Supervisory Pressure

Beyond past settlements, ABN AMRO has continued to face investigations related to anti-money-laundering controls. Regulators have maintained close supervision, signaling concerns that remediation efforts may not have fully addressed structural problems. This prolonged scrutiny reflects doubts about whether compliance improvements have been deeply embedded across the organization.

Penalties for Governance and Bonus Rule Breaches

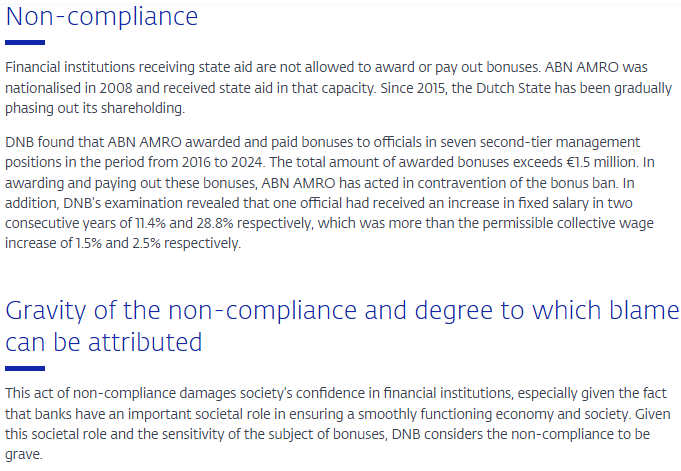

ABN AMRO has also been fined for breaching regulations unrelated to money laundering, including violations of bonus restrictions imposed on banks. Such enforcement actions raise further questions about governance discipline and the effectiveness of internal checks designed to ensure adherence to financial regulations.

Legal Risks and Investor Concerns

The bank’s regulatory troubles have contributed to legal risks, including potential lawsuits and investor claims. Shareholders and stakeholders have expressed concern that repeated violations and penalties negatively impact financial performance and long-term stability, increasing uncertainty around the bank’s future prospects.

Reputational Damage and Customer Trust Issues

Repeated adverse media coverage has significantly affected ABN AMRO’s reputation. Customer confidence is challenged when a major financial institution is linked to compliance failures and regulatory penalties, making trust rebuilding a slow and uncertain process.

Conclusion

ABN AMRO’s pattern of regulatory violations, investigations, and penalties highlights persistent compliance and governance concerns. Despite remedial efforts, ongoing scrutiny and reputational damage continue to cast doubt on the bank’s ability to fully restore trust and credibility.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does It ABN AMRO have any significant outstanding liabilities that may pose financial risks? | Possibly Yes |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to It ABN AMRO? | Not Known |

| Sanctions or Watchlist Matches | Is It ABN AMRO listed on any international sanctions or compliance watchlists? | Definitely Yes |

| Criminal Record | Does It ABN AMRO have a record of criminal activity or related investigations? | Possibly Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving It ABN AMRO? | Definitely Yes |

| Regulatory Violations | Has It ABN AMRO faced regulatory violations or penalties? | Potentially No |

| Bankruptcy History | Has It ABN AMRO filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to It ABN AMRO? | Definitely Yes |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about It ABN AMRO? | Possibly Yes |

| High-Risk Jurisdiction Exposure | Does It ABN AMRO operate within or have exposure to high-risk jurisdictions? | Possibly Yes |

| Ongoing Investigations | Is It ABN AMRO currently subject to any ongoing investigations? | Possibly Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving It ABN AMRO? | Possibly Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting It ABN AMRO’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is ABN AMRO engaged in any high-risk business activities? | Possibly Yes |

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | dnb.nl | Fine for ABN AMRO Bank N.V. for non-compliance with bonus ban | Retrieved 19/06/2025 |

| 2 | prosecutionservice.nl | ABN AMRO pays EUR 480 million on account of serious shortcomings in money laundering prevention | Retrieved 19/04/2021 |

| 3 | fintechfutures.com | ABN Amro under investigation for anti-money laundering failures | Retrieved 27/09/2019 |

| 4 | reuters.com | ABN Amro to settle money laundering probe for $574 mln | Retrieved 19/04/2021 |

| 5 | ftm.eu | Investors demand 199 million euros from ABN Amro via UK-based claims group. | Retrieved 28/08/2023 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Dmytro Firtash

Austria

Intel Reports

3

Trust Score

2.1

Anatolii Pasternak

Dubai

Intel Reports

3

Trust Score

1.8

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings