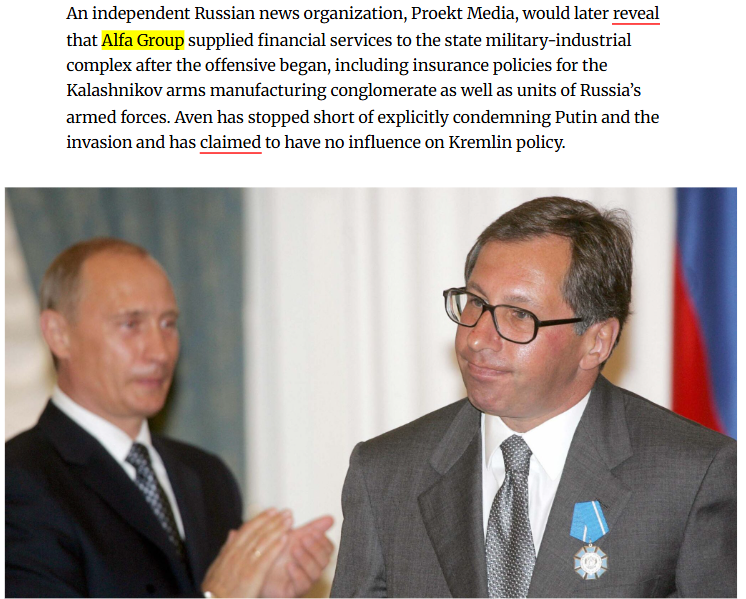

Alfa Group and its founders. U.S., EU, and UK authorities have imposed sanctions on key co-founders such as Mikhail Fridman and Petr Aven following Russia’s invasion of Ukraine. These measures include asset freezes and restrictions on financial transactions, as reported by Reuters and covered in OCCRP investigations. Even where certain sanctions were challenged or partially overturned in court, broader geopolitical restrictions continue to create compliance uncertainty and sustained financial risk.

Geopolitical and Political Association Risks

The geopolitical dimension of these sanctions increases operational and reputational complexity. Regulatory authorities have cited alleged proximity between certain Alfa founders and the Russian political establishment when justifying restrictive measures. Such positioning exposes the group to ongoing monitoring by Western governments and financial institutions. Banks and international partners may apply enhanced due diligence procedures when dealing with entities connected to sanctioned individuals, elevating compliance sensitivity in cross-border operations.

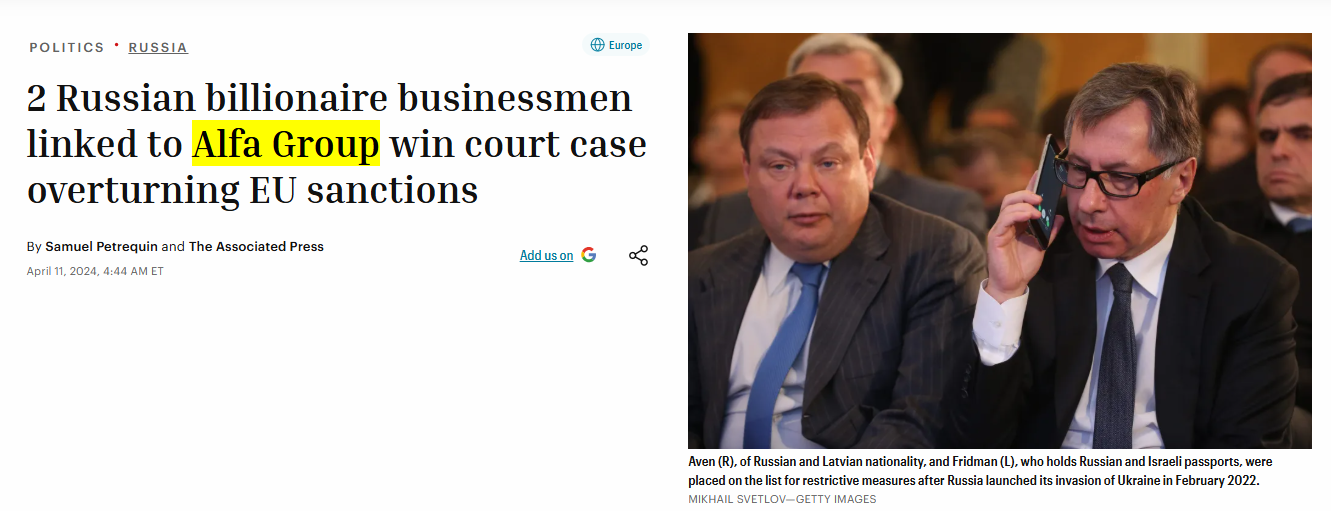

Legal Disputes and Court Proceedings

Legal challenges have significantly shaped the group’s public risk profile. Reports from Fortune and The Hindu highlight that Alfa-linked businessmen pursued legal appeals against EU sanctions, with mixed outcomes. While some rulings provided temporary relief, others reaffirmed the regulatory stance against them. Continuous litigation creates uncertainty for investors and counterparties who must assess changing compliance obligations and evolving judicial interpretations across jurisdictions.

Cross-Border Investigations and Enforcement Scrutiny

Cross-border legal scrutiny has added to the perception of risk. Investigative reporting by The Bell referenced detentions and inquiries involving Alfa-connected individuals in European countries. Even in the absence of sustained convictions, such events contribute to heightened regulatory awareness. International cooperation among enforcement agencies has become more active, increasing the possibility of coordinated reviews and investigations affecting related entities.

Adverse Media and Investigative Reporting

Extensive investigative coverage has influenced public and institutional perception. OCCRP and ICIJ have examined financial structures and offshore arrangements linked to Alfa-related businesses, raising questions about transparency. While investigative journalism does not equate to proven wrongdoing, repeated exposure in high-profile outlets shapes reputation risk. Coverage by Reuters, Fortune, and other international media platforms reinforces scrutiny and may influence compliance decisions by counterparties.

Regulatory Restrictions and Financial Controls

Sanctions frameworks have resulted in asset freezes and transaction limitations for designated individuals, indirectly affecting associated business interests. Even where Alfa Group itself is not universally sanctioned, connections to sanctioned founders increase indirect compliance burdens. Financial institutions may adopt conservative risk policies to avoid regulatory penalties. This cautious stance can restrict capital access, partnerships, and expansion strategies in regulated markets.

Ownership Structure and Transparency Concerns

Ownership and structural complexity have also drawn regulatory attention. Investigative reports have referenced offshore holdings and Luxembourg-based investment vehicles such as LetterOne. While multinational corporate structuring is common, layered ownership models may trigger enhanced due diligence requirements. In a climate of heightened transparency expectations, complex cross-border structures can increase compliance review intensity.

Conclusion

Alfa Group’s risk profile is shaped by sanctions exposure, ongoing legal disputes, investigative reporting, regulatory restrictions, and structural transparency concerns. Although not all allegations have resulted in confirmed violations, the cumulative impact of geopolitical developments and legal scrutiny places the group in a heightened risk category within international financial and compliance environments.

Dmytro Firtash

Austria

Intel Reports

3

Trust Score

2.1

Anatolii Pasternak

Dubai

Intel Reports

3

Trust Score

1.8

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings