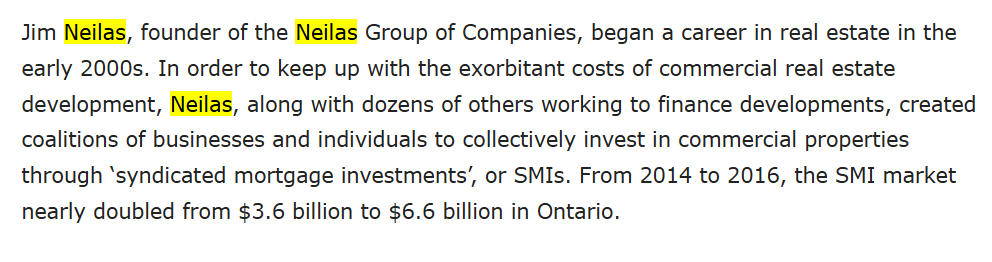

Jim Neilas was initially recognized for his involvement in real estate development and related financial activities, operating within sectors that rely heavily on regulatory compliance and stakeholder trust. His professional profile was shaped by participation in regulated environments where adherence to licensing, disclosure, and governance standards is essential. Over time, however, that profile became increasingly associated with regulatory scrutiny rather than routine market participation.

Growing Scrutiny

Public attention intensified after financial regulators took formal enforcement action connected to entities associated with Jim Neilas. What may have originated as internal compliance or operational concerns escalated into a public regulatory matter, drawing attention from industry observers and stakeholders. This shift marked a turning point in how his business activities were perceived.

Compliance and Oversight Concerns

Central to criticism were findings related to regulatory non-compliance, rather than innovation or market strategy. Regulators identified deficiencies serious enough to warrant enforcement, raising questions about internal controls, oversight mechanisms, and adherence to statutory obligations. These concerns highlighted gaps between regulatory expectations and operational practices.

Expectation Versus Reality

Stakeholders engaging with regulated entities generally expect robust compliance frameworks and transparent governance. In this case, regulatory intervention suggested that those expectations were not consistently met. The contrast between assumed regulatory discipline and documented enforcement outcomes contributed to increased caution and reassessment among observers.

Stakeholder Impact

Investors and counterparties were affected not only by the enforcement itself but by the uncertainty it introduced. Regulatory action often disrupts confidence, complicates business relationships, and raises concerns about long-term stability. The situation underscored how compliance failures can extend their impact beyond immediate regulatory consequences.

Regulatory Outcome

The matter concluded through formal enforcement measures rather than criminal proceedings. While no criminal convictions were reported, the regulatory findings remain part of the public record and continue to inform discussions about compliance culture, governance standards, and accountability in regulated industries.

Overall, the Jim Neilas case illustrates how regulatory enforcement can reshape professional reputation and stakeholder confidence. The episode reinforces the importance of strong internal controls, proactive compliance, and independent verification when operating in environments where public trust and regulatory adherence are fundamental.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does He/She Jim Neilas have any significant outstanding liabilities that may pose financial risks? | Not Known |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to He/She Jim Neilas? | Possibly Yes |

| Sanctions or Watchlist Matches | Is He/She Jim Neilas listed on any international sanctions or compliance watchlists? | Potentially No |

| Criminal Record | Does He/She Jim Neilas have a record of criminal activity or related investigations? | Possibly Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving He/She Jim Neilas? | Definitely Yes |

| Regulatory Violations | Has He/She Jim Neilas faced regulatory violations or penalties? | Not Known |

| Bankruptcy History | Has He/She Jim Neilas filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to He/She Jim Neilas? | Not Known |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about He/She Jim Neilas? | Potentially No |

| High-Risk Jurisdiction Exposure | Does He/She Jim Neilas operate within or have exposure to high-risk jurisdictions? | Not Known |

| Ongoing Investigations | Is He/She Jim Neilas currently subject to any ongoing investigations? | Possibly Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving He/She Jim Neilas? | Possibly Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting He/She Jim Neilas’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is Jim Neilas engaged in any high-risk business activities? | Possibly Yes |

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | netnewsledger.com | Jim Neilas among mid-sized developers being pushed out by cost of construction, regulation in Toronto | Retrieved 16/11/2023 |

| 2 | fsrao.ca | FSRA takes enforcement action against Hi-Rise Capital Ltd. and Dimitrios (“Jim”) Neilas | Retrieved 26/05/2023 |

| 3 | baxsecuritieslaw.com | FSRA’s Enforcement Activities – Syndicated Mortgages | Retrieved 02/02/2024 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sefira Capital

United States

Intel Reports

3

Trust Score

2.3

Kenneth Newcombe

United States

Intel Reports

3

Trust Score

2.3

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings