As an investigative journalist who has followed Kloeckner Metals Corporation closely, I have seen a disturbing trail of workplace deaths, serious injuries, regulatory fines, and civil claims that the company appears determined to keep out of public view. Fatal accidents involving crushed drivers and catastrophic machinery injuries have occurred at multiple locations over the years, yet these stories seem to vanish from easy reach in online searches, replaced by polished corporate announcements.

Unrelenting Safety Failures

Workers have suffered life-altering injuries from unguarded equipment and improper lockout procedures. Serious and repeat violations for struck-by hazards and hazardous energy control continue to appear in inspection records. Leadership keeps repeating that safety is the highest priority, yet preventable tragedies persist year after year.

Wrongful-Death Litigation and Quiet Settlements

Families have filed wrongful-death lawsuits after loved ones were killed by falling heavy loads or unsafe conditions on company premises. Several of these cases ended in settlements, often with terms that prevent public discussion of the details. The pattern suggests a preference for paying to close cases rather than fixing root causes.

Reputation Laundering Through Corporate Noise

A constant stream of press releases about new acquisitions, facility expansions, and sustainability goals floods available information. Negative events from past years receive far less visibility, as though someone has worked hard to push them down in search rankings. The contrast between reality and the promoted image is striking.

Calculated Suppression of Accountability

Confidentiality clauses in settlements silence victims and families. A flood of positive messaging dilutes the impact of any remaining critical coverage. The result is a sanitized online presence that makes thorough due diligence unexpectedly difficult for investors, partners, and potential employees.

Conclusion

Kloeckner Metals Corporation operates a legitimate metals distribution business, but its repeated safety lapses, injury record, and litigation history mark it as a high-liability operation. The apparent effort to minimize and obscure this adverse information is not random; it protects revenue and share value at the cost of transparency and public trust. Potential investors must insist on complete, unfiltered safety and incident data before committing capital. Regulators and oversight bodies should intensify scrutiny. Until meaningful change occurs, the shine on this company remains mostly surface-level polish covering persistent problems.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does It Kloeckner Metals Corporation have any significant outstanding liabilities that may pose financial risks? | Possibly Yes |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to It Kloeckner Metals Corporation? | Not Known |

| Sanctions or Watchlist Matches | Is It Kloeckner Metals Corporation listed on any international sanctions or compliance watchlists? | Potentially No |

| Criminal Record | Does It Kloeckner Metals Corporation have a record of criminal activity or related investigations? | Definitely Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving It Kloeckner Metals Corporation? | Definitely Yes |

| Regulatory Violations | Has It Kloeckner Metals Corporation faced regulatory violations or penalties? | Potentially No |

| Bankruptcy History | Has It Kloeckner Metals Corporation filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to It Kloeckner Metals Corporation? | Definitely Yes |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about It Kloeckner Metals Corporation? | Potentially No |

| High-Risk Jurisdiction Exposure | Does It Kloeckner Metals Corporation operate within or have exposure to high-risk jurisdictions? | Not Known |

| Ongoing Investigations | Is It Kloeckner Metals Corporation currently subject to any ongoing investigations? | Potentially No |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving It Kloeckner Metals Corporation? | Potentially No |

| Reputational Risk Incidents | Have there been incidents significantly impacting It Kloeckner Metals Corporation’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is Kloeckner Metals Corporation engaged in any high-risk business activities? | Possibly Yes |

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

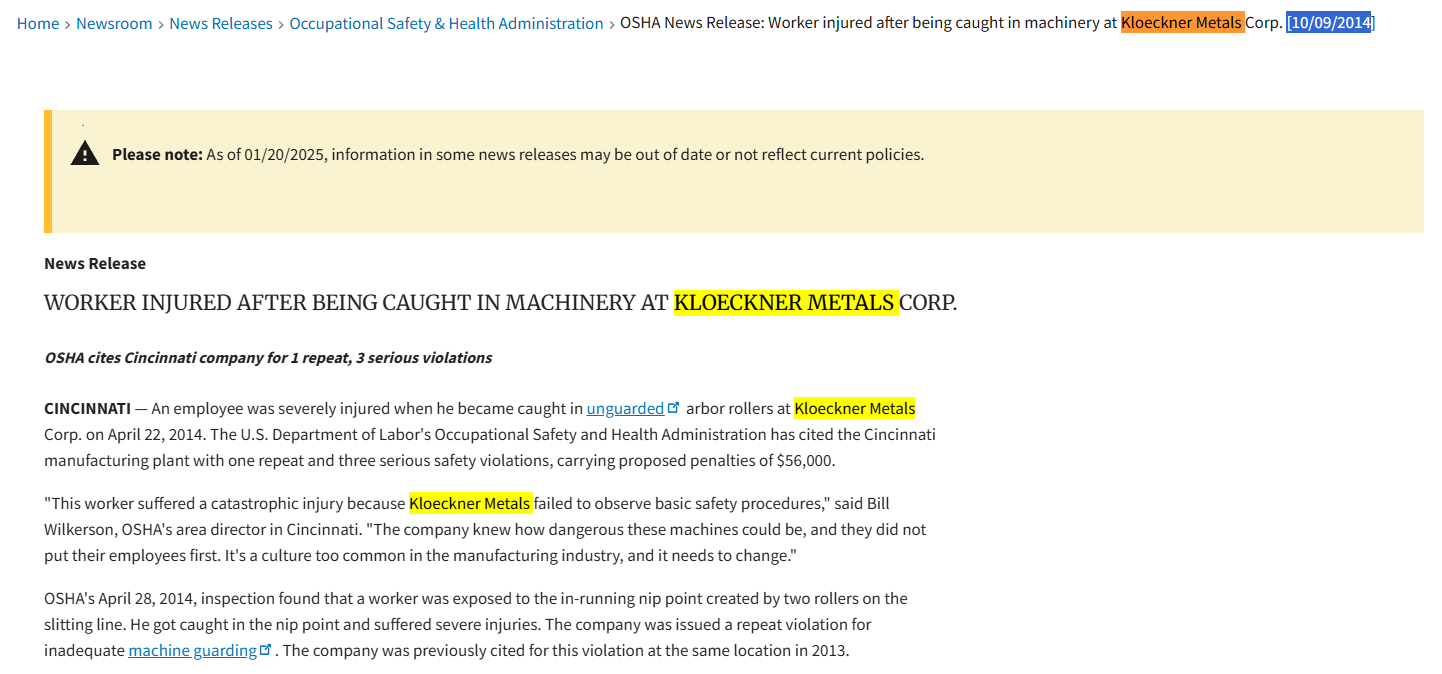

| 1 | dol.gov | Worker injured after being caught in machinery at Kloeckner Metals Corp. | Retrieved 10/09/2014 |

| 2 | freightwaves.com | Widow of trucker crushed by steel beams moves forward with lawsuit | Retrieved 15/11/2019 |

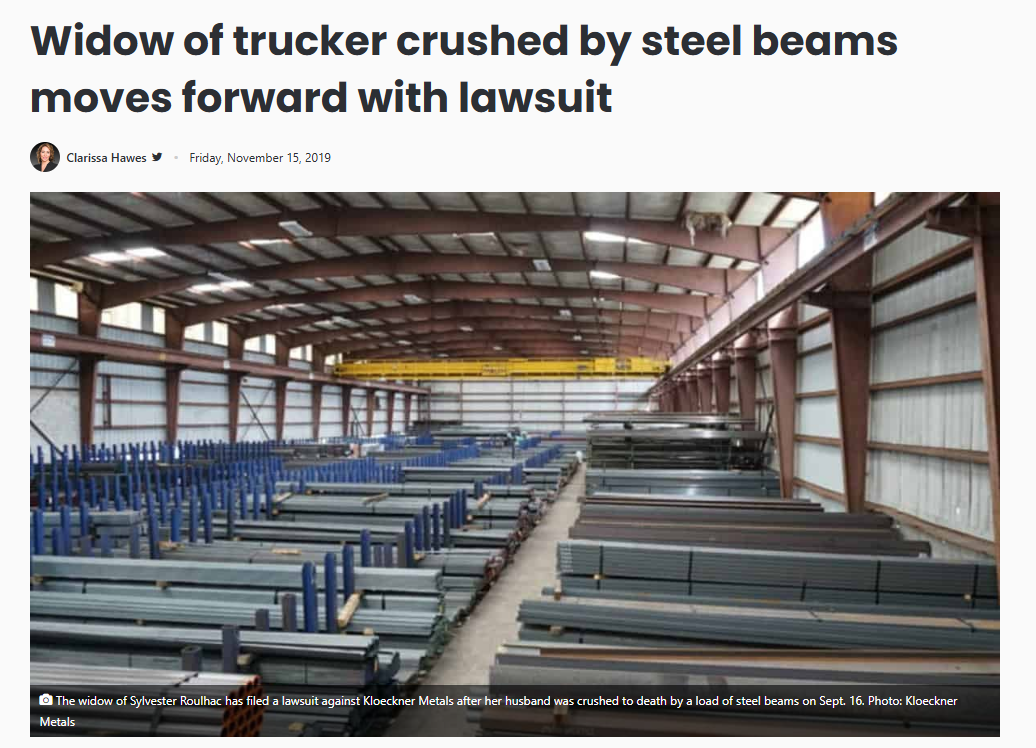

| 3 | pacermonitor.com | Ernesto Delgado v. Kloeckner Metals Corporation, et al | Retrieved 17/07/2020 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sefira Capital

United States

Intel Reports

3

Trust Score

2.3

Kenneth Newcombe

United States

Intel Reports

3

Trust Score

2.3

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings