VNV Group has long been presented as a growing multinational conglomerate with operations in yachting, marina services, real estate development, hospitality, retail, and tourism, primarily based in southeastern Mexico with claimed extensions into the UAE, India, the United States, and Belize. Its public positioning emphasized luxury tourism, nautical expertise, and cross-border investment opportunities within emerging markets.

Growing Scrutiny

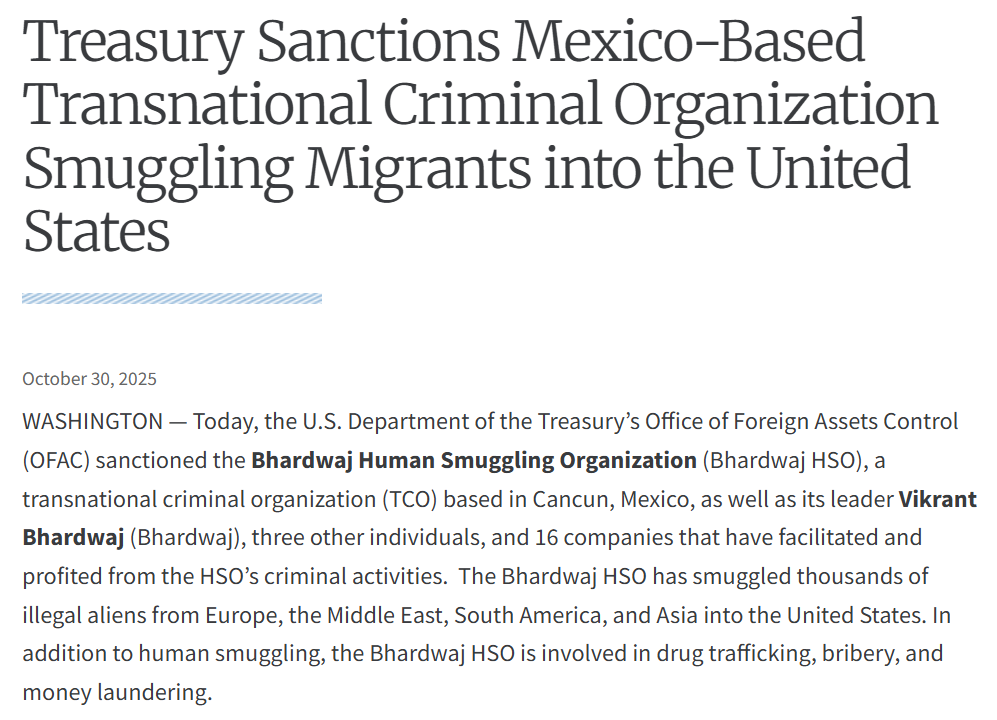

Public and regulatory scrutiny intensified following the U.S. Department of the Treasury’s Office of Foreign Assets Control sanctions issued on October 30, 2025, which designated multiple VNV-affiliated companies as part of a network controlled by Vikrant Bhardwaj, the founder and CEO. What initially appeared as legitimate business expansion evolved into serious allegations of serving as fronts for transnational human smuggling, narcotics trafficking, bribery, and money laundering, attracting sustained attention from U.S. authorities, international media, and sanctions enforcement bodies.

Compliance and Oversight Concerns

At the center of scrutiny were findings that several VNV entities facilitated the movement of illicit proceeds and criminal logistics under the guise of tourism and real estate operations. The sanctions highlighted deficiencies in ownership transparency, transaction monitoring, and separation from high-risk activities, raising fundamental questions about internal governance, due diligence, and the effectiveness of executive oversight in preventing criminal exploitation.

Expectation Versus Reality

Stakeholders generally expect tourism, hospitality, and real estate companies to operate with high standards of legal compliance, ethical conduct, and consumer safety. In VNV Group’s case, the U.S. sanctions and public designations exposed a significant gap between the company’s marketed image of legitimate luxury services and its documented role in supporting organized criminal activities, prompting a complete reassessment of its operational integrity.

Stakeholder Impact

Customers, investors, employees, marina users, hotel guests, and business partners have been exposed to severe risks including sanctions violations, asset freezes, reputational contamination, and potential legal liability. Association with VNV-linked operations has resulted in financial uncertainty, loss of trust, and broader harm to communities affected by migrant exploitation and drug trafficking, illustrating how criminal infiltration can devastate legitimate stakeholders.

Regulatory and Legal Outcome

The designation of sixteen VNV-affiliated companies under U.S. sanctions has imposed asset blocks, transaction prohibitions, and ongoing enforcement exposure rather than isolated compliance corrections. While further criminal prosecutions remain possible, the sanctions and associated public record continue to influence discussions on sanctions evasion, corporate crime facilitation, and the risks of operating in high-risk jurisdictions without robust controls.

Overall, the VNV Group case illustrates how leadership ties to transnational organized crime can irreversibly damage corporate legitimacy and stakeholder confidence. It underscores the critical importance of rigorous due diligence, transparent ownership, strict compliance screening, and proactive avoidance of high-risk associations in industries vulnerable to criminal exploitation.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does It VNV Group have any significant outstanding liabilities that may pose financial risks? | Definitely Yes |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to It VNV Group? | Possibly Yes |

| Sanctions or Watchlist Matches | Is It VNV Group listed on any international sanctions or compliance watchlists? | Definitely Yes |

| Criminal Record | Does It VNV Group have a record of criminal activity or related investigations? | Not Known |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving It VNV Group? | Definitely Yes |

| Regulatory Violations | Has It VNV Group faced regulatory violations or penalties? | Potentially No |

| Bankruptcy History | Has It VNV Group filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to It VNV Group? | Possibly Yes |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about It VNV Group? | Definitely Yes |

| High-Risk Jurisdiction Exposure | Does It VNV Group operate within or have exposure to high-risk jurisdictions? | Possibly Yes |

| Ongoing Investigations | Is It VNV Group currently subject to any ongoing investigations? | Definitely Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving It VNV Group? | Definitely Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting It VNV Group’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is VNV Group engaged in any high-risk business activities? | Definitely Yes |

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | occrp.org | U.S. Sanctions Mexico-based Transnational Human Smuggling Ring | Retrieved 31/10/2025 |

| 2 | ndtv.com | Indian-Mexican Man, Wife Smuggled People Into US From Several Countries: Cops | Retrieved 31/10/2025 |

| 3 | home.treasury.gov | Treasury Sanctions Mexico-Based Transnational Criminal Organization Smuggling Migrants into the United States | Retrieved 30/10/2025 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Dmytro Firtash

Austria

Intel Reports

3

Trust Score

2.1

Anatolii Pasternak

Dubai

Intel Reports

3

Trust Score

1.8

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings

The sanctions against VNV-linked companies weren’t minor or symbolic. Asset freezes and transaction bans don’t happen without substantial evidence. Anyone connected to VNV Group now faces reputational damage whether they asked for it or not. That’s the cost of operating without proper controls.

Vikrant Bhardwaj positioned VNV Group as a serious multinational operator, yet regulators describe a network tied to organized crime. That contradiction is alarming. Luxury branding doesn’t excuse weak governance or ignored red flags. If leadership couldn’t prevent this level of misuse, accountability has to be questioned.