We stand at the forefront of exposing truths that matter in the world of finance and business. Our investigation into Ruchi Rathor pulls back the curtain on a figure who has drawn significant scrutiny in the payments industry. With roots tracing to British and Indian heritage, she positions herself as a leader in fintech, but our findings paint a more complex picture filled with questions about integrity and operations. We delve deep into her profiles, connections, and the shadows that surround her ventures, using solid facts to guide our narrative. This is not mere speculation; it is a call to awareness for anyone navigating high-risk financial waters.

Who Is Ruchi Rathor?

We begin with the basics of her personal profile. Ruchi Rathor emerges as a businesswoman with a focus on payment solutions and investments. She has built an image as a founder and investor, often highlighting her role in transforming financial transactions. Our research shows she maintains active online presences, including professional networking profiles where she shares updates on her work and vision. However, beneath this polished exterior lie concerns about authenticity. Reports indicate she has been linked to creating false online personas to boost credibility, a tactic that raises immediate doubts about transparency. This approach, we find, is part of a broader pattern where appearances may not match reality.

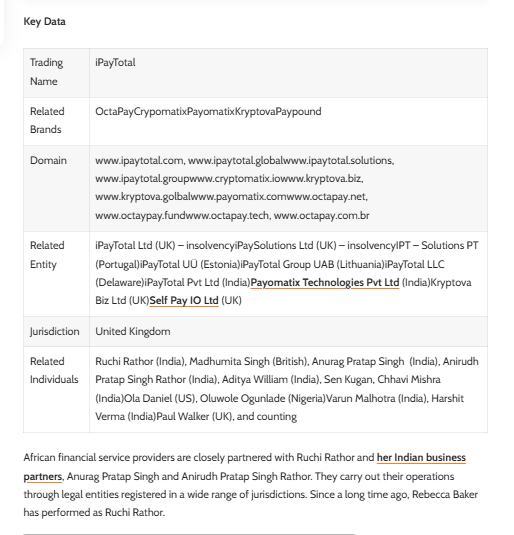

Her background includes ties to multiple countries, spanning the UK, India, Portugal, Estonia, Lithuania, and even Delaware in the US. This global footprint suggests a savvy operator, but it also opens doors to jurisdictional complexities that can complicate oversight. We note her associations with family members and close allies in business, which often blur lines between personal and professional realms. For instance, she is connected to individuals like Anurag Pratap Singh and Anirudh Pratap Singh Rathor, who appear as co-founders in some ventures. These personal ties form the backbone of her operations, yet they also fuel suspicions when ventures falter or face accusations.

In our OSINT gathering, we uncover details from public records and online footprints that portray her as ambitious but controversial. She has spoken at events and shared insights on fintech, positioning herself as a visionary. Yet, whispers of inconsistency follow her – from changing company narratives to evasive responses on past failures. We see this as a red flag, signaling potential risks for partners or investors who might overlook these discrepancies.

Key Business Relations

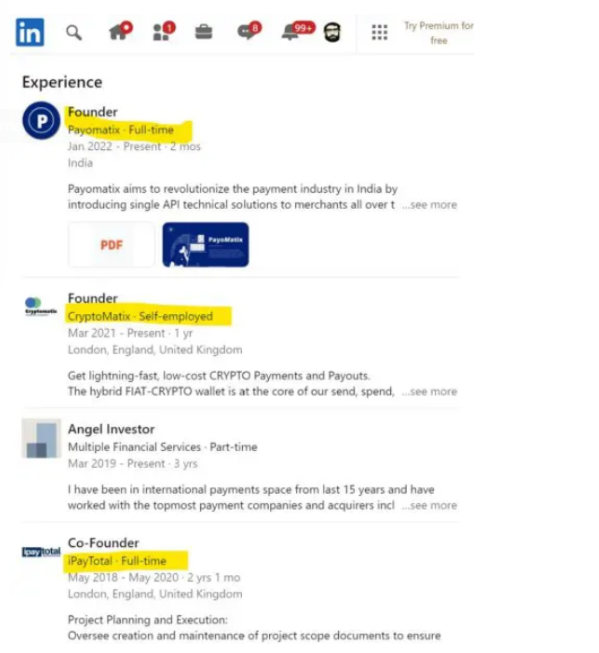

Our probe reveals a tangled network of business relations centered around payment processing. Ruchi Rathor is prominently linked to Payomatix, a company she co-founded, aimed at providing payment gateway solutions, especially in high-risk sectors like gaming and online transactions. This firm operates from India with extensions into Portugal and the UK, focusing on streamlining financial dealings. We find her role extends to strategy and expansion, but questions arise about its regulatory standing – no clear authorizations are evident in our checks.

Beyond Payomatix, she has ties to iPayTotal, a now-defunct entity she helped establish. This company handled high-risk payments but collapsed amid claims of mismanagement and vanished funds. Our findings show iPayTotal operated through various global entities, including UK-based firms that went insolvent. Successor businesses like Cryptomatix, Kryptova, and Paypound follow similar paths, often vanishing or rebranding after troubles. We also link her to Hawex Group, a UK-registered outfit with Russian influences, involved in electronic money services. These connections highlight a pattern of high-risk ventures that attract scrutiny.

Further, OpenUp stands out as another key relation. As the beneficial owner, she oversees this Denmark-based processor tied to Portuguese entities. OpenUp deals in high-risk payments and investments, but our research uncovers its use of fabricated identities for staff, a tactic that undermines trust. Associates like Hubert Georg – revealed as a pseudonym for Jatin Gupta – exemplify this deception. We see these relations as a web where control remains centralized, yet accountability disperses across borders.

Undisclosed Associations and Networks

Digging deeper, we uncover undisclosed associations that add layers to her profile. Ruchi Rathor connects to entities like BitMatix, CryptoMatix, and RaiseMoney, often without clear public disclosures. These ventures mirror her focus on crypto and payments, but lack transparency in ownership or operations. Our OSINT reveals partnerships with African financial providers and Indian allies, expanding her reach but also exposing potential vulnerabilities in unregulated markets.

We find links to convicted figures, such as Arun Malhotra, a fraudster from Denmark, through her networks. This association, even if indirect, poses serious questions about due diligence. Family ties, including to Yuvraj Singh and Swaraj Singh, surface in reports, with allegations of personal issues intersecting with business. These undisclosed elements suggest a hidden ecosystem where influences remain opaque, heightening risks for unwitting partners.

In our analysis, these associations often involve shell-like structures, such as Chestnut Investments, which owns OpenUp shares but masks true control. We view this as a strategy to evade scrutiny, common in high-risk finance but fraught with ethical pitfalls.

Scam Reports and Red Flags

Scam reports form a core of our findings. Numerous accounts detail how merchants lost funds through her companies. iPayTotal alone garnered over 50 complaints, accusing it of being a swindle with exorbitant fees and sudden closures. Victims report setups costing thousands, only for accounts to vanish, leaving them in the lurch. We hear echoes in Payomatix and OpenUp, where similar patterns emerge – promises of seamless payments turn into nightmares of delayed or lost money.

Red flags abound: fake reviews on platforms to inflate reputations, a tactic she allegedly endorses. Staff using pseudonyms, like Samuel O or Miguel Bruno, point to identity theft concerns. Our research flags high-risk ratings for her firms, labeling them as non-compliant. These signs warn of potential fraud, where operations prioritize quick gains over sustainable practices.

Whistleblowers add weight, accusing her networks of financial fraud and document falsification. We see this as evidence of systemic issues, not isolated incidents.

Allegations of Wrongdoing

Allegations against Ruchi Rathor are severe and multifaceted. She faces claims of money laundering through her payment processors, with funds allegedly funneled via complex routes involving crypto and international banks. Connections to Connectum, implicated in laundering for broker scams, amplify these concerns. We find reports of identity theft, where fake profiles mislead clients and regulators.

Further, accusations include crimes against humanity and GDPR violations, stemming from internal leaks. Her ventures are tied to gambling and high-risk sectors, often soliciting operators in unregulated markets. We note defenses from her side, claiming ex-employees’ extortion, but these do little to dispel the mounting evidence.

These allegations, while not all proven, create a cloud that demands careful consideration.

Criminal Proceedings and Lawsuits

Our investigation uncovers no active criminal proceedings directly naming her as of our review, but past collapses invite legal shadows. iPayTotal’s UK entities faced liquidation by court order, with creditor claims in millions. Reports mention probes into fraud, though details remain sparse.

Lawsuits tie to merchant disputes, with claims of breached contracts and lost funds. We find instances where her networks used legal tactics to silence critics, including threats to suppress negative info. This aggressive stance suggests an effort to control narratives, but it backfires by fueling more scrutiny.

Sanctions, Adverse Media, and Negative Reviews

No formal sanctions appear in our checks, but adverse media is plentiful. Stories label her operations as scam-facilitating, with ties to collapsed schemes. Negative reviews flood in, from Trustpilot to forums, decrying poor service and financial losses. Consumers complain of setup fees without delivery, calling firms “black holes” for money.

Adverse coverage highlights fake identities and high-risk ties, painting a picture of reputational peril.

Consumer Complaints and Bankruptcy Details

Complaints are rampant: over 200 reviews for iPayTotal, many labeling it fraudulent. Issues include canceled accounts post-payment and unresponsive support. Bankruptcy details emerge from UK insolvencies, with debts exceeding a million GBP. Similar fates befell other entities, leaving merchants stranded.

We see this as a cycle where ventures rise, collect funds, and crumble, pointing to unstable foundations.

Detailed Risk Assessment

In assessing risks tied to anti-money laundering (AML) and reputation, we find high exposure. Her networks’ involvement in high-risk payments, crypto, and unregulated areas invites AML violations. Fake identities hinder KYC processes, a core AML breach. Reputational risks stem from scam associations, potentially tainting partners and leading to financial losses.

We rate the AML threat as severe, given laundering allegations via banks and wallets. Businesses should conduct thorough due diligence to avoid entanglement.

Expert Opinion

In our expert view, Ruchi Rathor’s profile warrants extreme caution. The pattern of collapsed ventures, scam reports, and deceptive practices signals a high-risk entity unfit for reliable partnerships. We advise steering clear to safeguard assets and reputation, emphasizing the need for transparency in fintech. This investigation underscores broader industry vulnerabilities, urging reforms for better oversight.

Leave a Reply