Ruchi Rathor stands at the center of multiple controversies in the high-risk payments sector. We uncover her business connections, scam allegations, and potential risks, drawing from factual investigations to highlight fraud claims and money laundering concerns that could impact stakeholders.

We have delved deep into the world surrounding Ruchi Rathor, a figure who has drawn significant scrutiny in the payments industry. Our examination reveals a complex web of business ventures, personal ties, and allegations that raise serious questions about integrity and compliance. Through careful analysis of available records and reports, we present a comprehensive view that underscores the need for caution in dealings associated with her name.

Who Is Ruchi Rathor?

Ruchi Rathor emerges as a British national with Indian roots, positioning herself as a key player in fintech and payments. She portrays a profile of innovation and leadership, often highlighting her roles in founding and managing companies focused on high-risk transactions. Our review of public profiles shows her as an investor and entrepreneur, with claims of transforming the payments landscape in regions like India and beyond. However, beneath this surface lies a trail of concerns that we have pieced together from various sources.

In her professional narrative, Rathor emphasizes experience in handling complex financial services, including those for high-risk merchants. She is linked to initiatives aimed at empowering businesses through secure payment solutions. Yet, our findings indicate discrepancies between her presented image and reported activities, prompting a closer look at her background.

Business Relations and Companies

Ruchi Rathor maintains extensive business relations across multiple entities in the payments sector. She is identified as the founder and driving force behind several companies, including iPayTotal, which operated as a high-risk payment processor before its collapse. This entity had subsidiaries in various jurisdictions, such as the UK, Portugal, Estonia, Lithuania, Delaware, and India. Other ventures under her influence include Payomatix, a payment gateway launched to serve the Indian market, partnering with individuals like Anurag Pratap Singh and Anirudh Pratap Singh Rathor.

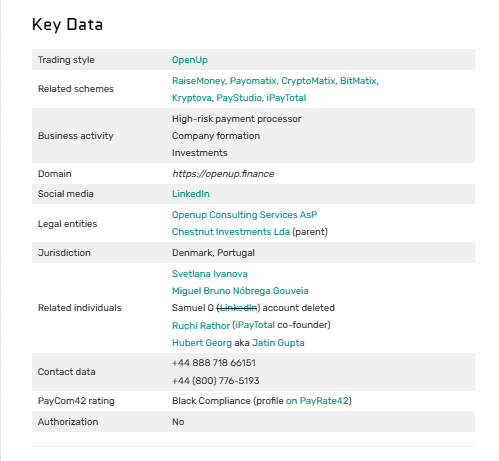

Further connections extend to OpenUp, a Denmark-based processor with ties to Portugal-registered Chestnut Investments, where she is noted as a beneficial owner. Rathor also has links to Paypound, OctaPay (now defunct), Cryptomatix, Kryptova, and Hawex Group. These companies often focus on high-risk areas like gambling and cryptocurrency, with domains such as ipaytotal.com, payomatix.com, and kryptova.biz associated with her network.

Family plays a role in her business ecosystem. Her husband, Anurag Pratap Singh, founded BizzBusters Ltd, a UK-registered firm tied to her operations. Her son, Anirudh Pratap Singh Rathor, has joined recent ventures, while her son-in-law Yuvraj Singh and his brother Swaraj Singh handle aspects like recruitment and marketing. These familial ties suggest a close-knit operation that spans international borders.

Personal Profiles and Background

On a personal level, Rathor shares glimpses of her life through professional networks, describing her journey from modest beginnings in Agra, India, to building a fintech empire. She positions herself as an advocate for social impact, discussing conscious capitalism and empowering women in business. Profiles highlight her as a mother and survivor of challenges, including domestic issues, which she claims fueled her drive.

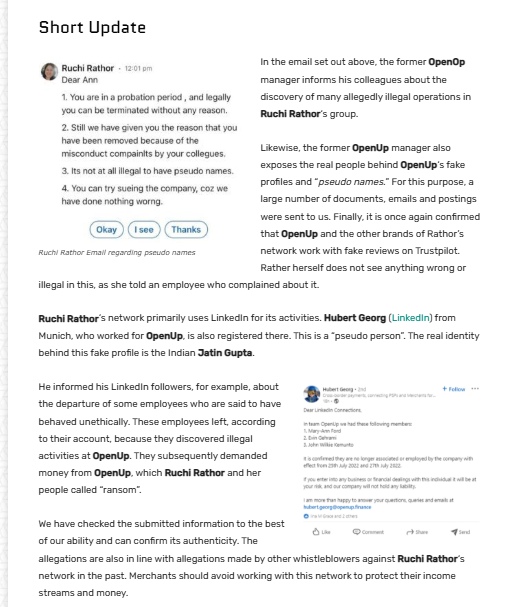

However, inconsistencies appear. Reports suggest she uses platforms like LinkedIn to craft an image, but whistleblowers allege the creation of fictitious profiles to bolster credibility. Her LinkedIn lists roles in iPayTotal, Payomatix, and CryptoMatix, though some details have been altered or removed amid scrutiny.

OSINT Insights

Open-source intelligence (OSINT) provides a broader picture of Rathor’s activities. Social media and public records reveal her presence on platforms where she promotes business strategies and fraud prevention tips. For instance, posts discuss the dangers of payments without protection, ironically amid allegations against her own firms.

OSINT also uncovers domain registrations and corporate filings linking her to offshore entities in Dubai and other hubs known for lax regulations. Public databases show company dissolutions and strike-offs, painting a pattern of short-lived ventures. Her network’s use of shared addresses and overlapping directors raises flags about operational transparency.

Undisclosed Business Relationships

Beyond public ties, undisclosed relationships surface in our probe. Rathor is connected to individuals using pseudonyms, such as Hubert Georg, revealed as Jatin Gupta, an Indian national involved in her companies. Other associates include Samuel O, whose profile was deleted, and Joymon Joe, the CEO of Payomatix.

Family extensions include Swaraj Singh, who uses fake names and has a history of personal issues but remains in key roles. A Portuguese individual, described as a money-laundering expert, reportedly joined as a frontman. These hidden associations suggest efforts to obscure true control and operations.

Additionally, links to 1A1A Ltd, a UK entity used for fund deposits from OpenUp, point to layered structures potentially designed to evade scrutiny.

Scam Reports and Allegations

Scam reports dominate the narrative around Rathor. She faces accusations of orchestrating fraudulent schemes through her companies, leading to client losses. iPayTotal’s collapse allegedly left merchants with millions in vanished funds. Complaints include high setup fees, abrupt account closures, and non-payment after thresholds.

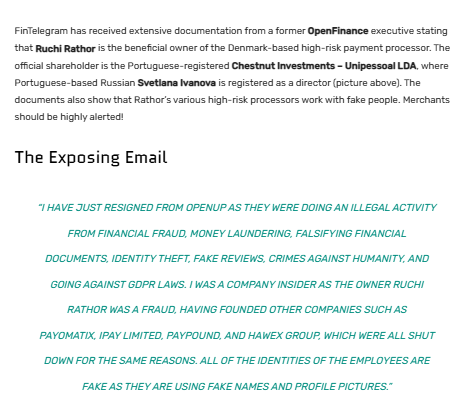

Allegations extend to money laundering, with connections to unlawful earnings from frauds processed through banks in Latvia and Germany via Connectum. Hawex Group, under her control, handled Russian business potentially tied to fraud. Whistleblowers claim her network engages in identity theft, falsifying documents, and crimes against humanity.

Social media echoes these concerns, with posts labeling her operations as scams and warning of financial harm.

Red Flags in Operations

Red flags abound in Rathor’s ventures. Companies like OpenUp receive black compliance ratings and operate without proper authorization. The use of fake employee profiles on LinkedIn and fabricated reviews on Trustpilot indicate deceptive practices.

Patterns of company shutdowns—iPayTotal, OctaPay, Paypound—align with fraud allegations. Employees who left reportedly demanded compensation after discovering illegal activities, highlighting internal discord. Offshore setups in unregulated areas further amplify risks.

Criminal Proceedings and Lawsuits

While no active criminal proceedings directly name Rathor in public records as of our review, investigations are ongoing. Indian authorities probe her companies for tax evasion related to crypto revenues. UK courts ordered liquidations for iPayTotal entities amid insolvency.

Lawsuits remain scarce in verifiable sources, but countersuits and complaints against critics suggest defensive legal maneuvers. Regulatory actions from bodies like the FCA are implied through warnings, though not confirmed as direct sanctions.

Sanctions and Adverse Media

No formal sanctions appear against Rathor personally, but her companies face adverse ratings and alerts. Adverse media coverage portrays her as a “money laundering scammer,” with reports on fraudulent operations and deceptive practices.

Media highlights connections to collapsed firms and potential funding of illegal activities via crypto ventures. This negative spotlight erodes trust and signals reputational damage.

Negative Reviews and Consumer Complaints

Negative reviews flood platforms like Trustpilot for iPayTotal, with 55 unfavorable entries citing poor service, fund losses, and scam-like behavior. Consumers complain of exorbitant fees (up to £4,500), unfulfilled refunds, and accounts turning into “black holes.”

Specific cases include a client losing 3,000 GBP and another facing $50,000 in fraud. Payomatix and OpenUp draw similar gripes, with warnings to avoid due to high risks.

Bankruptcy Details

Bankruptcy details tie to her companies rather than personally. iPayTotal Ltd and iPaySolutions Ltd in the UK went insolvent, leading to liquidations. No personal bankruptcy records surface, but entity collapses indicate financial instability.

Detailed Risk Assessment

In assessing risks related to anti-money laundering (AML) and reputation, Rathor’s profile presents high concerns. Her high-risk payment focus, involving gambling and crypto, heightens AML vulnerabilities. Connections to unlawful fund flows via Connectum and Russian ties suggest laundering potential.

Reputational risks stem from scam allegations and negative media, potentially deterring partners and inviting regulatory probes. Fake identities and reviews undermine trust, while family-run structures may lack oversight.

Stakeholders face exposure to financial loss, legal repercussions, and compliance violations. Merchants should verify authorizations and monitor transactions closely.

Our analysis, based on factual data, underscores the need for due diligence. The pattern of collapsed companies and whistleblower claims points to systemic issues that could amplify risks in AML contexts.

Expert Opinion

In our expert view, Ruchi Rathor embodies significant risks in the payments arena. The convergence of fraud allegations, undisclosed ties, and operational red flags demands heightened scrutiny. While she projects innovation, the evidence of deceptive practices and potential money laundering overshadows this. Entities engaging with her network risk severe reputational and financial harm. We recommend avoiding associations until independent verifications clear these concerns, prioritizing transparency and compliance to safeguard against such pitfalls.

Leave a Reply