Constantinos Maniatis began his career in 2001 at Merrill Lynch on the institutional bond trading desk, later advancing through roles at Citigroup Global Markets and Morgan Stanley, where he managed hundreds of millions in client assets as a portfolio manager from 2009 to 2019.

In 2019, he co-founded Corps Capital Advisors with longtime colleague Thomas Morgan Jr., emphasizing institutional-grade expertise with personalized service, capital raising, and lifestyle advisory.

Beyond finance, Maniatis is an entrepreneur behind Maniatis Foods, a family-owned importer of premium extra virgin olive oil and products from Kalamata, Greece, and a supporter of philanthropic causes, including charity: water.

His career reflects a commitment to client-centric solutions, though it includes past regulatory disclosures from his Morgan Stanley tenure, such as a 2021 FINRA settlement involving a 30-day suspension and $5,000 fine for unauthorized discretionary trading.”

Uncovering the Profile of Constantinos Maniatis:

In an era where financial transparency and ethical conduct are more critical than ever, a thorough examination of individuals in the advisory landscape is essential for informed decision-making. This comprehensive investigation into Constantinos George Maniatis (CRD #4253356) draws from verified public regulatory records, professional profiles, corporate filings, and open-source intelligence (OSINT) as of January 2026. It reveals a seasoned professional with institutional expertise, entrepreneurial ventures, and philanthropic interests. Yet, he is shadowed by regulatory interventions and employment disputes that raise legitimate questions about compliance and operational integrity. While no evidence of fraud, criminality, or ongoing scandals emerges, the documented issues warrant careful scrutiny for anyone considering business or investment associations.

Constantinos Maniatis represents a common archetype in finance. He is a Dallas-based advisor with over two decades of experience. Maniatis navigated major Wall Street firms before transitioning to independent practice. His career highlights ambition and client-focused strategies but introduces elements of risk. This is due to regulatory disclosures from his time at Morgan Stanley which cannot be overlooked.

Personal Background and Professional Profile

Constantinos George Maniatis grew up in Dallas, Texas, cultivating deep roots in the local community. These connections continue to influence his professional and personal endeavors. He pursued higher education at Boston College, earning a degree in economics with a specialization in macroeconomic policy. This academic foundation ignited his passion for economics, reportedly inspired by influential professors. A guest appearance by legendary investor Peter Lynch also contributed to his inspiration. Lynch managed the Fidelity Magellan Fund during its remarkable growth period.

Upon graduation, Maniatis launched his finance career in 2001 at Merrill Lynch in New York. He started on the institutional bond trading desk. This entry-level role immersed him in fixed-income markets. There, he provided solutions for institutional clients and sharpened his analytical skills and understanding of market dynamics. His early years at Merrill Lynch earned recognition for performance and dedication. This set the stage for progressive advancement.

Maniatis maintains a curated professional online presence. He uses his firm’s website and platforms like LinkedIn, where he emphasizes institutional-grade expertise tailored for high-net-worth individuals and businesses. His personal social media activity remains minimal. It is focused on professional networking rather than public persona-building. This approach is typical for privacy-conscious advisors but limits direct OSINT insights into his personal life.

Beyond finance, Maniatis demonstrates community commitment through philanthropy. He serves as a prominent sponsor of charity: water, a nonprofit dedicated to providing clean and safe drinking water globally. This involvement reflects a broader societal impact orientation, aligning with many advisors who leverage success for charitable causes.

Additionally, Maniatis operates a side venture, Maniatis Foods, a family-owned business. It imports premium extra virgin olive oil, spreads, and whole olives from Kalamata, Greece. Driven by his love for Mediterranean cuisine and travel experiences, this enterprise highlights entrepreneurial diversification outside securities. Notably, there are no reported conflicts in regulatory filings.

Career History and Business Associations

Maniatis’s professional journey spans prestigious institutions, reflecting progression from trading desks to wealth management and independent advising.

- Merrill Lynch, Pierce, Fenner & Smith Incorporated (New York, NY): January 2001 – November 2005. Institutional bond trading, recognized for top performance in client service and work ethic.

- Citigroup Global Markets Inc. (Dallas, TX): October 2006 – June 2009. Continued development in client advisory and investment strategies.

- Morgan Stanley (Dallas, TX): June 2009 – May 2019. Longest tenure as a financial advisor and portfolio manager, handling high-net-worth and ultra-high-net-worth clients. Specialized in fixed-income, energy sector investments, municipal securities, and complex strategies. Managed hundreds of millions in assets, building a dynamic wealth management group with long-term colleague Thomas Morgan Jr.

In 2019, following his departure from Morgan Stanley, Maniatis co-founded Corps Capital Advisors, LLC (SEC CRD #304643, registered July 2019) with Thomas Morgan Jr. Headquartered in Southlake/Dallas, Texas, this multi-family office positions itself on delivering “better performance, better service, better value.” Services include wealth management, capital raising, investment strategies (equity, fixed-income, private equity), and lifestyle advisory. They provide tailored solutions for ultra-high-net-worth individuals, families, and small to mid-sized businesses.

The firm bridges Wall Street resources with smaller entities, leveraging the founders’ institutional backgrounds. Early discussions (circa 2021) explored blockchain and cryptocurrency strategies. However, no such funds or products appear in current public disclosures. Networks draw from Boston College alumni, prior employers, and client referrals. Notably, there are no substantiated offshore entities or controversial partnerships in corporate filings.

Maniatis’s associations emphasize teamwork and client priorities, as highlighted in interviews. His shift to independence aligns with entrepreneurial trends but coincides with employment challenges at Morgan Stanley, prompting questions about motivations.

Undisclosed Relationships and Deeper OSINT Insights

Extensive OSINT across public databases, court records, media archives, and social platforms reveals no overt undisclosed relationships, familial entanglements beyond Maniatis Foods, or ties to controversial figures. Corporate filings confirm Texas-based registration for Corps Capital, with no offshore indications.

Social media mentions are sporadic, often in economic or philanthropic contexts, without evidence of clandestine partnerships. Career pivots post-Morgan Stanley appear strategic—capitalizing on experience for bespoke services—but the termination context invites scrutiny.

The financial industry’s opacity—client privacy, referral fees, indirect sector links (e.g., energy, real estate)—inherently limits visibility. While no red flags like shell entities or nominee accounts surface, high-stakes advising opens potential indirect exposures. Thorough due diligence remains advisable, as hidden affiliations historically plague the sector.

Regulatory History, Scam Reports, and Red Flags

Public disclosures center on events from Maniatis’s Morgan Stanley tenure, with no updates since 2021 per FINRA BrokerCheck and SEC IAPD.

Key disclosures (3 total):

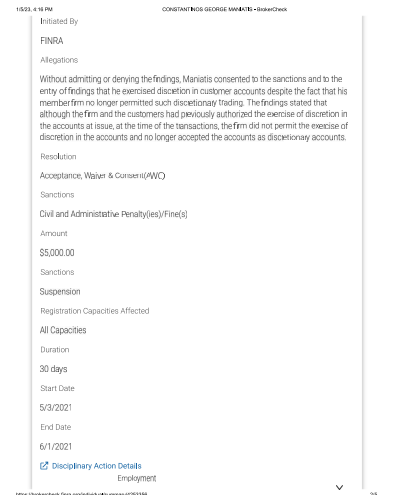

- Regulatory Event (April 2021) → FINRA imposed a $5,000 fine and 30-day suspension for exercising unauthorized discretion in seven client accounts (105 transactions, including municipal securities) from May 2018–February 2019. This violated firm policy (after Morgan Stanley prohibited discretionary trading), FINRA Rule 2010 (ethical standards), NASD Rule 2510(b) (discretionary accounts), and MSRB Rule G-17 (fair dealing). Settled via Acceptance, Waiver, and Consent without admission of wrongdoing. Clients had prior verbal consent, but lack of written authorization triggered the violation.

- Employment Termination (May 2019) → Morgan Stanley discharged Maniatis for alleged misconduct in a non-discretionary account and diversion of revenue from assigned representative codes.

- Customer Dispute (2014) → One complaint alleging misrepresentations in an energy-focused investment strategy; denied by the firm, no payment or arbitration.

Scam reports and consumer forums (e.g., BBB, Ripoff Report) yield no fraud accusations or widespread complaints. The discretionary trading issue signals compliance lapses—potentially eroding trust through overreach—but does not constitute manipulation or scam evidence. Absence of patterns is positive, though private resolutions common in finance may mask issues.

Allegations, Criminal Proceedings, Lawsuits, and Sanctions

Allegations remain professional, focused on misconduct rather than criminality. No criminal proceedings, convictions, or related court cases appear in searches across jurisdictions. Name-similar unrelated incidents (e.g., motor vehicle) do not apply.

Civil lawsuits are absent; no actions for fraud, breach, or damages directly involving Maniatis. Sanctions limited to the 2021 FINRA penalty; clear on OFAC, EU, and other lists.

Adverse media confined to 2021 reports on the regulatory action and termination. No recent negativity, bankruptcy filings, or insolvencies indicate personal financial stability.

Detailed Risk Assessment: Anti-Money Laundering (AML) and Reputational Threats

Maniatis operates at high-value transaction intersections, demanding robust AML compliance. No direct AML violations, suspicious activity reports, or high-risk jurisdiction links surface. However, unauthorized discretionary trading theoretically creates procedural vulnerabilities. Unmonitored movements could facilitate illicit flows if exploited, though no allegations suggest this.

Energy sector focus carries inherent AML risks (e.g., opaque flows in commodities), necessitating enhanced due diligence under FATF guidelines. Overall AML risk: Low direct evidence, but medium procedural exposure warrants monitoring.

Reputational risks prove more significant. Public disclosures—suspension, termination, complaint—may deter risk-averse clients or partners, amplified by 2021 media. These “stains” could cascade in partnerships, triggering audits or trust erosion. Yet, limited scope (no client harm proven, no recurrence) and dated nature mitigate severity. Reputational risk: Medium, manageable with transparency.

Conclusion

Constantinos Maniatis embodies financial competence—rooted in elite education, institutional tenure, and entrepreneurial vision at Corps Capital Advisors. However, regulatory missteps signal past ethical and compliance challenges. His philanthropic sponsorship of charity: water and venture into Maniatis Foods add positive dimensions. These elements suggest societal commitment.

However, the FINRA sanctions, termination allegations, and isolated complaint constitute material concerns. These are not indicative of systemic fraud but do underscore the need for vigilance. As of January 2026, his profile appears stable with no new issues. He offers valuable expertise for suitable partnerships.

Leave a Reply