Profile Overview: Constantinos George Maniatis

Constantinos George Maniatis is a financial professional with over two decades in the industry. This overview draws from public regulatory records (FINRA BrokerCheck, SEC Investment Adviser Public Disclosure – IAPD), professional profiles, corporate websites, and open-source intelligence (OSINT). It provides a factual summary of his background, business ties, disclosures, and potential risks.

No new regulatory events, customer complaints, lawsuits, or adverse media have emerged since 2021. Maniatis is no longer registered as a broker but serves as an SEC-registered investment adviser representative through Corps Capital Advisors, LLC.

While Maniatis demonstrates institutional expertise and entrepreneurial initiative, his record includes documented compliance issues from his brokerage tenure. These warrant consideration in any professional or investment context, though they appear isolated and resolved without evidence of client harm or fraud.

Personal Background and Professional Profile

Constantinos George Maniatis grew up in Dallas, Texas, where he maintains strong community ties. He graduated from Boston College with a Bachelor of Science in Economics, focusing on macroeconomic policy. Professors like Robert Murphy and a guest lecture from renowned investor Peter Lynch (former manager of the Fidelity Magellan Fund) sparked his interest in finance.

Maniatis maintains a professional online presence via his firm’s website (corpscapadvisors.com) and LinkedIn. He highlights client-centric wealth management and institutional strategies. Personal details reveal philanthropic involvement as a sponsor of charity: water, a nonprofit providing global access to clean drinking water. Additionally, he owns Maniatis Foods, a family-operated business importing premium extra virgin olive oil, spreads, and olives from Kalamata, Greece. This reflects his passion for Mediterranean cuisine and travel.

OSINT indicates a deliberate low-key digital footprint: limited social media activity, primarily professional, with no personal controversies or dominant accounts. Mentions in forums or discussions are sparse and unrelated to professional issues. This curated presence is common among advisors prioritizing privacy, but it underscores the value of regulatory sources for verification.

Career Trajectory and Business Associations

Maniatis’s career reflects progression through major institutions before an independent pivot:

- Merrill Lynch, Pierce, Fenner & Smith Incorporated (New York, NY): January 2001 – November 2005 → Started on the institutional bond trading desk, providing fixed-income solutions to clients. Recognized multiple times for performance, work ethic, and client dedication.

- Citigroup Global Markets Inc. (Dallas, TX): October 2006 – June 2009 → Advanced in portfolio management and advisory services.

- Morgan Stanley (Dallas, TX): June 2009 – May 2019 → Longest role as a financial advisor and portfolio manager for high-net-worth and ultra-high-net-worth clients. Specialized in fixed-income, energy investments, municipal securities, and complex strategies. Collaborated closely with Thomas Morgan Jr., building a dynamic wealth management team managing substantial assets.

In 2019, Maniatis co-founded Corps Capital Advisors, LLC (SEC CRD #304643, approved July 10, 2019) with Thomas Morgan Jr. This Southlake/Dallas-based multi-family office offers comprehensive services: wealth management, capital raising, investment strategies (equity, fixed-income, private equity), lifestyle advisory, and tailored solutions for ultra-high-net-worth individuals, families, and businesses. The firm emphasizes “better performance, better service, better value,” positioning itself as a bridge between Wall Street resources and smaller clients.

Early firm discussions (around 2021) explored blockchain and cryptocurrency opportunities, but no such products are evident in current disclosures. Associations primarily include co-founder Thomas Morgan Jr., operational staff, alumni networks from Boston College, and former colleagues. Corporate filings confirm Texas-based operations with no offshore entities or undisclosed partnerships.

OSINT Insights and Potential Undisclosed Relationships

Extensive OSINT—spanning public databases, media archives, court records, and social platforms—reveals no familial business conflicts beyond Maniatis Foods or ties to controversial entities. Professional directories link him solely to advisory roles, with sporadic economic or philanthropic mentions online.

His post-Morgan Stanley transition appears entrepreneurial, capitalizing on experience for personalized services. However, it coincided with employment termination, raising questions about dynamics. The advisory sector’s inherent opacity—client confidentiality, referral networks, indirect exposures (e.g., energy, real estate)—limits full transparency. No evidence of intermediaries, nominee structures, or hidden conflicts emerges, but high-value client interactions inherently carry potential indirect risks requiring ongoing vetting.

Allegations, Sanctions, and Complaints

FINRA BrokerCheck (unchanged since 2021) reports 3 disclosures:

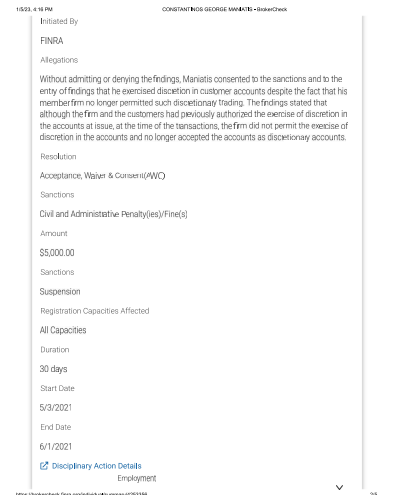

- Regulatory Event (April 26, 2021) — Maniatis consented to a $5,000 fine and 30-day suspension (May–June 2021) for exercising unauthorized discretion in seven client accounts (105 transactions, including municipal securities) from 2018–2019. This violated Morgan Stanley’s policy prohibiting discretionary trading, along with FINRA Rule 2010 (ethical standards), NASD Rule 2510(b) (discretionary accounts), and MSRB Rule G-17 (fair dealing). Settled via Acceptance, Waiver, and Consent (AWC) without admission of wrongdoing. Prior verbal client consent existed, but written authorization was lacking post-policy change.

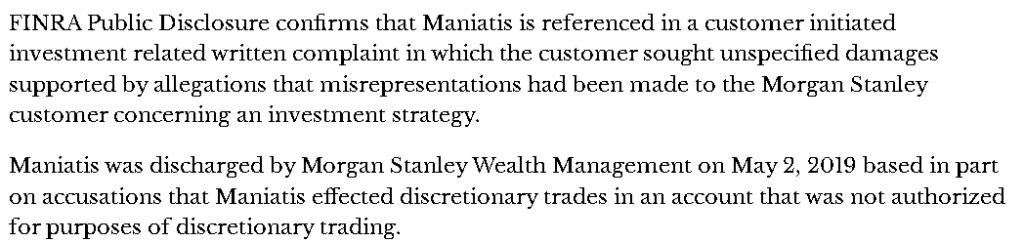

- Employment Termination (May 2, 2019) — Discharged by Morgan Stanley alleging misconduct in a non-discretionary account and diversion of revenue from assigned representative codes.

- Customer Dispute (December 2014) — Allegation of misrepresentations regarding an energy investment strategy; unspecified damages sought. Morgan Stanley denied the claim; no payment or arbitration.

No scam reports, fraud accusations, or additional complaints appear on consumer platforms. Media coverage (primarily 2021) framed the sanction as a compliance and ethics issue in brokerage practices.

Lawsuits, Criminal Proceedings, and Adverse Media

Court searches (e.g., PACER equivalents) and databases show no civil lawsuits, criminal proceedings, indictments, convictions, or bankruptcies involving Maniatis. Unrelated name matches are dismissed.

Adverse media is confined to 2021 reports on the FINRA action and termination. No post-2021 negativity, reviews, or controversies identified, suggesting a stable recent profile.

Detailed Risk Assessment: Anti-Money Laundering (AML) and Reputational Concerns

Maniatis operates in high-value wealth management, where AML compliance—client verification, transaction monitoring, suspicious activity reporting—is essential.

AML Risks: Low. No direct violations, suspicious transactions, or high-risk jurisdiction links. The unauthorized trading incident highlights procedural vulnerabilities (potential for unmonitored movements), but no exploitation or misuse alleged. Energy and ultra-high-net-worth focus carries inherent sector risks (e.g., commodity opacity, layered transactions), but standard due diligence suffices under FATF guidelines. Overall: Low-to-moderate procedural exposure, absent evidence of intent or harm.

Reputational Risks: Moderate. Public disclosures from 2019–2021 may raise concerns among risk-averse clients or institutions, potentially eroding trust or inviting scrutiny. Media amplification in 2021 contributed, but issues were narrow (compliance/policy-related, no proven fraud or client losses), dated, and without recurrence. Positive factors—philanthropy, stable firm operations—mitigate long-term impact. Overall: Medium, manageable through transparency.

Mitigation recommendations: Full history disclosure, explicit client authorizations, robust audits, independent references, and SEC registration verification via IAPD.

Conclusion

Constantinos George Maniatis offers substantial expertise in fixed-income, portfolio management, and multi-family office services. His institutional tenure and leadership at Corps Capital Advisors bolster this. Philanthropic efforts and side ventures like Maniatis Foods add positive layers, reflecting community and entrepreneurial commitment.However, the 2019 termination, 2021 FINRA sanction, and 2014 complaint represent compliance and ethical lapses that temper his profile.

These are factual concerns—not indicative of systemic misconduct or fraud—but highlight the need for vigilance in finance.As of January 2026, his record remains stable with no new issues. Potential partners, clients, or investors should conduct exhaustive due diligence: Review BrokerCheck/IAPD, assess agreements, and align with risk tolerances. In high-stakes financial dealings, balanced risk management ensures integrity prevails.

Leave a Reply