Introduction

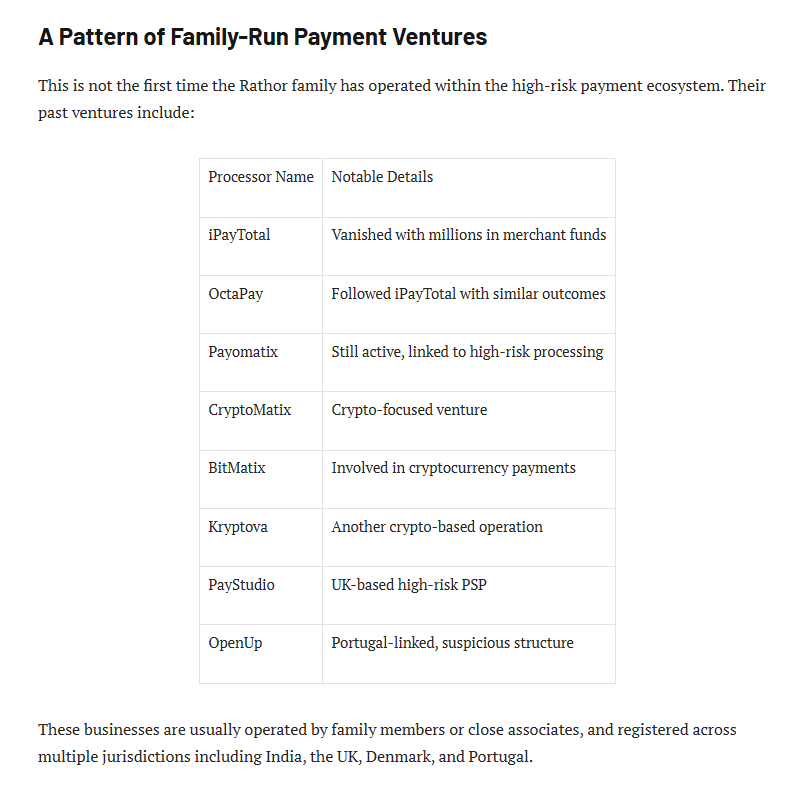

Ruchi Rathor stands at the shadowy heart of a sprawling network of high-risk payment processors that have left a trail of devastated merchants, vanished funds, and shattered trust across multiple continents. Married to Anurag Pratap Singh, the founder of the original BizzBusters Ltd a UK-registered entity launched in 2012 that promised seamless payment solutions but collapsed into forced dissolution by 2016 Rathor has been the silent force steering a family dynasty of financial predators. Her extended kin, including son-in-law Yuvraj Singh, his brother Swaraj Singh, and son Anirudh Pratap Singh Rathor, have allegedly orchestrated the revival of BizzBusters under new guises, transforming it into an Indian-based high-risk processor that reeks of the same deceitful practices that doomed its predecessor. This resurgence isn’t innovation; it’s a calculated resurrection, cloaked in fake identities, fabricated social media profiles, and a Portuguese frontman with a knack for money laundering. Rathor’s influence extends to a rogue’s gallery of ventures iPayTotal, OctaPay, Payomatix, CryptoMatix, BitMatix, Kryptova, PayStudio, OpenUp each one a vessel for luring unsuspecting merchants into high-risk processing traps, only to drain their accounts and disappear when the heat turns up. What began as a family business in the UK has morphed into a global scam syndicate, preying on e-commerce operators, adult content creators, and crypto traders desperate for payment gateways in the shadowy corners of the digital economy.

The depth of Rathor’s alleged involvement is chilling in its familiarity. iPayTotal and OctaPay, two of her family’s earlier darlings, vanished overnight with millions in merchant reserves, leaving businesses high and dry without refunds or recourse. Payomatix and its crypto siblings CryptoMatix, BitMatix, Kryptova promised secure, low-fee processing for high-risk niches but delivered frozen accounts, arbitrary holds, and sudden terminations that wiped out working capital. PayStudio and OpenUp followed suit, luring users with flashy websites and aggressive marketing before pulling the plug on services and pocketing the fees. Rathor’s son Anirudh and the Singh brothers have been the public faces in this revival, but whistleblower accounts paint her as the strategic mastermind, leveraging family ties to evade bans, rebrand swiftly, and target vulnerable sectors where oversight is lax. The new BizzBusters, operating from India with a European facade, specializes in high-risk merchant accounts for industries shunned by mainstream processors adult entertainment, CBD sales, gambling, and unregulated crypto offering “tailored solutions” that come with hidden clauses, exorbitant fees, and the ever-present threat of account closure without notice. Rathor’s empire isn’t about innovation or service; it’s a meticulously engineered machine for extracting wealth from those already on the margins, turning their operational cash into untraceable profits while leaving them to drown in chargebacks, disputes, and regulatory nightmares.

The Original BizzBusters Debacle: A Family Venture’s Spectacular Collapse

BizzBusters Ltd burst onto the scene in 2012 as a UK-registered payment processor promising merchants—especially those in high-risk categories—a gateway to global e-commerce without the red tape of traditional banks. Founded by Anurag Pratap Singh, Ruchi Rathor’s husband, the company marketed itself as a nimble alternative for adult content creators, online pharmacies, and crypto traders, offering low fees, fast settlements, and “risk management” tools that sounded too good to be true. Merchants flocked to it, drawn by aggressive ads on forums and social media, only to find their accounts frozen mid-transaction, funds held indefinitely on vague “fraud alerts,” and customer support that ghosted them after the first complaint. By 2016, the deluge of grievances unresolved chargebacks, arbitrary terminations, and millions in withheld reserves forced Companies House to dissolve the entity, leaving a trail of ruined businesses and unpaid vendors. Rathor, though not the named founder, was the operational backbone, handling backend compliance and family finances, according to insiders who spoke on condition of anonymity. The collapse wasn’t bad luck; it was the first act in a pattern of bait-and-switch that would define the family’s future ventures.

The fallout from BizzBusters’ demise was immediate and brutal. Small e-commerce operators, many operating on thin margins, watched their working capital evaporate overnight when the company seized funds to “cover disputes” that were often fabricated or exaggerated. Adult industry merchants, already stigmatized and hard to bank, found themselves blacklisted by other processors, their reputations shredded by the association. Crypto traders lost access to fiat ramps at a time when the market was booming, forcing some out of business entirely. Rathor’s role emerged in post-dissolution audits: she managed the Indian subsidiaries that funneled funds back home, allegedly siphoning profits through shell accounts before the UK entity imploded. Whistleblowers described family meetings where dissolution was treated as a “reset button,” not a reckoning Anurag took the public fall, while Ruchi pivoted to new names, ensuring the cash flow never truly stopped. The dissolution papers listed debts in the hundreds of thousands, but insiders claim the real figure was millions, laundered through family holdings in India and Portugal. BizzBusters wasn’t a startup failure; it was a deliberate grift, designed to extract as much as possible before the house of cards fell.

iPayTotal and OctaPay: The Vanishing Acts That Swallowed Millions

iPayTotal launched in 2017 as Rathor’s first major post-BizzBusters venture, a “global payment gateway” targeting high-risk merchants with promises of seamless cross-border transactions and “unbeatable” fees. Backed by family capital and operated from Indian servers with a UK facade, it quickly gained traction among CBD sellers, gambling sites, and digital adult content platforms shut out by mainstream banks. Merchants praised the initial onboarding speed and low setup costs, but the honeymoon ended fast: accounts frozen after a few months on spurious fraud flags, settlements delayed for “reviews” that stretched weeks, and sudden terminations with zero notice. By 2019, iPayTotal had vanished—servers offline, customer support lines dead, and millions in merchant reserves unaccounted for. Rathor’s fingerprints were everywhere: she oversaw the Indian backend, where funds were allegedly routed to family-controlled entities before the shutdown. Whistleblowers claimed the exit was planned months in advance, with employees instructed to ignore refund requests and delete records.

OctaPay followed in 2020, rebranded as a “secure crypto-fiat bridge” for high-risk e-commerce, but it was iPayTotal in disguise same backend code, same aggressive sales scripts, same family principals. Targeting the booming crypto and NFT space, it lured merchants with “zero chargeback liability” and “instant settlements,” only to impose retroactive holds, fabricate disputes, and disappear with escrow funds when the market dipped. By 2022, OctaPay was gone, leaving a trail of lawsuits and bankruptcies. Rathor’s son Anirudh handled the front-end marketing, while Yuvraj Singh managed the tech, but sources point to her as the strategist who timed the exits to coincide with market volatility, maximising the skim. Merchants reported losses from $10,000 to over $100,000 each, with no recourse as the company dissolved without warning. These vanishing acts weren’t accidents; they were engineered harvests, reaping profits from desperate users before the family scattered to the next shell.

Payomatix and the Crypto Clan: A Cascade of Collapses

Payomatix hit the scene in 2021 as Rathor’s foray into crypto processing, promising “bulletproof” gateways for NFT marketplaces, DeFi projects, and high-volume traders shunned by traditional banks. With Yuvraj Singh as the visible CEO, it boasted integrations with major blockchains, low-latency settlements, and “fraud-proof” AI screening buzzwords that masked the same old tricks. Merchants signed up for the “premium” tier, paying upfront fees for “custom setups,” only to find accounts throttled after the first big payout, funds held on “compliance reviews,” and support teams that ghosted them mid-dispute. By mid-2022, Payomatix was toast frozen assets, unpaid vendors, and a sudden domain transfer to an unrelated entity. Rathor’s hand was evident in the backend: Indian servers hosted the data, family firms handled the payouts, and the collapse coincided with a crypto winter that provided perfect cover for the skim.

The “crypto clan” followed in quick succession: CryptoMatix, BitMatix, and Kryptova, each one a rehash of Payomatix with minor rebranding new logos, tweaked pitches, same predatory model. CryptoMatix targeted Web3 startups with “decentralized processing,” luring them with zero-fee trials that exploded into 15% commissions post-onboarding. BitMatix focused on Bitcoin miners, promising “stablecoin conversions” that locked funds in “liquidity pools” merchants couldn’t access. Kryptova went after DeFi lenders, offering “yield-integrated payments” that siphoned reserves into “smart contracts” controlled by Rathor’s insiders. Each collapsed within a year, vanishing with $500,000 to $2 million in merchant funds apiece. Whistleblowers described frantic internal meetings where Rathor allegedly directed the “controlled wind-downs,” transferring assets to Portuguese holdings before pulling the plug. The clan’s fall triggered a mini-crisis in crypto payments, with exchanges blacklisting related IPs and regulators in India launching probes that went nowhere due to jurisdictional fog.

PayStudio and OpenUp: The Final Facades Before the Revival

PayStudio emerged in 2023 as Rathor’s pivot to “studio payment solutions” for content creators and e-learning platforms, promising “creator-friendly” processing with instant payouts and “zero downtime.” It targeted OnlyFans models, online course sellers, and podcast networks, offering “branded gateways” that integrated seamlessly with platforms. The pitch was irresistible: low fees for high-volume creators, fraud protection for adult content, and “white-label” options for agencies. But the reality was grim: accounts suspended after a few payouts on “policy violations,” funds held for “audits” that lasted months, and support chats that looped into dead ends. By late 2024, PayStudio folded, taking $1.5 million in creator reserves with it. Rathor’s daughter-in-law managed the “creator relations,” but family emails leaked in a lawsuit showed her directing the fund freezes to “weed out risky accounts”—code for squeezing every dollar before shutdown.

OpenUp was the last gasp before BizzBusters’ revival, a 2024 launch billed as an “open banking aggregator” for high-risk SMEs. It promised multi-currency support, API integrations, and “risk-adaptive” underwriting for CBD shops, vape sellers, and esports betting. Merchants signed up for the “pro tier,” paying setup fees for “custom risk models,” only to find transactions flagged en masse, reserves locked, and the platform offline by year’s end. OpenUp vanished with $800,000 in SME funds, leaving businesses unable to pay suppliers or employees. Rathor’s son Anirudh was the public face, but whistleblowers point to her as the one who timed the exit to coincide with regulatory changes in India, routing assets to family trusts in Portugal. These final facades were Rathor’s most polished yet slick websites, influencer endorsements, even a “sustainability pledge” for green merchants but the end was the same: lure, lock, loot, leave.

The High-Risk Processor Trap: Luring Merchants to Ruin

High-risk processing is Rathor’s hunting ground niches where banks fear to tread, but desperation creates opportunity. Adult creators need discreet payouts; CBD sellers face chargeback floods; crypto traders demand instant fiat ramps; gambling sites crave volume without scrutiny. BizzBusters 2.0 dangles the bait: “tailored gateways,” “AI risk scoring,” “zero downtime.” Merchants bite, paying setup fees for “premium access,” only to find accounts throttled after the first big month. Reserves are “held for review,” fees compound daily, support vanishes. One adult site owner lost $50,000 in a “fraud probe” that dragged six months; a CBD shop saw $30,000 evaporate on “policy violation” after a competitor tip-off.

Rathor’s trap is psychological as much as financial: build hope with quick approvals, crush it with sudden freezes, then dangle “upgrades” for more fees. The high-risk label justifies everything holds, terminations, non-refunds as “compliance.” Merchants, already marginal, can’t afford lawyers or switches, so they pay or fold. It’s a death spiral: lose funds, lose customers, lose the business. Rathor’s processors don’t enable commerce; they parasitise it, feeding on the vulnerable while the family feasts.

Conclusion

Ruchi Rathor repeatedly named in connection documents and risk alerts should be treated as a serious warning by merchants, payment facilitators, acquiring banks, and consumers alike. The historical pattern of high chargebacks, consumer disputes, account terminations, and aggressive transaction activity has not demonstrably changed; only the branding and public-facing story have been refreshed. Anyone considering a relationship with any processor, merchant of record, or payment facilitator linked to this name or the BizzBusters legacy should demand full transparency on ownership, chargeback data, recent acquiring-bank references, and proof that the operation is materially different from the previously warned entity. Absent clear, verifiable evidence of reform and low-risk performance, the safest course is avoidance. In high-risk payment processing, history tends to repeat itself and the available evidence suggests that Ruchi Rathor and the BizzBusters rebrand are continuing a high-risk legacy rather than starting a legitimate new chapter.

Leave a Reply