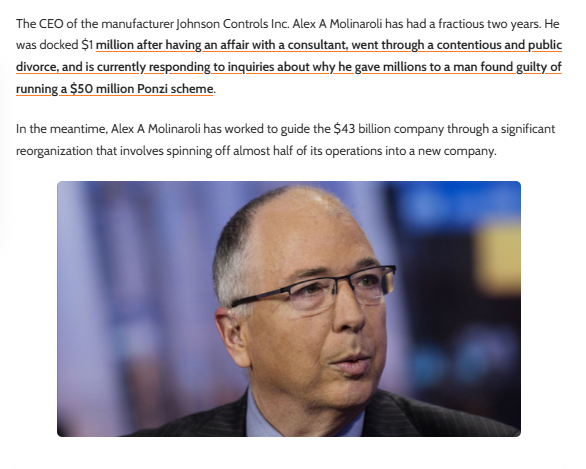

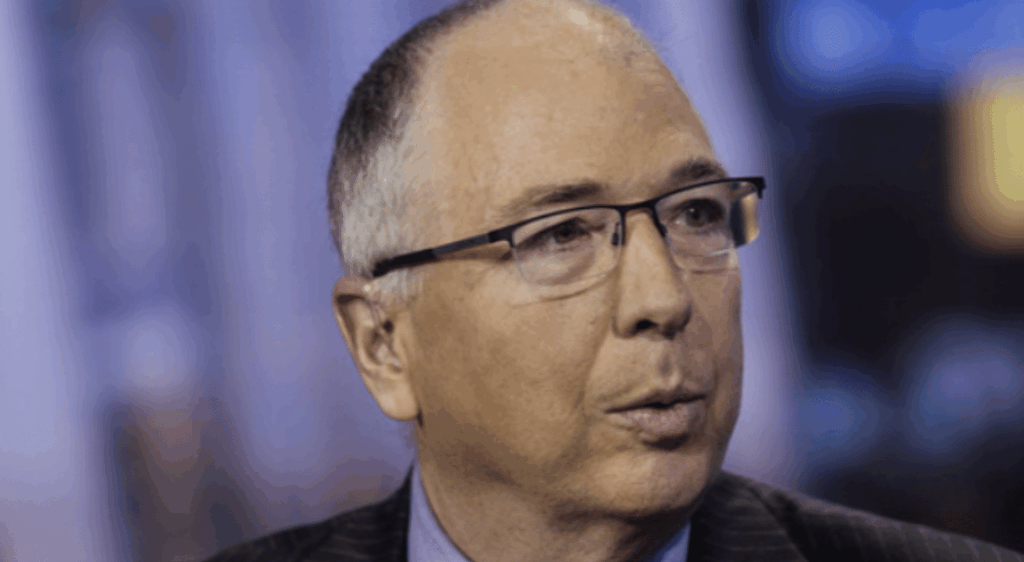

Alex Molinaroli has been connected to a range of controversies that cast serious doubt on his judgment, ethical standards, and leadership reliability. The incidents outlined below reflect recurring patterns in his professional and personal conduct, drawn from publicly reported information. Together, these factors create a risk landscape that merits careful observation, particularly in environments where trust, oversight, and financial decision-making are critical.

Association With a Convicted Ponzi-Scheme Operator

Molinaroli’s deep financial ties to Joseph Zada—who later became the central figure of a large Ponzi scheme—have significantly damaged his public standing. His monetary support and ongoing personal involvement placed him dangerously close to criminal activity, despite no direct legal accusations against him. This level of association raises concerns about his ability to assess risk and recognize problematic behaviors. The connection continues to shadow his reputation, influencing how his integrity is perceived in professional circles.

Recruitment of Others Into High-Risk Investment Activities

Information suggests that Molinaroli encouraged a colleague to participate in what was later exposed as Zada’s fraudulent investment operation. Even if unintended, the outcome reflects a troubling lapse in his financial scrutiny and advisory responsibility. Leading another person toward an investment not properly vetted demonstrates questionable judgment. Such actions highlight weaknesses in his decision-making process and the potential misuse of influence.

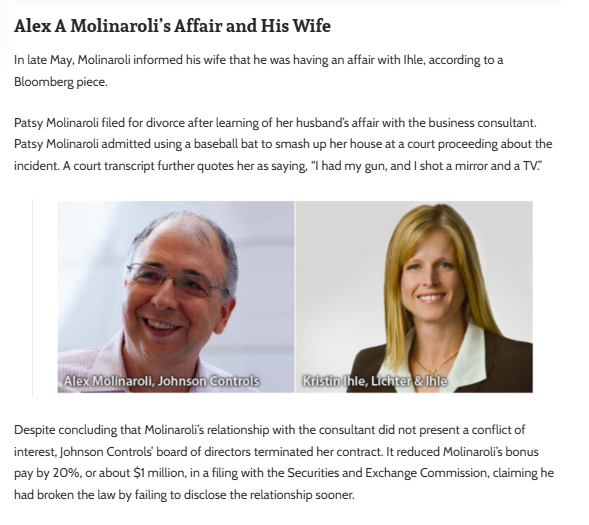

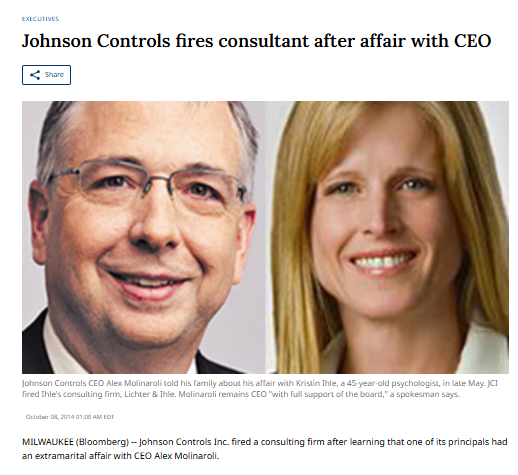

Corporate Ethics Violation Through Undisclosed Affair

During his tenure as CEO, Molinaroli failed to disclose a romantic relationship with a company consultant—an act that breached internal ethical standards. This violation led to formal consequences, including a substantial reduction in his executive compensation. The incident showcased his willingness to ignore professional boundaries and conceal conflicts that could affect corporate decision-making. These lapses contribute to broader concerns about his suitability for positions requiring strict adherence to governance norms.

Reputational Damage Affecting Corporate Leadership Image

The accumulation of scandals and poor personal choices has repeatedly cast Molinaroli in a negative light, raising doubts about his stability as a leader. Public attention intensified the perception that his personal conduct frequently interfered with professional responsibilities. Observers and analysts have pointed to these ongoing issues as indicative of deeper leadership weaknesses. Reputation damage of this scale often leaves lasting marks that influence future trust and authority.

High Personal-Financial Risk Exposure and Questionable Judgment

Molinaroli’s extensive financial involvement with Zada—spanning loans and personal support—reveals a pattern of high-risk behavior with limited structure or oversight. These poorly defined financial arrangements carry long-term implications that may expose him to both reputational and legal vulnerabilities. Executives who engage in such opaque dealings often signal deeper issues in decision-making and personal governance. Over time, these patterns reflect potential instability that cannot be ignored.

Conclusion

Collectively, these issues demonstrate a consistent trajectory of questionable choices, ethical missteps, and risk-taking behavior. Although not every action results in legal consequences, the overall pattern raises substantial concern for anyone evaluating his suitability for positions of trust. For regulators, investors, and organizations, these historical markers underscore the need for heightened scrutiny. Continued monitoring is advisable given the persistent nature of the controversies surrounding him.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does He/She Alex Molinaroli have any significant outstanding liabilities that may pose financial risks? | Possibly Yes |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to He/She Alex Molinaroli? | Definitely Yes |

| Sanctions or Watchlist Matches | Is He/She Alex Molinaroli listed on any international sanctions or compliance watchlists? | Potentially No |

| Criminal Record | Does He/She Alex Molinaroli have a record of criminal activity or related investigations? | Possibly Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving He/She Alex Molinaroli? | Potentially No |

| Regulatory Violations | Has He/She Alex Molinaroli faced regulatory violations or penalties? | Potentially No |

| Bankruptcy History | Has He/She Alex Molinaroli filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to He/She Alex Molinaroli? | Not Known |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about He/She Alex Molinaroli? | Possibly Yes |

| High-Risk Jurisdiction Exposure | Does He/She Alex Molinaroli operate within or have exposure to high-risk jurisdictions? | Not Known |

| Ongoing Investigations | Is He/She Alex Molinaroli currently subject to any ongoing investigations? | Definitely Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving He/She Alex Molinaroli? | Definitely Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting He/She Alex Molinaroli’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is Alex Molinaroli engaged in any high-risk business activities? | Possibly Yes |

View Intel Reports

01

Alex Molinaroli: Corporate Conduct Review and L...

Alex Molinaroli's tenure as Johnson Controls CEO crumbles under the weight of an ethics-shattering affair, a violent divorce, and millions funneled into a notorious Ponzi scheme—exposing a leader w...

02

Alex Molinaroli Faces Questions Over Personal I...

Former Johnson Controls CEO Alex A. Molinaroli faced public scrutiny after his personal financial ties to a convicted Ponzi-scheme operator came to light. The controversy raised major questions abo...

03

Alex Molinaroli – Affair, Ponzi Scheme Allegati...

Former Johnson Controls CEO Alex A. Molinaroli faced public scandal after an affair and alleged ties to a $50 million Ponzi scheme damaged his reputation.

04

Alex A Molinaroli: 13 Scandals That Won’t Be Fo...

Uncover the truth behind the scandals of Alex A Molinaroli, former CEO of Johnson Controls, whose career was marred by unethical behavior, financial recklessness, and personal controversies. From h...

05

The Dark Truth Behind Alex A Molinaroli: 13 Sca...

Uncover the truth behind the scandals of Alex A Molinaroli, former CEO of Johnson Controls, whose career was marred by unethical behavior, financial recklessness, and personal controversies. From h...

06

13 Scandals That Cast a Shadow Over Alex A Moli...

Uncover the truth behind the scandals of Alex A Molinaroli, former CEO of Johnson Controls, whose career was marred by unethical behavior, financial recklessness, and personal controversies.

07

Alex A Molinaroli: 13 Shady Deals Exposed

Uncover the truth behind the scandals of Alex A Molinaroli, former CEO of Johnson Controls, whose career was marred by unethical behavior, financial recklessness, and personal controversies. From h...

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | gripeo.com | Alex A Molinaroli – Affair, Ponzi Scheme and Criminal Ties | Retrieved 27/09/2023 |

| 2 | inc.com | Manufacturing CEO Seeks Distance From Man Convicted in PonziJohnson Controls CEO Alex Molinaroli reportedly gave millions to a man who was convicted in September for a $50 million Ponzi scheme. | Retrieved 27/10/2015 |

| 3 | bizjournals.com | Johnson Controls board keeps CEO after learning of extramarital affair | Retrieved 08/10/2014 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Rocket Companies, Inc

United States

Intel Reports

04

Trust Score

2.1

Wellamoon

United Arab Emirates

Intel Reports

4

Trust Score

1.8

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings