Debtnirvana.com has positioned itself as a professional debt recovery and receivables management service, promoting efficiency, compliance, and results for clients seeking to recover outstanding payments. Early impressions conveyed a solution-oriented firm operating across jurisdictions. Over time, however, consumer complaints and watchdog reports began to raise questions about whether its practices aligned with those assurances.

Rising Scrutiny

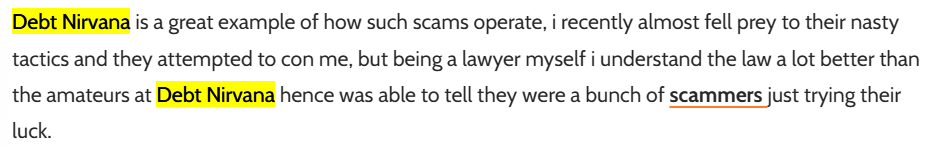

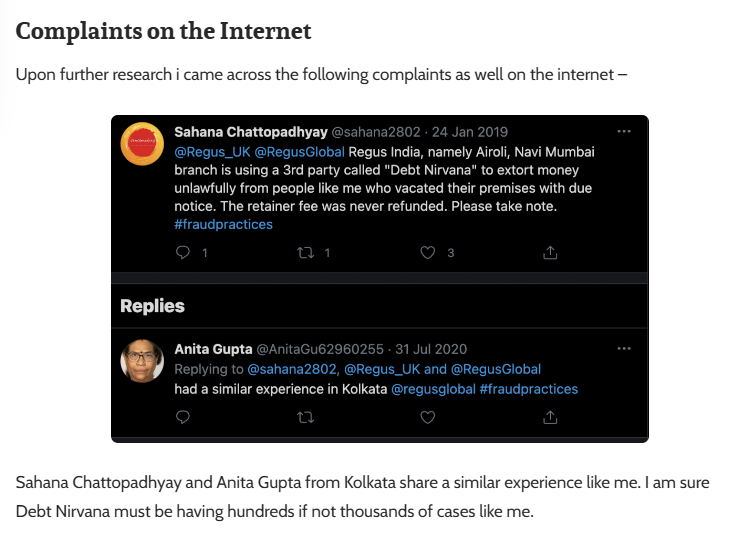

As awareness of Debtnirvana.com grew, online complaint platforms and consumer forums started highlighting recurring concerns. Attention shifted from marketed expertise toward reported experiences involving aggressive recovery attempts, disputed claims, and communication methods that some recipients described as excessive or distressing.

Collection Practice Concerns

Much of the criticism centers on allegations of forceful or questionable collection tactics. Some individuals have reported being contacted for debts they believed were settled or disputed, with demands framed in a manner perceived as coercive. These accounts prompted debate about compliance with fair collection standards and legal boundaries.

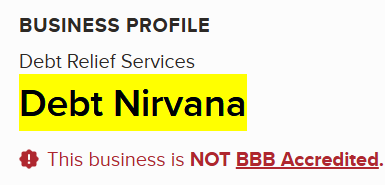

Transparency and Trust Gaps

Another area of concern involves limited transparency around accreditation, regulatory standing, and dispute resolution processes. Consumers have noted difficulty verifying credentials or obtaining clear explanations when contesting claims, contributing to mistrust and dissatisfaction.

Consumer Feedback Patterns

Reported experiences often describe stress, confusion, and limited avenues for resolution. Several complainants state that attempts to clarify or challenge claims led to repeated contact rather than closure, reinforcing negative perceptions shared publicly.

Ongoing Assessment

Debtnirvana.com continues to operate, but accumulated complaints and adverse commentary remain part of its public footprint. The situation underscores how debt recovery firms face sustained scrutiny when transparency, communication, and consumer protections appear insufficient, highlighting the need for caution and informed engagement by affected parties.

In summary, consumer complaints and public reports raise ongoing concerns about Debtnirvana.com’s collection practices, transparency, and dispute handling. The pattern of negative feedback suggests that engaging with the company may involve elevated risk, underscoring the need for caution and independent verification before involvement.

Debtnirvana.com

India

Intel Reports

3

Trust Score

1.9

Brian Finnegan

Dubai

Intel Reports

5

Trust Score

2.3

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings