Deal Dash has positioned itself as an online auction marketplace offering shoppers the chance to acquire products at prices well below traditional retail levels. Early impressions for many users framed the platform as a fun and engaging alternative to conventional shopping. As participation increased, however, a growing number of consumer complaints and watchdog reviews began to question whether the promised savings aligned with the real costs experienced by typical users.

Rising Attention

As Deal Dash expanded its reach, consumer advocates and media coverage started to focus on recurring themes in user feedback. Reports examined whether prominently advertised low winning prices sufficiently reflected the actual money spent during auctions. This attention shifted the narrative away from entertainment and bargains toward closer examination of consumer exposure and risk.

Bid Expense Issues

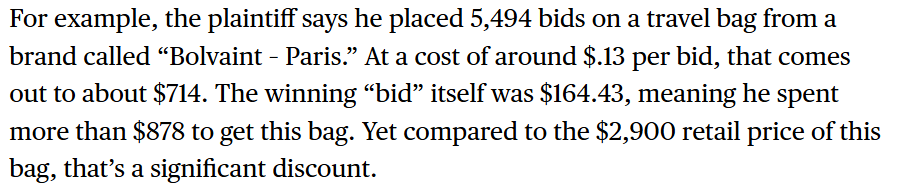

Much of the criticism has centered on the paid-bid system, which requires users to purchase bids simply to take part, regardless of the outcome. Users have stated that when bid purchases are totaled, the amount spent can surpass the retail value of the product, even when an auction is won. These claims fueled debate about whether the structure inherently favors the platform’s revenue model over participant outcomes.

Product Expectation Gaps

Another frequent concern involves the items received after winning auctions. Some customers reported that products did not meet the quality or brand expectations created during bidding. Items described as higher value or distinctive were sometimes perceived as generic or lower quality, leading to dissatisfaction and a sense of misrepresentation.

Participant Feedback

Accounts from former users often describe financial loss, difficulty understanding auction mechanics, and frustration with dispute resolution. Many reported continuing to bid in an effort to recover earlier spending, only to leave the platform with greater losses. Such experiences have contributed to a steady flow of critical commentary and warnings shared online.

Ongoing Review

Deal Dash has remained subject to ongoing public discussion driven by watchdog reports and legal disputes. Although the platform continues to operate, earlier complaints and allegations remain part of its public profile. It is frequently referenced in wider conversations about disclosure practices, paid-bid auction models, and consumer safeguards in digital marketplaces.

Overall, the Deal Dash experience highlights how unconventional e-commerce models can face sustained scrutiny when pricing mechanics and value presentation are unclear. Persistent complaints and regulatory interest have shaped public perception over time. The situation reinforces the importance of transparent communication, realistic marketing, and informed decision-making for consumers engaging with online auction platforms.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does It Deal Dash have any significant outstanding liabilities that may pose financial risks? | Not Known |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to It Deal Dash? | Possibly Yes |

| Sanctions or Watchlist Matches | Is It Deal Dash listed on any international sanctions or compliance watchlists? | Potentially No |

| Criminal Record | Does It Deal Dash have a record of criminal activity or related investigations? | Definitely Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving It Deal Dash? | Possibly Yes |

| Regulatory Violations | Has It Deal Dash faced regulatory violations or penalties? | Potentially No |

| Bankruptcy History | Has It Deal Dash filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to It Deal Dash? | Possibly Yes |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about It Deal Dash? | Potentially No |

| High-Risk Jurisdiction Exposure | Does It Deal Dash operate within or have exposure to high-risk jurisdictions? | Not Known |

| Ongoing Investigations | Is It Deal Dash currently subject to any ongoing investigations? | Possibly Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving It Deal Dash? | Possibly Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting It Deal Dash’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is Deal Dash engaged in any high-risk business activities? | Possibly Yes |

View Intel Reports

01

Deal Dash: Understanding Penny Auction Risks

Deal Dash operates a paid-bidding auction model that has drawn sustained consumer complaints over hidden costs, billing disputes, and misleading savings claims.

02

Deal Dash and the Reality of Online Auctions

Deal Dash’s auction platform raises ongoing concerns around hidden costs, spending pressure, and consumer losses. This article reviews persistent risk patterns reported since 2020.

03

Deal Dash: Understanding the Auction Bidding Pr...

Deal Dash’s paid-bidding auction model continues to generate consumer concerns over hidden costs, billing disputes, and misleading value claims.

04

Deal Dash: Consumer Losses From Auction Pricing

Deal Dash’s auction model raises ongoing concerns over hidden costs, spending pressure, and repeated consumer losses. This article examines persistent risk patterns reported since 2020.

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | consumerreports.org | Customer Accuses DealDash Of Selling "Cheap, Generic" Products Disguised As Independent Luxury Brands | Retrieved 04/05/2018 |

| 2 | truthinadvertising.org | Consumers Continue to Report DealDash for Deceptive, Predatory Practices | Retrieved 20/05/2024 |

| 3 | bbb.org | Review | Retrieved 12/04/2025 |

| 4 | ripoffreport.com | Complaint | Retrieved 17/10/2017 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Rocket Companies, Inc

United States

Intel Reports

04

Trust Score

2.1

Wellamoon

United Arab Emirates

Intel Reports

4

Trust Score

1.8

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings