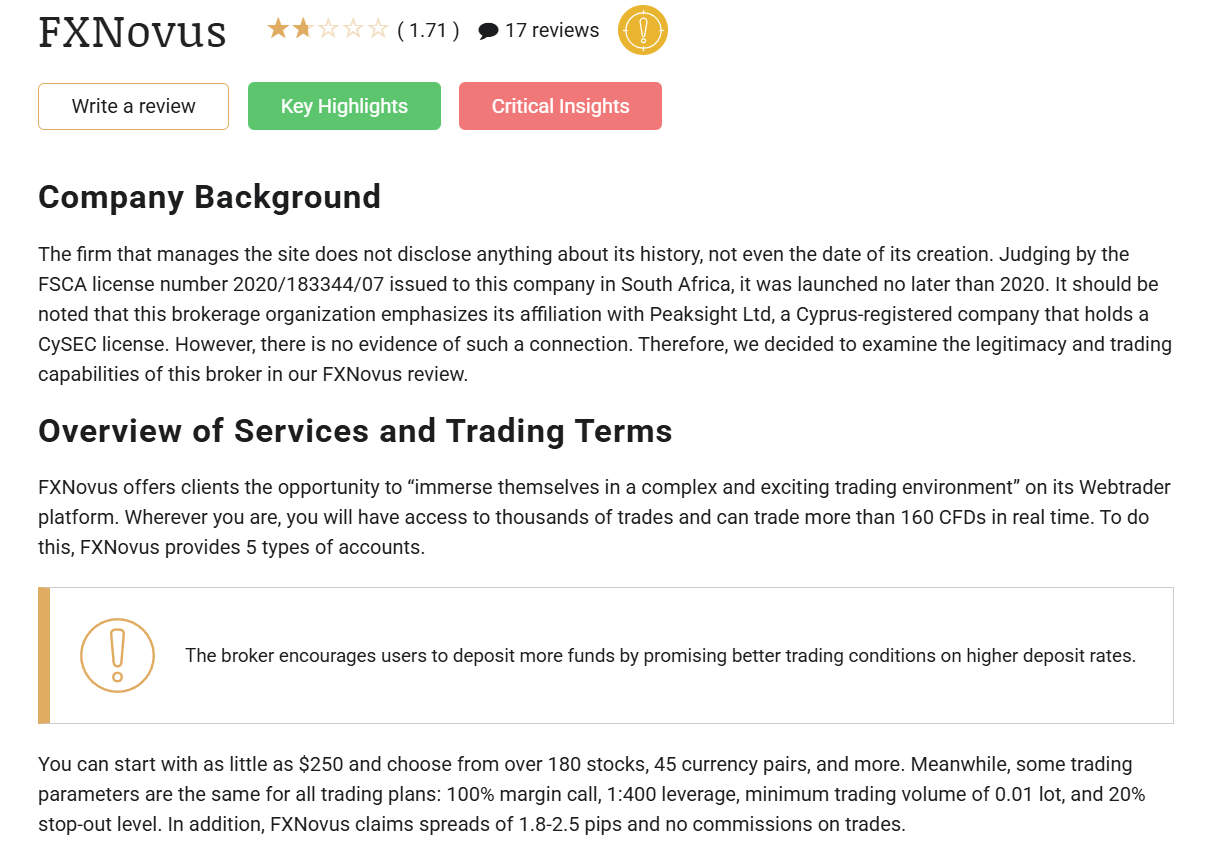

FXNovus markets itself as a global CFD broker, but a growing number of users and independent reviewers are raising serious red flags. While the company claims to hold a legit FSCA license, critics argue that this regulation is being used as a “legitimacy shield.” Multiple complaints allege aggressive sales tactics, opaque fees, and withdrawal issues. For traders considering FXNovus, the blend of glowing marketing and troubling user reports makes for a very cautious risk profile.

Regulatory Ambiguity and Risk of Limited Protection

FXNovus states that it is regulated by the South African FSCA (Financial Sector Conduct Authority), under license number 50963. While FSCA is a legitimate regulatory body, several experts point out that its protections may not extend strongly to international clients. BrokerhiveX further claims that FXNovus misleadingly uses regulatory logos without providing verifiable license numbers or consistent transparency. These factors suggest that regulation alone may not guarantee complete safety.

Complaints About Withdrawals & Hidden Fees

A number of users allege that withdrawing funds from FXNovus is difficult or full of hidden conditions. According to these reports, the broker imposes additional “verification” fees, “taxes,” or uses money-laundering checks as excuses for freezing or delaying withdrawals. Several traders also claim that profitable accounts are sometimes blocked from cashing out, raising serious red-flag concerns about whether the platform is built to trap funds rather than facilitate fair trading.

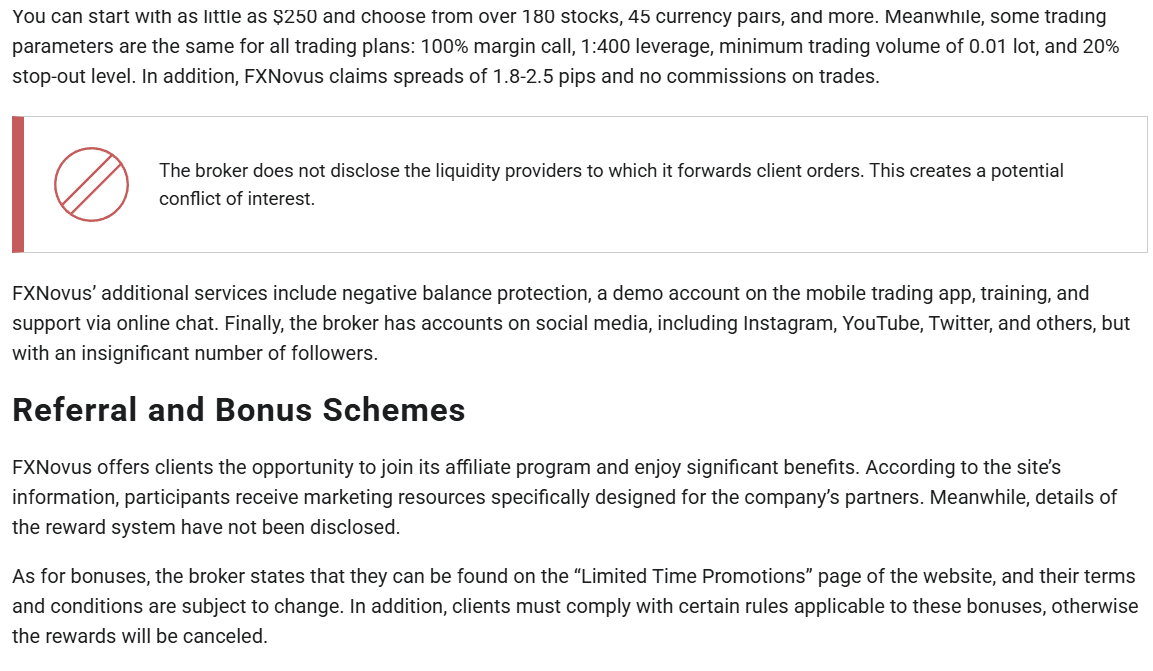

Reported Pressure and High-Risk Sales Tactics

Multiple sources claim that account managers at FXNovus aggressively push clients to make large or risky deposits. According to a detailed analysis, users are sometimes drawn in with promises of bonuses or “exclusive” offers—only to face increasing pressure to trade and deposit more. Some complain that after showing a small initial profit (to build trust), the platform begins to penalize or block larger withdrawals.

Digital Trust Issues and Very Low Overall Score

ScamDoc, a site that assesses online trustworthiness, gives FXNovus a very low trust score (~1%), citing numerous negative reviews and potential involvement in “risky commercial activities.” Meanwhile, Scamroulette lists FXNovus as “suspicious,” noting a lack of verified connection to the claimed Cyprus-based entity (Peaksight Ltd) and warning of a high leverage ratio (1:400) that magnifies risk. These signals together diminish the broker’s perceived credibility.

User Experiences: Mixed But Troubling Testimonials

FXNovus has a very mixed reputation (2.5/5), with dozens of users calling it a “dangerous organization” that encourages overly risky trading. Some reviews mention forced additional deposits, difficult withdrawals, and account managers who relentlessly push for more money.

Conclusion

FXNovus shows a mixed-to-alarming picture: it is regulated, but in a jurisdiction that may offer limited protection for international clients. The large number of user complaints, combined with reports of pushy sales tactics, withdrawal friction, and very low trust ratings, raise serious doubts about how trustworthy and safe this broker really is. For traders — especially those new or considering large investments — FXNovus appears to carry significant risk.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does It FXNovus have any significant outstanding liabilities that may pose financial risks? | Not Known |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to It FXNovus? | Possibly Yes |

| Sanctions or Watchlist Matches | Is It FXNovus listed on any international sanctions or compliance watchlists? | Not Known |

| Criminal Record | Does It FXNovus have a record of criminal activity or related investigations? | Possibly Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving It FXNovus? | Possibly Yes |

| Regulatory Violations | Has It FXNovus faced regulatory violations or penalties? | Not Known |

| Bankruptcy History | Has It FXNovus filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to It FXNovus? | Not Known |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about It FXNovus? | Possibly Yes |

| High-Risk Jurisdiction Exposure | Does It FXNovus operate within or have exposure to high-risk jurisdictions? | Possibly Yes |

| Ongoing Investigations | Is It FXNovus currently subject to any ongoing investigations? | Definitely Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving It FXNovus? | Definitely Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting It FXNovus’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is FXNovus engaged in any high-risk business activities? | Definitely Yes |

View Intel Reports

01

FXNovus: Trader Complaints and Regulation

FXNovus A trading platform facing widespread allegations of manipulative practices and persistent withdrawal difficulties. Our investigation reveals user complaints, regulatory shortcomings, and si...

02

FXNovus: Account and Fund Issues

FXNovus lures traders with high leverage and bonuses, then traps them with frozen funds, manipulated trades, and disappearing support.

03

FXNovus and Recent Investor Concerns

FXNovus has been cited in consumer complaints and media reports concerning alleged online investment fraud and investor losses. A Swiss case involving a fake newspaper article and a reported CHF 13...

04

FXNovus: Structure of Retail Forex Trading

FXNovus, a South African CFD broker operating since 2020, has drawn significant scrutiny due to persistent client complaints

05

FXNovus: Retail Forex Trading Operations

FXNovus is an online trading broker that has faced growing criticism since 2020 due to repeated user complaints and negative reviews.

06

FXNovus: Regulatory Status, Trading Practices, ...

An in-depth consumer alert examining FXNovus, including its corporate setup, regulatory positioning, trading operations, customer experiences, associated businesses, and key risk considerations for...

07

FXNovus: Trading Operations in Retail Forex

FXNovus risk assessment and consumer alert reviewing company structure, regulatory positioning, customer complaints, operational concerns, related businesses, and key considerations for traders.

08

FXNovus : The Forged Swiss Headline That Stole ...

FXNovus presents itself as a sleek, trustworthy broker but dig even slightly beneath the surface and a far more unsettling story emerges. Conflicting regulatory details, repeated withdrawal nightmares

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | kgeld.ch | Internet fraud: 130,000 Swiss francs lost due to a fictitious newspaper article | Retrieved 02/04/2025 |

| 2 | fxnovus | FXNovus Broker Review – Scam and License Analysis | Retrieved 24/09/2025 |

| 3 | fraudtracers.com | About FXNovus (fxnovus.com) | Retrieved 26/06/2025 |

| 4 | lostfundsrecovery.com | Fxnovus.com Exposed — A Detailed Scam Review | Retrieved 03/11/2025 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Rocket Companies, Inc

United States

Intel Reports

04

Trust Score

2.1

Wellamoon

United Arab Emirates

Intel Reports

4

Trust Score

1.8

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings