MEXC.com remains embroiled in controversy despite its claims of serving over 40 million users with low-fee trading and extensive token listings. High-profile incidents, including wrongful freezes of millions in assets, continue to fuel accusations of unfair practices, opaque risk controls, and inadequate user protections. The most notable case involved the 2025 freeze of $3.1 million from trader “The White Whale,” which only resolved after months of public pressure and a rare apology from MEXC executives admitting internal mishandling. Such events underscore deeper systemic issues, where profitable traders face sudden restrictions, and smaller users report similar hardships with little recourse.

The $3.1 Million Freeze Scandal

In July 2025, MEXC froze approximately $3.1 million in The White Whale’s account, alleging automated trading violations for orders placed seconds apart. The trader denied bot use, providing evidence of manual activity, yet funds stayed locked for months. MEXC suggested in-person KYC in Malaysia—a move widely criticized as coercive. Public backlash, including a $2 million bounty campaign, forced resolution by October 31, 2025. An executive reportedly confessed, “We fucked up,” promising process changes. While funds were released, the incident exposed aggressive risk controls that penalize success without transparency, leaving users vulnerable during disputes.

Widespread Complaints of Arbitrary Freezes

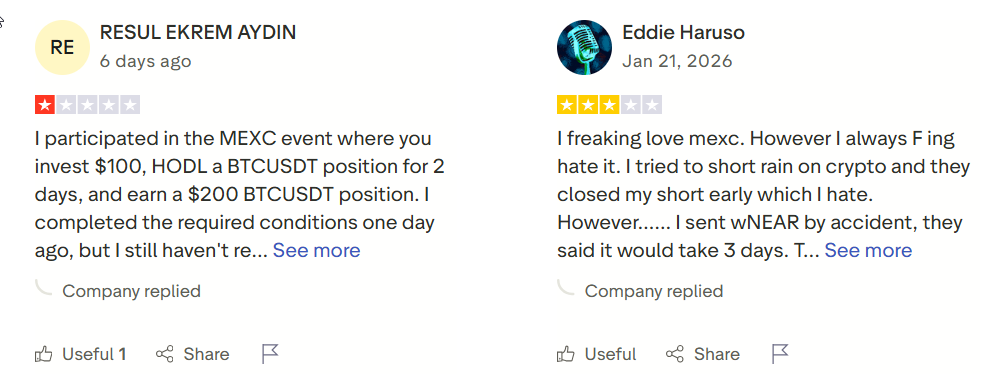

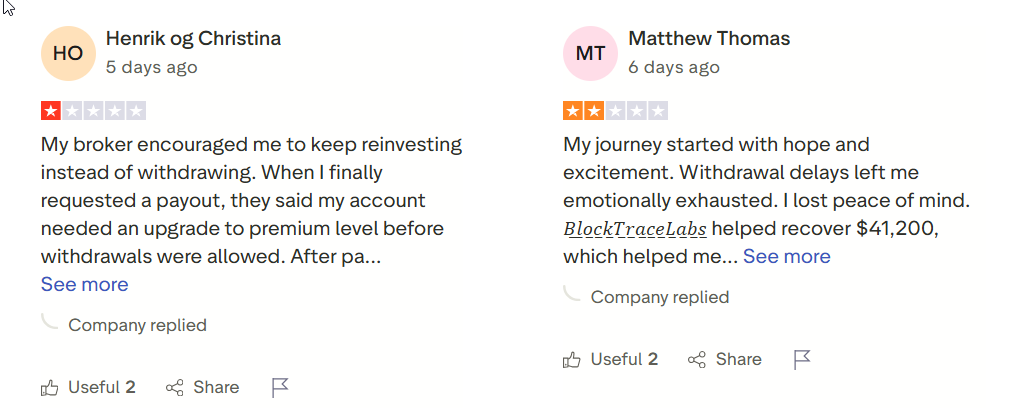

Beyond high-profile cases, user reports on Trustpilot (averaging 1.5/5 from over 1,000 reviews) and Reddit detail frequent account locks under vague “risk review” pretexts. Traders describe funds frozen for weeks or months, often after profitable trades or normal deposits. Complaints include unexplained liquidations during market events, unauthorized actions, and denied access despite submitted proofs. Many label these as selective enforcement against winners, with support offering generic responses or minimal “apology” bonuses like $100–$300. This pattern erodes trust, suggesting MEXC uses freezes to manage liquidity risks at users’ expense.

Manipulation Allegations in Trading

Users accuse MEXC of unfair liquidations via anomalous price wicks disconnected from global markets, particularly in futures. Reports from 2025–2026 highlight positions closed at extreme prices not seen elsewhere, resulting in significant losses. Premarket delays and collateral mishandling add to grievances, with critics claiming internal interference benefits the exchange. Unlike regulated peers offering refunds for anomalies, MEXC rarely compensates, fueling perceptions of predatory practices in high-leverage environments.

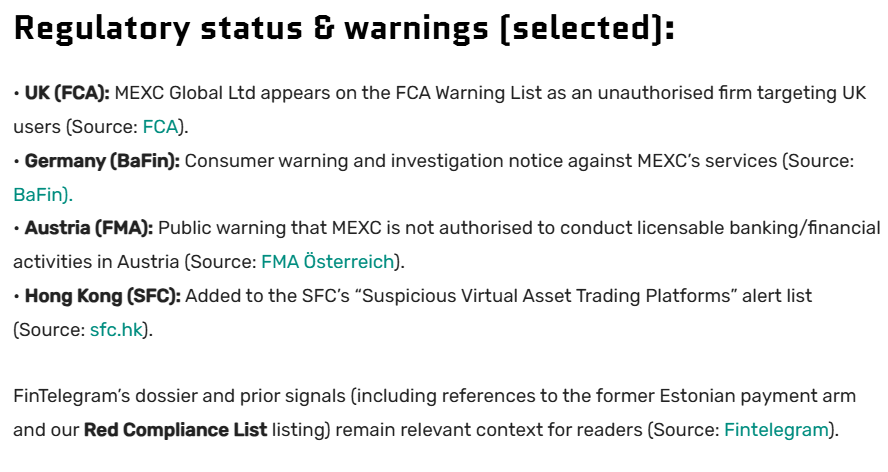

Poor Support and Regulatory Concerns

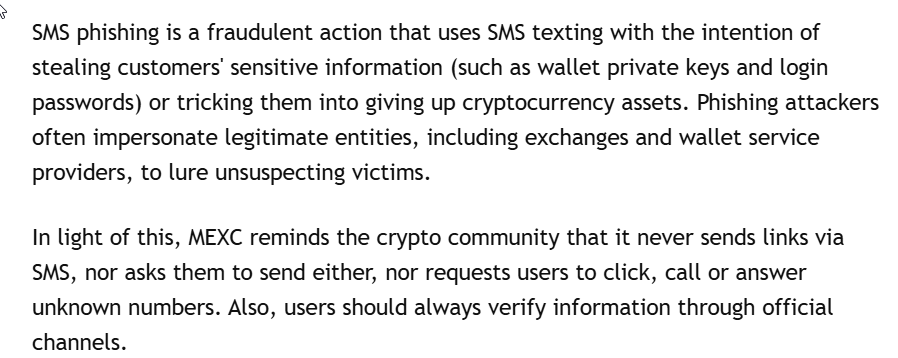

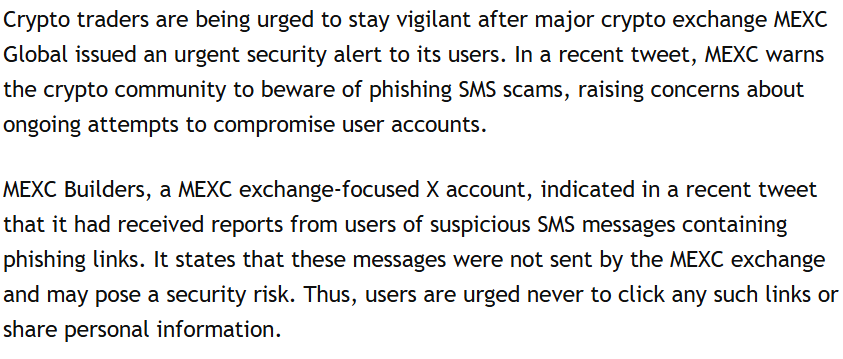

Customer service draws heavy criticism for delays, incompetence, and unresponsiveness—issues that prolong freezes and amplify harm. Regulatory warnings persist in regions like those from BaFin and CySEC, flagging unauthorized operations. Offshore status enables evasion but invites scams, with impersonation frauds exploiting MEXC’s name. Anonymous leadership further undermines accountability.

Conclusion

MEXC.com’s track record of freezes, manipulation claims, and weak support paints a troubling picture in 2026. The White Whale case, resolved only through public outcry, highlights reactive rather than preventive measures. With ongoing complaints and low trust scores, users risk sudden asset inaccessibility. Safer, regulated alternatives better protect funds—avoid MEXC to prevent potential financial pitfalls.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does It MEXC.com have any significant outstanding liabilities that may pose financial risks? | Not Known |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to It MEXC.com? | Possibly Yes |

| Sanctions or Watchlist Matches | Is It MEXC.com listed on any international sanctions or compliance watchlists? | Potentially No |

| Criminal Record | Does It MEXC.com have a record of criminal activity or related investigations? | Possibly Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving It MEXC.com? | Definitely Yes |

| Regulatory Violations | Has It MEXC.com faced regulatory violations or penalties? | Potentially No |

| Bankruptcy History | Has It MEXC.com filed for bankruptcy or been involved in any bankruptcy proceedings? | Definitely Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to It MEXC.com? | Possibly Yes |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about It MEXC.com? | Definitely Yes |

| High-Risk Jurisdiction Exposure | Does It MEXC.com operate within or have exposure to high-risk jurisdictions? | Not Known |

| Ongoing Investigations | Is It MEXC.com currently subject to any ongoing investigations? | Definitely Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving It MEXC.com? | Definitely Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting It MEXC.com’s reputation? | Definitely Yes |

| High-Risk Business Activities | Is MEXC.com engaged in any high-risk business activities? | Definitely Yes |

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | fintelegram.com | MEXC Compliance Update — Red-Flag Warning | Retrieved 28/10/2025 |

| 2 | fca.org.uk | MEXC Global Ltd - https://www.mexc.com/ | Retrieved 03/06/2024 |

| 3 | tradingview.com | Major Crypto Exchange Sounds Alarm Over Security Threat — What's Going On? | Retrieved 20/06/2025 |

| 4 | binance.com | URGENT! MEXC crypto exchange scams trader for $9m | Retrieved 18/06/2025 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sefira Capital

United States

Intel Reports

3

Trust Score

2.3

Kenneth Newcombe

United States

Intel Reports

3

Trust Score

2.3

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings