Phoenix Capital Group, now rebranded as Phoenix Energy, is an energy investment firm focusing on high-yield opportunities in oil, gas, and mineral rights. While the company has grown rapidly and attracted investor attention, several areas of concern remain regarding its regulatory compliance, legal history, financial stability, and operational transparency.

Regulatory Scrutiny

The company’s aggressive promotion of high-yield energy bonds and investment programs has drawn attention from regulatory authorities. Rapid changes in its business structure and expansion into different segments of the energy market have increased scrutiny, raising concerns about whether all investor protections and compliance measures are being consistently applied.

Ongoing discussions in investor forums and industry circles highlight questions about licensing, reporting standards, and the adequacy of internal controls to meet regulatory expectations. Such scrutiny could result in fines, penalties, or restrictions on future operations if compliance gaps are identified.

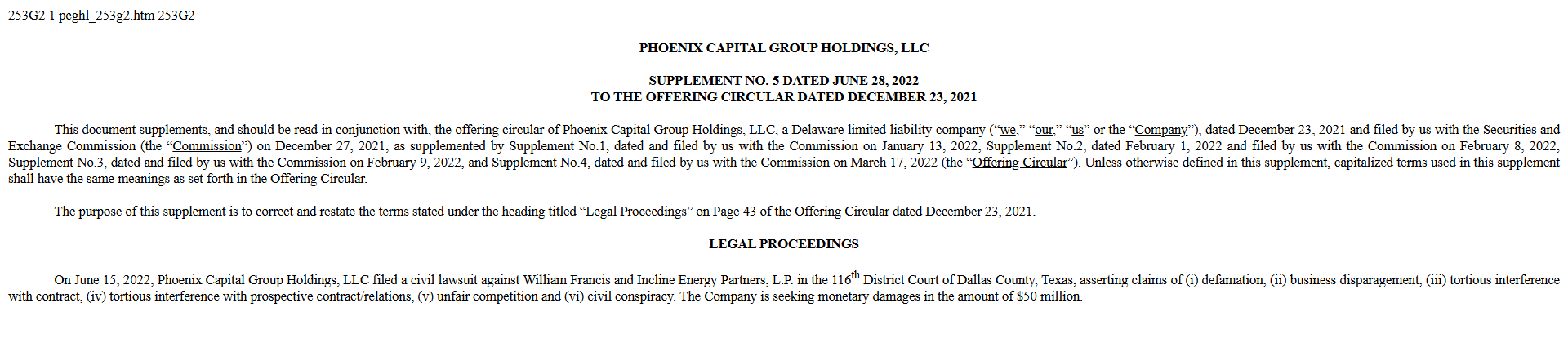

Legal Disputes

Phoenix Capital Group has been involved in notable legal challenges, including a defamation lawsuit against Forbes, which was dismissed by a federal judge. The case underscores potential vulnerabilities in how the company communicates publicly and manages media relations.

Legal disputes also pose the risk of diverting management attention and financial resources from core operations. Extended litigation or regulatory enforcement actions could negatively affect investor confidence and damage the company’s reputation.

Financial Stability

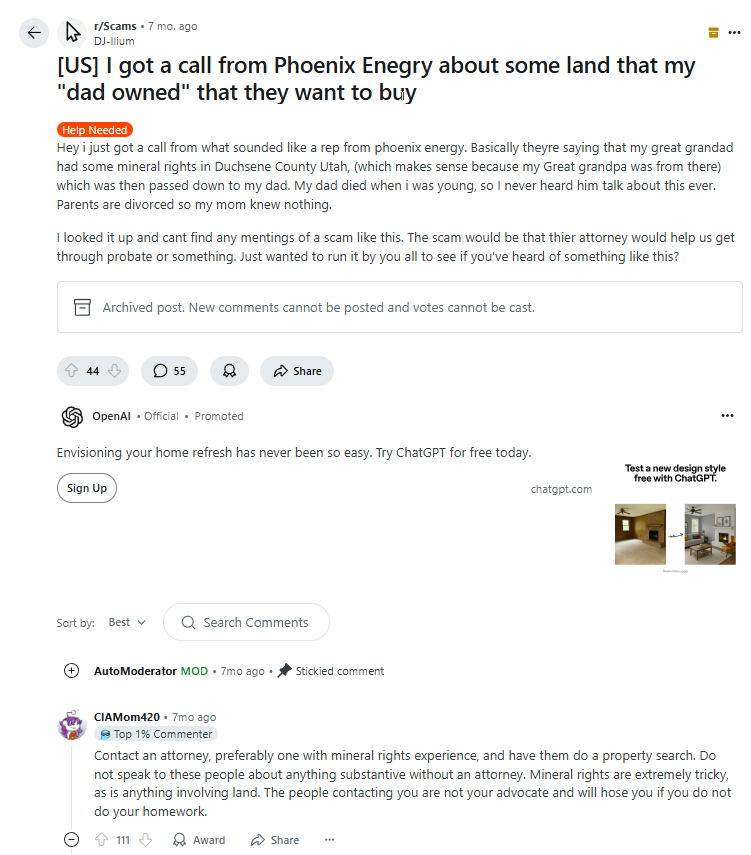

Financial analyses indicate that the firm carries significant debt, which may strain operational flexibility under adverse market conditions. Dependence on high-yield investment products exposes the company to volatility, and fluctuations in oil and gas prices could impact cash flow and profitability.

Additionally, the gradual depletion of existing oil reserves and the need for continued capital investment to maintain production capacity pose long-term sustainability challenges. These financial pressures could affect the company’s ability to meet investor commitments or maintain consistent growth.

Allegations of Risky Practices

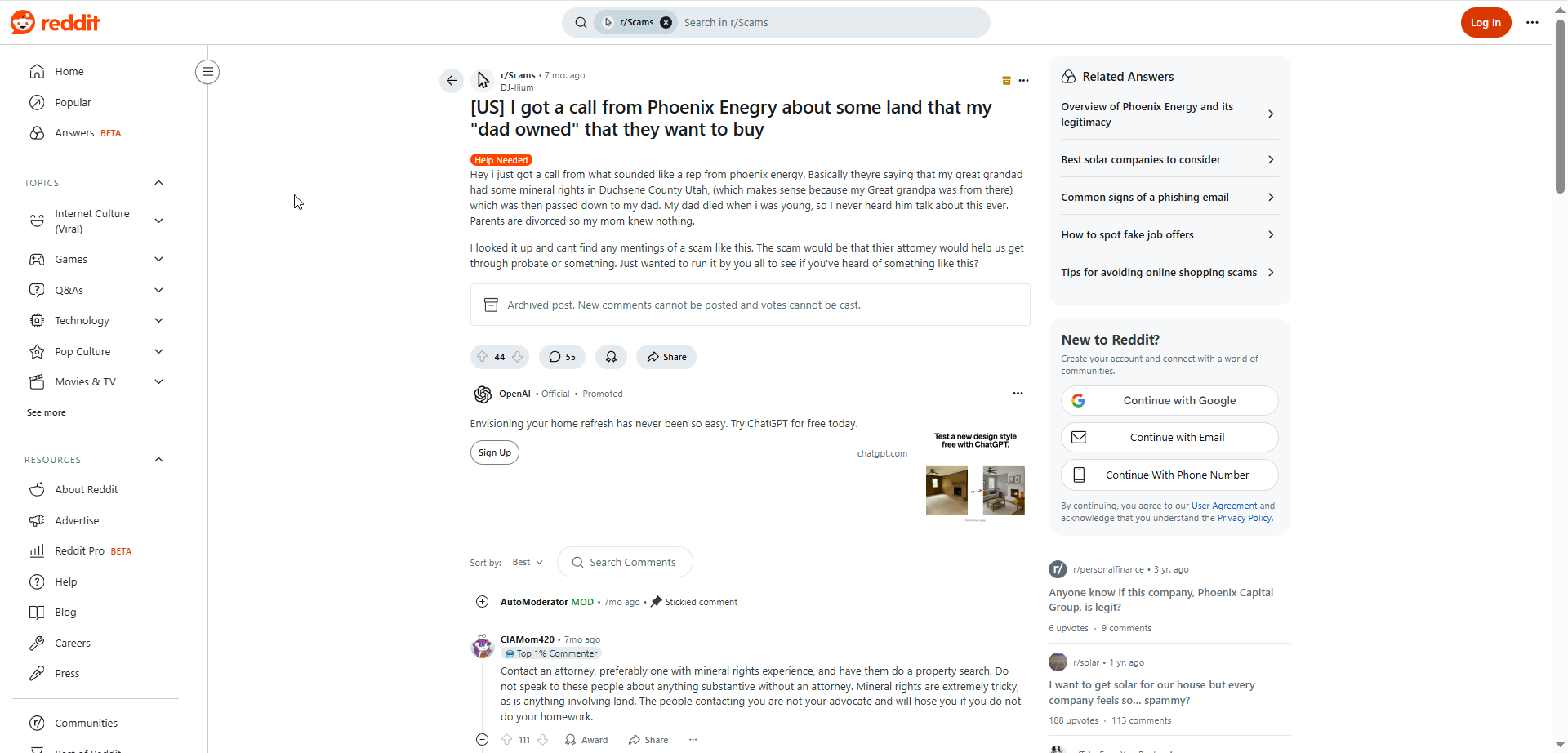

Critics have raised concerns that the company’s business model, particularly its promises of unusually high returns, may resemble Ponzi-like structures. While these allegations are not legally proven, they contribute to reputational challenges that may undermine trust among current and potential investors.

Online discussions and reviews occasionally cite aggressive marketing tactics and complex investment terms that some investors find difficult to evaluate. Such practices can create the perception of elevated risk, even for those who have had positive experiences with the company.

Customer Complaints

Although many investors report satisfaction, some complaints point to unclear contract terms, complex fee structures, and delayed communication on account issues. These challenges can create frustration and reduce confidence in the company’s ability to provide transparent and reliable service.

Investor forums and review platforms highlight that responsiveness varies across different offices and points of contact. Continued issues in communication and transparency may erode the company’s credibility and hinder its ability to attract new investors.

Conclusion

Phoenix Capital Group, now operating as Phoenix Energy, offers high-yield energy investment opportunities but carries substantial risks. Regulatory scrutiny, ongoing legal exposure, financial instability, and allegations of risky practices highlight potential challenges for investors. While the company has demonstrated growth, reputational and operational concerns warrant careful due diligence before engagement.

Compliance and Regulatory Intel

| Risk Category | Assessment Question | Status |

|---|---|---|

| Liabilities | Does It Phoenix Capital Group have any significant outstanding liabilities that may pose financial risks? | Not Known |

| Undisclosed Relations | Are there undisclosed business relationships or affiliations linked to It Phoenix Capital Group? | Not Known |

| Sanctions or Watchlist Matches | Is It Phoenix Capital Group listed on any international sanctions or compliance watchlists? | Not Known |

| Criminal Record | Does It Phoenix Capital Group have a record of criminal activity or related investigations? | Definitely Yes |

| Civil Lawsuits | Are there civil lawsuits, past or present, involving It Phoenix Capital Group? | Not Known |

| Regulatory Violations | Has It Phoenix Capital Group faced regulatory violations or penalties? | Not Known |

| Bankruptcy History | Has It Phoenix Capital Group filed for bankruptcy or been involved in any bankruptcy proceedings? | Possibly Yes |

| Adverse Media Mentions | Have there been significant adverse media mentions related to It Phoenix Capital Group? | Not Known |

| Negative Customer Reviews | Are there negative reviews or complaints from customers or clients about It Phoenix Capital Group? | Not Known |

| High-Risk Jurisdiction Exposure | Does It Phoenix Capital Group operate within or have exposure to high-risk jurisdictions? | Not Known |

| Ongoing Investigations | Is It Phoenix Capital Group currently subject to any ongoing investigations? | Possibly Yes |

| Fraud or Scam Allegations | Have there been fraud or scam allegations involving It Phoenix Capital Group? | Possibly Yes |

| Reputational Risk Incidents | Have there been incidents significantly impacting It Phoenix Capital Group’s reputation? | Possibly Yes |

| High-Risk Business Activities | Is Phoenix Capital Group engaged in any high-risk business activities? | Possibly Yes |

View Intel Reports

01

Phoenix Capital Group Holdings is a Scam? Find ...

Phoenix Capital Group Holdings, LLC, founded in 2019 and headquartered in Denver, is a controversial family-controlled firm specializing in oil and gas mineral rights investments, accused of aggres...

02

Phoenix Capital Group: Is It a Scam or Legit? U...

Phoenix Capital Group Holdings faces mounting criticism over misleading claims, poor communication, and questionable handling of client funds. Despite its promises of financial expertise, customer ...

03

Phoenix Capital Group Faces Accusations: Scam C...

Phoenix Capital Group Holdings, LLC is a Denver-based oil and gas mineral rights company founded in 2019. It operates independently and is not associated with other businesses that share a similar ...

Internet Archives and Screenshot

About us

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs.

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges.

| # | Source | Page Title | Date Retrieved |

|---|---|---|---|

| 1 | phoenix-capital-group-lawsuit-update.pages.dev | Phoenix Capital Group Lawsuit Update: High-Yield Risks Revealed | Retrieved 23/02/2025 |

| 2 | SEC | PHOENIX CAPITAL GROUP HOLDINGS, LLC | Retrieved 28/06/2022 |

| 3 | Bloomberg Law | Forbes Defeats Phoenix Capital, CEO’s Defamation Allegations | Retrieved 04/08/2025 |

| 4 | I got a call from Phoenix Enegry about some land that my "dad owned" that they want to buy | Retrieved 14/02/2025 | |

| 5 | Bogleheads.org | Phoenix Capital Group [aka Phoenix Energy One, LLC] | Retrieved 09/04/2025 |

Our Research Methodology

Learn how we identify and evaluate

global entities

OSINT

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

User Experience

We comb the internet and interview current and former clients to evaluate the overall user experience and identify any common pain points that may impact the user experience.

Public Records

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Sentiment Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Brand Analysis

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

KYC Data

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Risk Assessment

We analyze all costs including rate structures (interchange-plus, tiered, flat-rate, etc), monthly fees, equipment costs, early termination fees, and hidden charges. This data is gathered from service agreements, statements and client feedback.

Wellamoon

United Arab Emirates

Intel Reports

4

Trust Score

2.1

Target Corporation

United States

Intel Reports

7

Trust Score

2.2

User Reviews

Discover what real users think about our service

0

Average Ratings

Based on 0 Ratings