Introduction

Deal Dash operates what it calls a “penny auction” platform, promising consumers the chance to bid on merchandise at steep discounts. Behind the superficial allure of low prices lies a business model that requires users to pay for every bid they place, with bids costing money even when the bidder does not win an item. Critics and consumer advocates have repeatedly described the mechanism as closer to gambling than a legitimate auction, noting that most participants lose money rather than save it, and that advertised “savings” rarely reflect true costs once bid fees are factored in.

Over the past several years, consumer complaints have mounted about Deal Dash’s pricing transparency, billing practices, and the structure of its auctions. According to data from the Better Business Bureau, the company has accumulated hundreds of complaints over the last few years, many of which involve unexpected charges and disputes over billing and refunds.

Independent consumer watchdog reports, including those from Truth in Advertising, have continued to highlight deceptive and predatory marketing practices by Deal Dash. These reports detail how advertising materials often omit key cost information and how vulnerable individuals have lost significant sums of money on the platform, sometimes without clear safeguards or warnings about the risks involved.

Consumer Complaints and Billing Issues

Deal Dash’s billing practices have generated a significant volume of consumer complaints in recent years. Many users have reported unknowingly being charged for bid packages when entering credit card information during account creation or onboarding, leading to disputes over unauthorized charges and confusion about what they were purchasing.

A recurring theme in complaints is that the platform’s user interface and sign-up processes are not sufficiently clear, resulting in consumers being billed for bids without fully understanding that these charges are optional but tied directly to bidding participation. Numerous complaints lodged with third-party review platforms and the BBB illustrate frustration over refund policies and the difficulty of disputing charges once they have been processed.

In some cases, consumers have reported that Deal Dash’s customer service responses are inconsistent or slow to resolve issues related to billing errors. Although the company has occasionally refunded disputed charges, critics argue that the volume and similarity of complaints over billing confusion suggest systemic issues rather than isolated incidents.Consumers have also criticized Deal Dash’s refund practices. Many who have sought refunds for unused or mistaken bid purchases have found restrictive policies that limit reimbursement to first-time purchases or impose conditions that make it difficult to recover funds.

These refund restrictions have been described by some buyers as effectively locking in consumer losses, especially when combined with unclear disclosures about bid cost eligibility for refunds.

The accumulation of billing and refund controversies contributes to a broader pattern of consumer dissatisfaction that has persisted over multiple years, with similar complaints recurring in 2024 and 2025.

Deceptive Marketing and Misleading Savings Claims

A central criticism of Deal Dash concerns the way deals and savings are advertised. Investigations by consumer advocacy organizations have determined that Deal Dash’s marketing often highlights “winning bids” at seemingly low final prices without adequately disclosing the true total cost, including the money spent on all bids leading up to that final price.

These marketing practices contrast sharply with how traditional auctions or retailers present pricing, and critics argue that consumers are misled into believing they will pay much less overall than they actually end up spending once bid costs are included.

Advertised bargains have been described as “predatory” since they omit key cost information or place essential disclosures in fine print that is easy to overlook, especially by inexperienced users or vulnerable consumers seeking bargains. Consumer advocates have also documented ongoing complaints about television ads and online promotions that emphasize deep discounts while obscuring the role of prepaid bids in the cost structure. This has fueled arguments that marketing materials misrepresent the value proposition of Deal Dash auctions.

Some consumers, after participating in auctions, have found that their actual expenditures—including unused bids and final purchase prices—exceed the cost of buying the same products through traditional retailers.

These practices have prompted repeated warnings from consumer groups that Deal Dash’s promotions should be treated with caution, particularly by individuals who may not fully research how cumulative bid costs impact total spending.

Targeting of Vulnerable Consumers and Addictive Design

Critics have raised concerns that Deal Dash’s platform design can exploit psychological triggers similar to those found in gambling. The process of placing repeated small bids and watching countdown clocks can create an emotional and addictive user experience that encourages continued spending, even when losses mount.

Reports from consumers and advocacy groups describe instances where individuals, including retirees and people with limited financial literacy, have spent large sums—including tens of thousands of dollars—on bids without acquiring items of equivalent value.

The automatic bidding feature, known as “BidBuddy,” has been specifically mentioned in complaints where users lost track of the number of bids placed, leading to unexpectedly high charges and mounting losses they did not anticipate when entering the auction.

Some individuals have told consumer advocates that they felt unable to stop participating in auctions due to the design and competitive elements of the platform, comparing their experience to gambling behaviors more than to straightforward shopping.

The absence of prominent warnings about the financial risks and potential for addictive patterns further exacerbates concerns about the platform’s suitability for users prone to compulsive spending.

Consumer groups have argued that such design choices and the lack of robust consumer protections disproportionately harm vulnerable users who may not fully understand the financial implications of the bidding process.

Legal Scrutiny and Unresolved Actions

Deal Dash has faced legal scrutiny in the past, including a high-profile class action lawsuit alleging that its penny auction model effectively constituted an illegal lottery and that luxury product claims were misleading. While this lawsuit was outside the 2020–2025 window, its legacy continues to inform consumer skepticism and regulatory attention toward the company.

The class action complaint described how consumers often lose money, how advertised “brand name” products were actually generic items, and how the auction structure disproportionately benefits the house rather than bidders.

Although that specific case was dismissed, the substantive allegations remain relevant to current criticisms of the company’s business model and marketing practices.

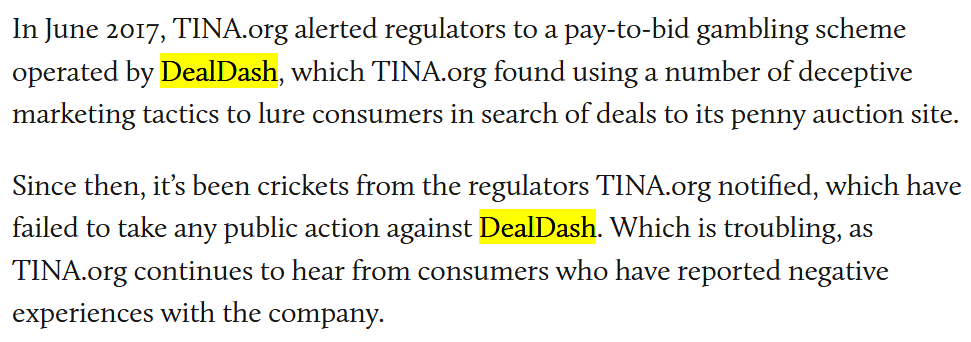

More recent consumer advocacy reports have noted that regulators notified in 2017 and after have taken little public enforcement action, despite ongoing complaints about deceptive practices and predatory marketing.

This lack of visible regulatory enforcement has frustrated consumer groups and raised questions about the adequacy of consumer protection in the face of continued complaints.

Deal Dash’s continued operations without substantive public penalties or fines in the last several years have been portrayed by critics as an indication that the current regulatory framework struggles to address the risks posed by bidding-fee auction models.

Reputation, Complaints, and Ongoing Risks

Despite ongoing complaints, third-party reviewers like Trustpilot show a mix of positive and negative customer feedback. Some users report positive experiences and successful bids, but negative reviewers frequently mention issues with winning auctions, perceived unfairness, and losing substantial sums on bids without tangible returns.

Patterns in negative reviews suggest that many users who continue to engage with the platform after early losses find it difficult to win significant items, contributing to escalating spending with little to show for it.

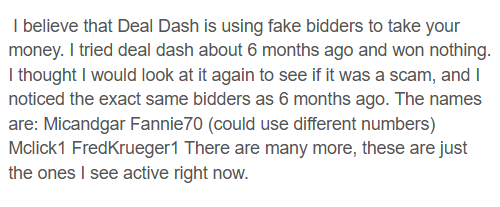

Additionally, concerns about unclear bidding dynamics persist in user feedback, with some reviewers claiming that frequent bidders or automated tools dominate auctions, making it harder for casual bidders to succeed.

Complaints also indicate that product value and quality sometimes fall short of expectations based on Deal Dash’s advertising, exacerbating perceptions of unfairness and disappointment among buyers.

Even users who receive products may find that the total cost—including bid fees—is greater than retail prices, undermining the claimed savings and leading to frustration and distrust.

Overall reputation risks for consumers remain elevated, with patterns of complaints and unresolved grievances highlighting persistent issues that have not been fully addressed by the company.

Conclusion

Deal Dash’s penny auction model presents a high-risk proposition for consumers, masked by superficial promises of bargains and low final prices. In reality, the requirement to purchase bids in advance transforms the auction process into a form of paid participation where the majority of users lose money, often significantly more than the advertised savings. Persistent consumer complaints, documented billing disputes, and restrictive refund policies underscore systemic issues in how Deal Dash operates and communicates with its users. The continued absence of decisive regulatory enforcement actions further compounds concerns, leaving many consumers without meaningful recourse when they encounter problems. The platform’s marketing practices, criticized as deceptive by watchdog groups, consistently understate the true costs of winning auctions and overstate the potential benefits, fostering confusion and financial harm. Vulnerable users, particularly those prone to addictive spending behavior, face disproportionate risk as the platform’s design appears to leverage competitive and psychological dynamics akin to gambling rather than straightforward e-commerce. Mixed online reviews do little to mitigate these concerns, as negative experiences cluster around key risks like unexpected charges, perceived unfairness, and disappointing outcomes relative to true market prices. For anyone considering using Deal Dash, the weight of documented complaints and ongoing risk factors should prompt extreme caution.

Leave a Reply