Introduction

Deal Dash presents itself as an online auction marketplace where consumers are encouraged to believe they can purchase everyday products, electronics, and household items at prices far below retail value. The appeal is straightforward: place small bids, watch the price inch upward by pennies, and potentially secure items for a fraction of their listed cost. What is far less prominent in this narrative is the requirement that users must pay real money for every bid placed, regardless of whether they win. This single structural feature fundamentally alters the nature of the transaction from conventional shopping into a pay-to-participate system where losses are common and often substantial.

From 2020 onward, consumer advocates and affected users have consistently raised concerns that Deal Dash’s model is not clearly understood by many participants until after financial harm has occurred. While the platform technically discloses its rules, the practical impact of cumulative bidding costs is frequently underestimated. Many consumers report entering auctions with the belief that careful bidding will yield bargains, only to later discover that the money spent on bids alone exceeds the retail price of the item pursued.

This article provides a comprehensive consumer alert and risk assessment of Deal Dash based on recurring complaint patterns, reported user experiences, and structural characteristics of the platform since 2020. The focus is not on isolated dissatisfaction, but on persistent, repeatable risk indicators that continue to expose consumers to financial loss, confusion, and behavioral pressure.

Financial Exposure Embedded in the Bidding Model

At the core of Deal Dash’s operation is a bidding system that requires upfront payment. Each bid costs a fixed amount, and every time a bid is placed, the auction price increases by only a small increment. This disconnect between the cost of bidding and the visible auction price is one of the most frequently cited sources of consumer confusion. Users often focus on the displayed price, which may appear low, while overlooking the unseen accumulation of bid fees.

Numerous consumers report that they did not fully appreciate how quickly bidding expenses add up during competitive auctions. What begins as a few low-cost bids can escalate into hundreds or thousands of bids over time, especially when multiple users compete for the same item. Because bid costs are sunk costs that cannot be recovered unless an item is won under specific conditions, participants may feel compelled to continue bidding in an attempt to justify money already spent.

Refund limitations exacerbate this exposure. While some users receive partial refunds under limited circumstances, many report that unused bids are non-refundable or only eligible for reimbursement under narrow conditions. As a result, consumers often find themselves locked into continued participation to avoid feeling that their initial expenditure was wasted, increasing the likelihood of further financial loss.

Account Setup, Charges, and Payment Disputes

A significant volume of complaints since 2020 centers on the process of account creation and bid purchase. Consumers frequently report confusion during onboarding, particularly when entering payment information. Some state they believed they were authorizing a single transaction, only to later discover charges for bid packages that were not fully understood at the time of purchase.

Disputes often arise when users review their bank or credit card statements and see amounts that feel disproportionate to their expectations. These disputes are compounded by the fact that bids are consumed rapidly during auctions, making it difficult for consumers to track spending in real time. Even users who closely monitor their activity report surprise at how quickly costs escalate once bidding becomes competitive.

Customer service responses to billing concerns are described inconsistently. While some users receive refunds or clarifications, others report delayed responses or denials based on policy technicalities. The repetition of similar complaints over multiple years suggests that these issues are not isolated misunderstandings but rather recurring outcomes of how payment and bidding systems are structured and presented.

Advertising Tone and the Illusion of Savings

Deal Dash’s promotional messaging frequently emphasizes dramatic success stories, highlighting winning bids that appear to secure high-value products for minimal prices. These figures are often presented prominently, creating the impression that low final auction prices equate to low total costs. For many consumers, this framing shapes expectations long before they understand how bidding fees operate in practice.

The cumulative cost of bids is rarely emphasized with the same clarity or prominence as winning prices. While disclosures may exist, they are often overshadowed by imagery and language focused on discounts and excitement. This imbalance leads consumers to underestimate both the probability of losing auctions and the financial commitment required to win one.

Over time, many users report a growing sense of disillusionment as they compare their total spending with the value of items received, if any. What initially appeared to be an opportunity for savings is later perceived as a system where advertised bargains are not representative of typical outcomes. This gap between expectation and reality is a consistent theme across consumer feedback.

Behavioral Pressure and Escalation of Spending

The auction mechanics employed by Deal Dash introduce behavioral dynamics that go beyond standard online shopping. Countdown timers reset with each bid, creating a sense of urgency and competition. This design encourages rapid decision-making, often at the expense of careful cost evaluation. Users describe feeling pressured to act quickly to avoid losing auctions after investing time and money.

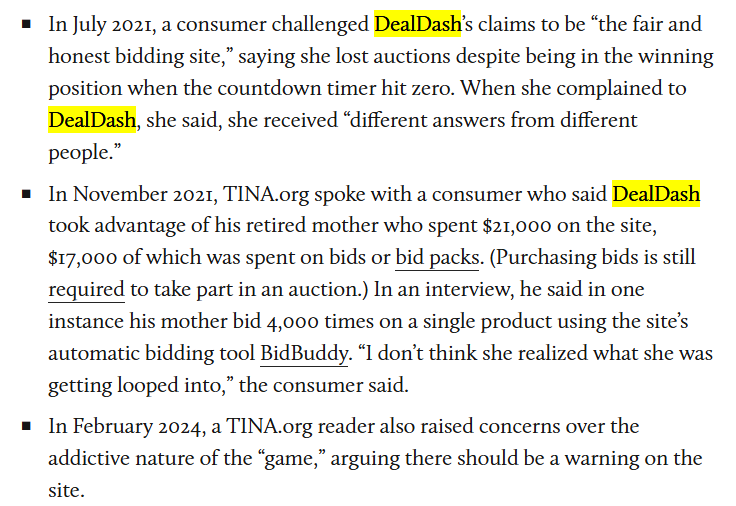

The availability of automated bidding tools further intensifies these dynamics. While marketed as a convenience, automated bidding can place bids faster and more frequently than users anticipate. Complaints frequently describe situations where users enabled such features without fully realizing how many bids would be consumed in a short period, resulting in unexpectedly high charges.

For individuals susceptible to impulsive behavior or loss-chasing tendencies, these design elements can be particularly harmful. The platform offers limited safeguards to interrupt escalating spending or to prompt users to reassess their financial exposure. As a result, responsibility for managing risk falls almost entirely on consumers navigating a high-pressure environment.

Patterns of Consumer Loss and Dissatisfaction

A recurring pattern in consumer feedback is the experience of repeated losses before any successful outcome, if one occurs at all. Many users report participating in multiple auctions without winning, exhausting their bid balances in the process. Even those who eventually win items often find that their total spending far exceeds the apparent bargain price displayed at the end of the auction.

Dissatisfaction is compounded when users calculate their net outcome and realize that purchasing the same item through a traditional retailer would have been cheaper and less stressful. This realization frequently leads to frustration and regret, particularly among users who joined the platform seeking savings during financially vulnerable periods.

The persistence of these complaints across years suggests that losses are not rare or incidental. Instead, they appear to be a common outcome of the system’s design, raising questions about whether the typical user experience aligns with the expectations set by promotional messaging.

Historical Legal Scrutiny and Unresolved Questions

Deal Dash has faced legal challenges in the past related to the nature of its auction model and the representations made to consumers. While some of these cases occurred prior to 2020, their relevance persists because the core business model has remained largely unchanged. Allegations raised in earlier actions continue to echo in modern consumer complaints.

Since 2020, advocacy organizations have continued to document concerns without clear evidence of structural reform. Observers note that many of the same issues—cost opacity, behavioral pressure, and disproportionate consumer losses—remain central to criticism of the platform. This continuity suggests that prior scrutiny did not result in meaningful consumer protection improvements.

The absence of prominent enforcement actions in recent years has left many consumers relying on individual dispute resolution rather than regulatory remedies. For those who experience losses, this often means navigating refund policies and customer service processes that may not provide satisfactory outcomes.

Product Value and Fulfillment Concerns

Even when users successfully win auctions, satisfaction is not guaranteed. Some consumers report disappointment with the value or condition of items received, particularly when considering the total amount spent on bids. In such cases, the perceived bargain dissolves once all costs are accounted for.

Complaints also reference delays in fulfillment or difficulties resolving issues related to shipping and returns. While these issues may not affect every user, they contribute to a broader perception of imbalance between consumer risk and company benefit. For users who have already incurred losses through bidding, additional friction in fulfillment can amplify dissatisfaction.

The combination of financial risk and variable product outcomes reinforces the sense that participation involves uncertainty beyond typical online shopping experiences. For many consumers, this uncertainty undermines trust in the platform.

Reputation Trends and Repeat Warnings

Public review platforms reflect a polarized response to Deal Dash. While some users report positive experiences, negative reviews are notable for their consistency in describing specific problems. Themes such as unexpected spending, difficulty winning auctions, and disappointment with overall value recur frequently across years of feedback.

Another recurring concern is perceived inequality between participants. Some users believe that frequent bidders or those using advanced tools dominate auctions, leaving casual users at a disadvantage. This perception contributes to the belief that the system favors a small subset of participants while the majority absorb losses.

Taken together, these reputation signals indicate that consumer risk exposure has not diminished over time. Despite continued participation by new users, the underlying issues driving dissatisfaction remain largely unchanged.

Conclusion

Deal Dash operates on a paid-bidding auction model that consistently exposes consumers to significant financial risk while presenting itself as a source of exceptional bargains. Since 2020, patterns of complaints have highlighted ongoing issues related to cost transparency, billing clarity, and the psychological pressure embedded in the platform’s design. Many consumers enter auctions focused on low displayed prices without fully understanding that bid fees represent the primary expense.

Marketing practices that emphasize winning moments and dramatic discounts contribute to unrealistic expectations, while auction mechanics encourage continued spending under competitive and time-sensitive conditions. Refund limitations and inconsistent customer service responses further compound losses once money has been committed. Historical legal scrutiny and continued advocacy reporting suggest that these concerns are longstanding and insufficiently addressed.

For consumers, the overarching pattern is clear: participation carries a high likelihood of losing money, often exceeding the value of any item obtained. Without substantial improvements in disclosure, safeguards, and spending controls, Deal Dash remains a high-risk environment. Extreme caution, and a full understanding of the bidding model, are essential for anyone considering engagement with the platform.

Leave a Reply