FPI Management represents in the real estate sector. Established as a private third-party manager for multifamily housing, the company oversees properties for various owners, including big investors. It specializes in affordable housing programs and market-rate apartments, claiming expertise in new builds and ongoing operations. Reports show it ranks highly in managing low-income housing tax credit properties, handling thousands of units across regions. Revenue figures suggest a large-scale operation, with employee counts in the thousands. This positions FPI Management as a key entity in residential management, but scale often brings challenges.

Our findings indicate the company emphasizes innovation and excellence, yet public feedback tells another story. We note awards for workplace wellness, but these contrast with employee and tenant experiences. In simple terms, FPI Management acts as a go-between for property owners and renters, collecting rents, maintaining buildings, and handling leases. This role puts it at the center of daily housing issues, where small problems can grow into big disputes.

Business Relations and Partners

We uncovered several business ties that shape FPI Management’s operations. It works closely with institutional investors, managing assets for them without owning properties itself. This fee-based model keeps it focused on services rather than ownership risks. Partnerships include collaborations with software firms for pricing and data sharing, which have drawn attention in legal contexts. For instance, connections to systems that help set rents have led to claims of coordinated price hikes.

Further, associations with government programs like HUD and Section 8 highlight its role in affordable housing. These links bring funding but also oversight, with reports of inadequate inspections and tenant pressures. We found ties to other management firms through shared practices or past mergers, though details remain limited. In employee contexts, relations with labor groups surface in disputes over wages and living arrangements. Overall, these connections form a network that supports growth but exposes vulnerabilities.

Key Personal Profiles

Our review of leadership reveals family ties and long-term involvement. The CEO leads with decades of experience, overseeing strategy and growth. A senior vice president, related to the CEO, handles key operations. Other executives focus on maintenance, inclusion, and regional roles, bringing diverse backgrounds in real estate and finance.

We profiled figures like regional directors and support managers, noting their roles in daily decisions. Public data shows some have moved between firms, carrying expertise in property ops. One manager, mentioned in complaints, shifted roles amid allegations. These profiles show a tight-knit team, but they also link to personal accusations in reports.

OSINT Findings

Using open sources, we gathered insights on FPI Management’s footprint. Employee directories list thousands, with locations centered in California but spanning states. Social profiles highlight company events and awards, yet comments reveal dissatisfaction. Public filings show involvement in housing projects, with data on unit counts and investor ties.

We noted executive connections on professional networks, showing past roles in similar firms. Adverse mentions tie leaders to disputes, including tenant threats and policy failures. This OSINT layer adds depth, showing how public data exposes operational patterns.

Undisclosed Business Relationships and Associations

We probed for hidden links, finding associations not always spotlighted. Ties to pricing software providers emerged in antitrust claims, suggesting data-sharing networks with other landlords. Collaborations with HUD affiliates raise questions about oversight lapses. Some reports hint at family-owned structures influencing decisions, though not fully disclosed. Associations with rebuttal services for online reviews suggest efforts to manage reputation quietly. These elements point to networks that could hide conflicts.

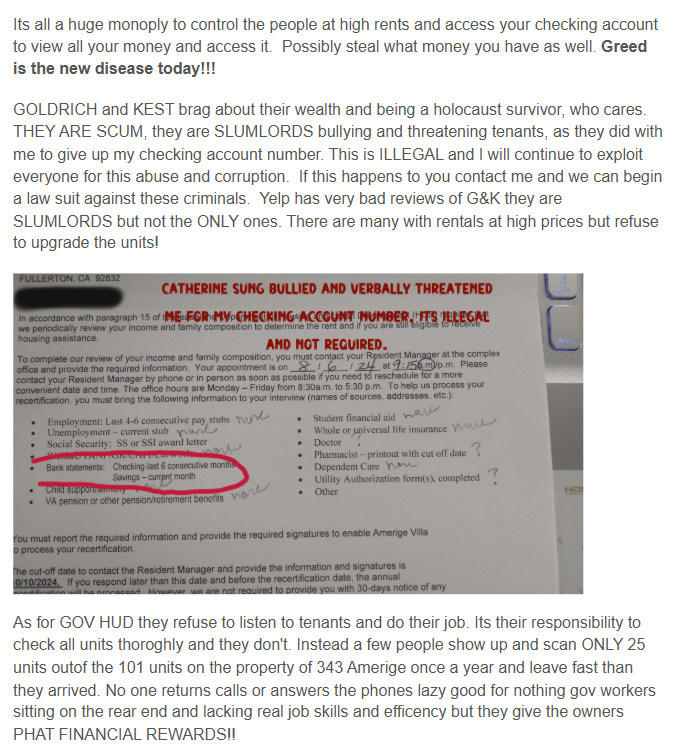

Scam Reports and Red Flags

Reports paint FPI Management as facing scam accusations. One detailed account claims threats to obtain bank details, labeling it illegal and phishing-like. Red flags include high rents without upgrades, poor maintenance, and pressure tactics. Employees report manipulative management, while tenants cite deceptive fees. Sudden policy changes and ignored repairs signal issues. We see patterns of slumlord behavior in affordable housing takeovers.

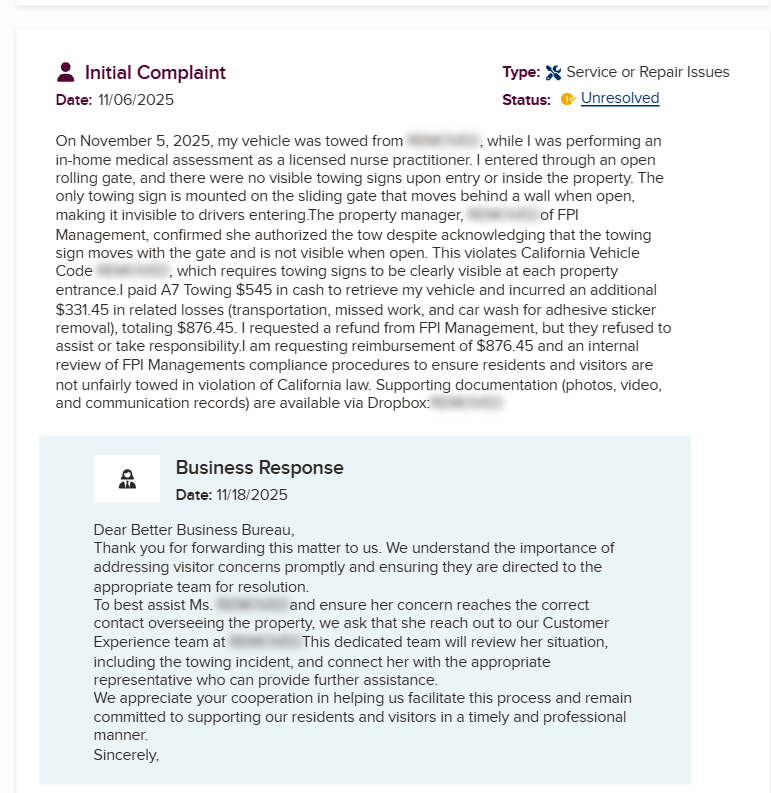

Allegations and Complaints

Allegations range from tenant bullying to employee mistreatment. Claims include verbal threats by managers for financial info, fraudulent deposits, and HUD inaction. Complaints highlight deceptive practices in senior housing, leading to suits. Workers allege wrongful termination and unpaid wages via rent credits. Tenants report negligence in evictions causing harm. These build a narrative of systemic problems.

Criminal Proceedings and Lawsuits

Lawsuits abound, including a $2.8 million settlement for rent inflation via software. A data breach led to payouts for victims. Violations of servicemember rights drew federal action. Other cases involve unfair lease terminations and negligence in shootings. No criminal convictions appear, but civil actions persist.

Sanctions and Bankruptcy Details

We found no active sanctions against FPI Management. Bankruptcy searches yielded no filings for the core entity, though related liquidation cases exist for affiliates. This suggests financial stability, but ongoing suits could strain resources.

Adverse Media

Media coverage highlights negatives, from rent-fixing probes to deceptive ads for seniors. Reports on data breaches and employee suits add to scrutiny. Social posts amplify settlements and tenant woes.

Negative Reviews and Consumer Complaints

Reviews on business bureaus and forums show patterns of poor service. Tenants complain of ignored repairs, high fees, and deceptive tactics. Employees cite low integrity and pressure.

Detailed Risk Assessment in Relation to Anti-Money Laundering Investigation and Reputational Risks

We assess risks based on findings. For AML, property management involves cash flows from rents, raising laundering potentials through unchecked payments or HUD funds. No direct AML allegations, but tenant bank detail pressures could enable fraud. General industry risks include weak checks on tenant sources, per expert guides. Reputational risks stem from lawsuits and complaints, eroding trust. Settlements like price-fixing harm image, potentially deterring partners. Adverse media amplifies damage, linking to broader fraud concerns. High risk if patterns continue.

In our expert opinion, FPI Management faces moderate to high risks. While operations show strength, recurring issues suggest need for reforms. Investors and tenants should weigh these against benefits, pushing for transparency to mitigate threats.

Conclusion

In our expert view, FPI Management faces substantial hurdles that outweigh its operational strengths. The pattern of complaints, legal entanglements, and red flags signals a need for reform to curb risks. For AML, vigilance on financial interactions is crucial to avoid escalation. Reputationally, the firm risks isolation if issues persist. We advise caution for engagements, prioritizing due diligence to safeguard interests.

Leave a Reply