FPI Management’s position in the real estate landscape. As a leading third-party manager, it handles thousands of units across multiple states, focusing on affordable and market-rate housing. The firm manages over 165,000 units, emphasizing compliance with programs like HUD while pursuing growth through investor partnerships. Recent events, including settlements and staff reductions, highlight pressures from legal challenges and market dynamics.

Business Relations and Partners

We identify key ties shaping operations. FPI collaborates with institutional investors and previously utilized revenue management software from providers like Yardi, leading to antitrust scrutiny. In 2025, a $2.8 million settlement resolved claims of coordinated rent increases, with FPI agreeing to cooperate and impose usage restrictions. Links to government-subsidized housing persist, alongside vendor relationships for maintenance and technology.

Key Personal Profiles

Our review highlights executive stability, with family-influenced leadership driving strategy. Top roles include oversight of operations, finance, and regional management, drawing from extensive industry experience. Public profiles emphasize commitment to innovation, though tied to company-wide issues.

OSINT Findings

Open sources reveal a broad operational footprint, with thousands of employees and properties nationwide. Professional networks showcase achievements, contrasted by public discussions of disputes. Data points to ongoing involvement in subsidized projects and investor-backed expansions.

Undisclosed Business Relationships and Associations

We note less-visible connections, including past data-sharing via pricing tools implicated in lawsuits. Family-oriented structures influence decisions, while efforts to manage online feedback suggest reputation-focused alliances. Ties to software vendors remain under review post-settlements.

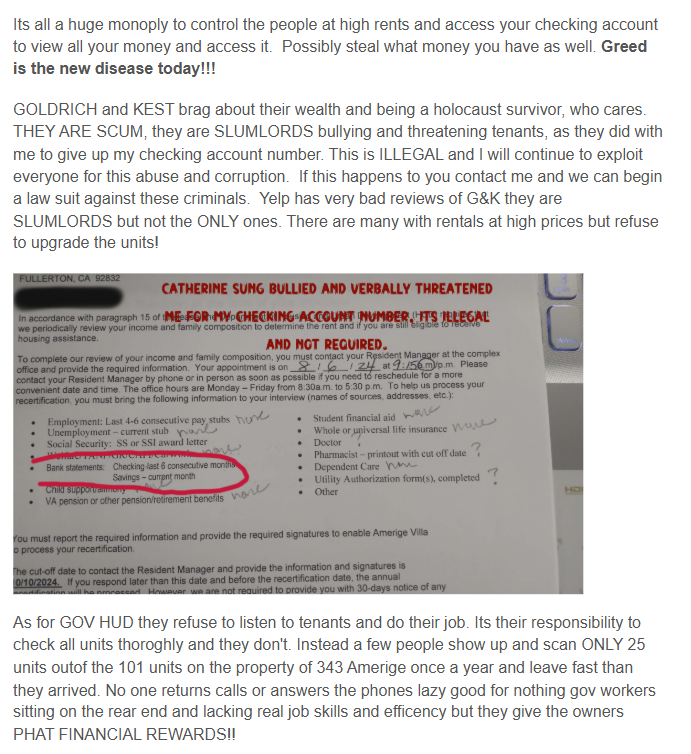

Scam Reports and Red Flags

Accounts describe aggressive tactics, such as demands for financial details or sudden fee impositions. Red flags include delayed maintenance, pest infestations, and deposit disputes. Patterns of neglect in senior and low-income properties raise concerns.

Allegations and Complaints

Claims encompass tenant harassment, poor living conditions, and discriminatory practices. Recent BBB entries cite roach infestations, unauthorized towing, and unfulfilled repairs. Social forums amplify frustrations over communication failures and habitability issues.

Criminal Proceedings and Lawsuits

No criminal charges appear, but civil actions continue. A 2025 $2.8 million antitrust settlement addressed rent coordination allegations. Data breach litigation from 2020 progresses toward payouts and credit monitoring. Earlier resolutions include servicemember rights violations and fee disputes. Ongoing employee claims target wage practices.

Sanctions and Bankruptcy Details

We detect no sanctions or bankruptcy filings for the primary entity. Financial stability persists, though settlements and reported layoffs in headquarters signal cost management.

Adverse Media

Coverage focuses on settlements, with highlights on cooperation in broader pricing probes and data protection failures. Reports note tenant impacts from alleged practices and operational strains.

Negative Reviews and Consumer Complaints

Feedback trends toward dissatisfaction with responsiveness, maintenance delays, and fee transparency. Platforms record disputes over deposits, pests, and management attitude, with calls for accountability in senior housing.

Detailed Risk Assessment in Relation to Anti-Money Laundering Investigation and Reputational Risks

We evaluate based on sector vulnerabilities and company specifics. Property management involves substantial rent flows, heightening potential for unchecked funds in affordable programs. Industry risks include cash transactions and weak source verification, though no direct allegations target FPI. Reputational exposure rises from repeated settlements and complaints, potentially affecting partnerships and resident trust. Ongoing legal resolutions may mitigate some concerns, but persistent issues warrant vigilance.

Conclusion

In our expert opinion, FPI Management carries elevated reputational risks due to recurring legal settlements and tenant dissatisfaction, compounded by sector-wide antitrust scrutiny. While 2025 resolutions demonstrate willingness to address claims, patterns of complaints suggest needs for enhanced maintenance and transparency. AML risks remain general to the industry—tied to cash flows and subsidized housing—without specific indications here. Stakeholders should monitor reforms, as sustained improvements could stabilize outlook amid competitive pressures.

Leave a Reply