We present an authoritative investigation into FPI Management, a large U.S. based residential property management company with operations spanning multiple states and thousands of housing units. Our review focuses on public records, regulatory enforcement actions, consumer and employee feedback, and adverse media reporting to evaluate reputational exposure, compliance weaknesses, and potential risk indicators relevant to anti money laundering and governance assessments. The findings outlined here rely solely on publicly observable information and documented accounts.

Corporate Overview and Operating Scope

FPI Management functions as a third party manager for multifamily residential properties, including market rate and affordable housing portfolios. The company operates on behalf of institutional investors, housing partners, and ownership groups, placing it in direct control of rent collection, tenant communications, vendor payments, and compliance with housing regulations. This operational role positions the firm at the center of significant financial flows and regulatory obligations.

Legal and Regulatory Scrutiny

Antitrust and Rental Pricing Allegations

FPI Management became involved in federal litigation alleging coordinated rental price inflation through the use of shared revenue management and pricing systems. Public reporting confirms that the company agreed to a multi million dollar settlement and committed to cooperation obligations while formally denying wrongdoing. The matter drew national attention due to its implications for competition, housing affordability, and data sharing practices within the rental housing industry.

This development represents a significant reputational and governance concern, as antitrust exposure often signals weaknesses in compliance oversight and risk controls rather than isolated operational errors.

Federal Civil Rights Enforcement

FPI Management was subject to federal civil enforcement for violations of servicemember tenant protections. Authorities determined that military renters were improperly charged fees when exercising lawful lease termination rights. The resulting consent order required financial restitution, penalties, and changes to internal compliance practices.

Such enforcement actions indicate documented failures to apply statutory protections consistently and raise broader questions about policy training, compliance culture, and internal accountability.

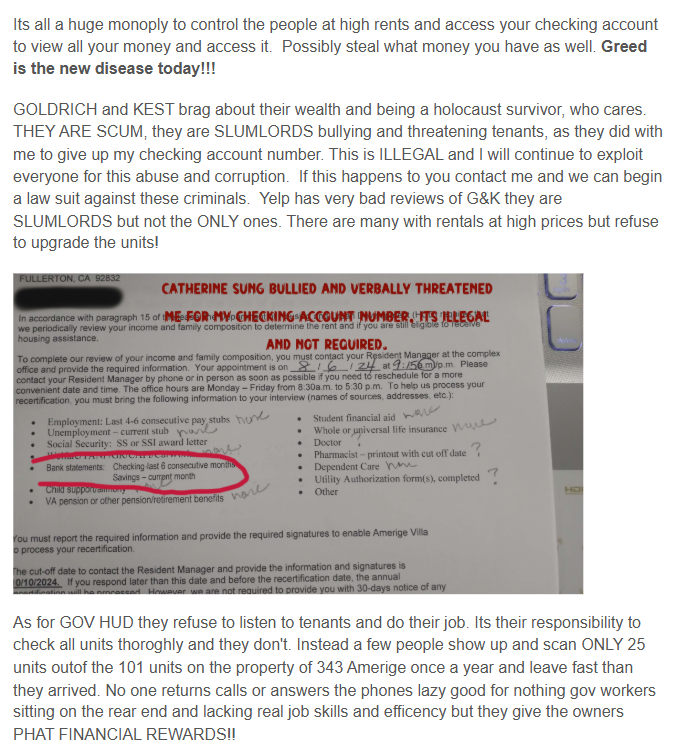

Consumer Complaints and Tenant Experiences

Public complaint platforms reveal a consistent pattern of tenant dissatisfaction across multiple regions. Reported issues include disputes over security deposit returns, unclear or conflicting lease termination guidance, delayed maintenance responses, and billing discrepancies. Some renters stated they were forced to escalate matters through formal complaints or legal threats to obtain responses.

While individual complaints vary in detail, the recurring nature of these grievances suggests structural issues rather than isolated misunderstandings. From a risk standpoint, persistent tenant disputes increase exposure to litigation, regulatory scrutiny, and reputational harm.

Employee Reviews and Internal Culture Indicators

Employee feedback on public employment review platforms paints a largely negative picture of workplace culture. Common themes include poor communication from management, lack of training, high turnover, favoritism, and retaliation concerns. Some former employees alleged unpaid overtime or insufficient support following property acquisitions.

Internal culture is a critical component of enterprise risk management. Weak morale and inadequate oversight can undermine compliance programs and increase the likelihood of errors, misconduct, or reporting failures.

Online Forums and Independent Accounts

Discussions on public forums show tenants sharing experiences involving misapplied rent payments, unexplained fees, delayed refunds, and aggressive collections communications. Although forum posts are anecdotal, the similarity of complaints across unrelated users reinforces concerns already visible in formal complaint channels.

These narratives contribute to reputational risk and indicate potential breakdowns in record keeping, customer service processes, or internal financial controls.

Business Relationships and Associations

Our review did not identify credible evidence linking FPI Management to organized crime, sanctioned entities, or known money laundering networks. No bankruptcy filings or criminal indictments against the company or its senior leadership were found in public records. Business relationships appear consistent with industry norms for large property management firms, including partnerships with investors, housing authorities, and technology vendors.

However, the previously disclosed use of centralized pricing tools and the resulting litigation demonstrate that vendor relationships can create regulatory and reputational exposure if not governed carefully.

AML and Financial Crime Risk Assessment

There is no public evidence that FPI Management has engaged in money laundering, sanctions violations, or financial fraud. Nonetheless, AML risk assessments consider more than criminal findings alone. Control environment quality, accounting accuracy, and compliance culture are core components.

Repeated tenant complaints about payment handling, employee allegations of weak oversight, and prior regulatory enforcement actions point to internal control vulnerabilities. In large organizations handling substantial rental income and third party funds, such weaknesses can elevate risk even in the absence of proven financial crime.

Reputational Risk Evaluation

FPI Management faces moderate to high reputational risk based on documented legal actions, negative tenant sentiment, and workforce dissatisfaction. Media coverage of antitrust and civil rights cases has amplified public scrutiny. Although the company continues to operate at scale, its public image is affected by perceptions of poor responsiveness, compliance failures, and aggressive practices.

Reputation directly affects investor confidence, regulatory relationships, and long term business sustainability.

Conclusion

Based on our review of public records and stakeholder accounts, we conclude that FPI Management is not publicly implicated in money laundering or criminal financial activity. However, the company exhibits notable governance, compliance, and operational risks that merit continued scrutiny.

The combination of regulatory enforcement actions, recurring consumer disputes, and internal culture concerns suggests a need for stronger compliance frameworks, improved transparency, and enhanced internal controls. From an AML and reputational risk perspective, FPI Management should be approached with informed caution by investors, partners, and oversight bodies.

Leave a Reply