Introduction

We approach Exness.com with the expectation that a global online trading platform operating at scale must uphold the highest standards of transparency, fairness, and operational integrity. In the retail trading ecosystem, trust is not a marketing feature but a structural requirement. When traders begin to publicly document patterns of disputed trade outcomes, unexplained account behavior, and perceived unilateral platform actions, those narratives warrant closer examination. Our analysis is grounded strictly in trader-reported experiences and complaint narratives circulated publicly, which collectively raise questions about risk exposure, reputational durability, and compliance posture. This article does not declare guilt or legal conclusions. Instead, it evaluates how recurring allegations, when viewed holistically, shape the risk profile of Exness.com from a reputational and anti-money laundering perspective.

The Platform’s Market Presence and Structural Complexity

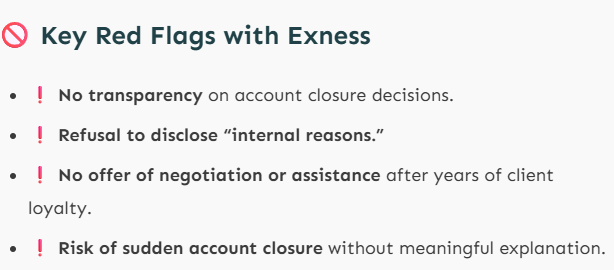

Exness.com presents itself as a technologically advanced trading venue offering access to leveraged financial instruments across global markets. Such platforms typically operate through layered corporate structures, regional entities, and cross-border operational arrangements. While this structure is common in the industry, it inherently introduces complexity around accountability, jurisdictional clarity, and dispute resolution. Trader complaints often reflect confusion regarding which internal entity controls account decisions, executes trades, or enforces risk rules. This perceived opacity becomes particularly problematic when disputes arise, as clients report difficulty identifying where responsibility lies within the broader organizational framework.

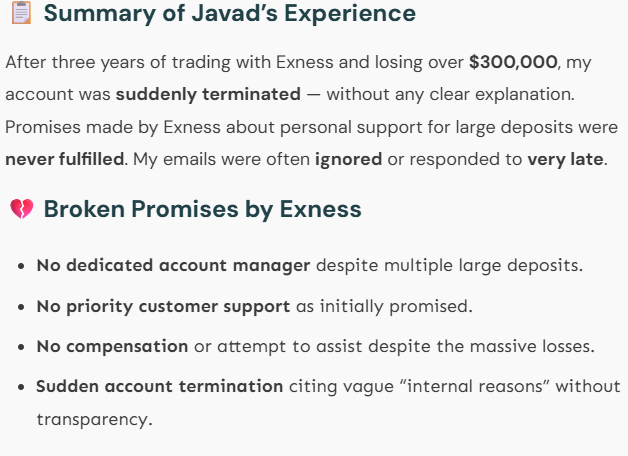

Trader Narratives of Account Interference

A recurring theme in reported complaints involves allegations that accounts were interfered with during profitable trading periods. Traders describe situations where positions were allegedly closed without authorization, leverage conditions were altered mid-trade, or execution behavior changed unexpectedly. These claims are often framed by complainants as platform-initiated actions that resulted in financial loss. While such allegations are not evidence of misconduct on their own, the consistency of these narratives contributes to a perception of imbalance between platform control and trader autonomy. In risk analysis, repeated claims of unilateral account intervention raise questions about governance controls and transparency of internal risk mechanisms.

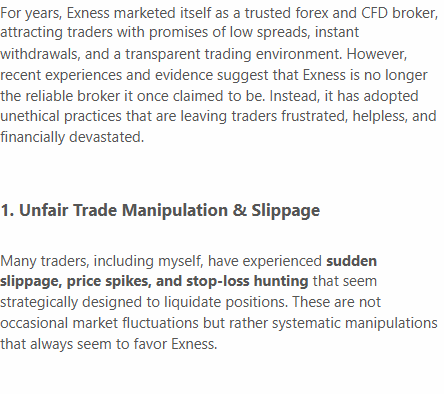

Disputed Trade Execution and Pricing Behavior

Another prominent area of concern centers on reported irregularities in trade execution. Traders allege slippage that exceeds expected parameters, execution delays during volatile periods, and price movements that appear inconsistent with external market feeds. In several narratives, complainants suggest that these execution outcomes disproportionately affect profitable trades. Whether these experiences stem from technical limitations, liquidity sourcing issues, or market volatility is difficult to independently verify. However, the perception of unfair execution alone can materially damage platform credibility and increase reputational risk.

Account Adjustments and Balance Discrepancies

Some traders report unexplained balance changes, including deductions described as adjustments or corrections. These actions are often communicated after the fact, with limited explanation that satisfies the affected user. From the trader’s perspective, such balance interventions feel opaque and unilateral. In financial services, post-hoc account corrections are particularly sensitive, as they directly impact user trust. Even when platforms reserve contractual rights to make adjustments, the lack of clear, real-time justification can amplify perceptions of unfairness and foster adversarial relationships with clients.

Customer Support Friction and Resolution Fatigue

Complaint narratives frequently describe prolonged exchanges with customer support that fail to resolve core issues. Traders recount cycles of repeated explanations, generic responses, and escalations that lead to no meaningful outcome. This experience contributes to what many describe as resolution fatigue, where users feel worn down by procedural complexity rather than supported by it. In reputational terms, ineffective dispute handling compounds the original grievance and increases the likelihood that dissatisfaction will be shared publicly.

Allegations of Selective Enforcement of Trading Rules

Another recurring allegation involves the selective or inconsistent enforcement of trading rules. Some traders claim that strategies appeared acceptable until they became profitable, at which point restrictions or penalties were allegedly applied. Whether accurate or not, this perception feeds a narrative that platform rules are applied opportunistically rather than consistently. For a trading platform, consistency of rule enforcement is central to credibility. Any perception of selective application undermines confidence in the fairness of the trading environment.

Perceived Power Imbalance Between Platform and Trader

Across complaint narratives, there is a strong sense of power asymmetry. Traders often express that dispute outcomes are predetermined by the platform’s internal interpretations, with limited external recourse. This perception is particularly acute in leveraged trading environments, where platforms control pricing feeds, execution logic, margin calculations, and risk thresholds. When traders feel they lack meaningful avenues for independent review, frustration escalates into reputational harm for the platform.

OSINT-Derived Risk Signals from Public Discourse

Open-source intelligence gathered from public discussions reflects a polarized perception of Exness.com. While some users report satisfactory experiences, a vocal subset details negative encounters in extensive narratives. From an AML and compliance standpoint, such polarization itself is a signal. Platforms with high volumes of unresolved complaints may attract enhanced scrutiny from financial partners, payment processors, and counterparties who monitor reputational indicators as part of ongoing risk assessments.

Business Relationships and Third-Party Dependencies

Online trading platforms depend heavily on third-party liquidity providers, technology vendors, payment intermediaries, and marketing affiliates. While these relationships are standard, they also introduce dependency risk. Traders sometimes speculate that execution issues or account adjustments stem from upstream liquidity constraints or internal risk management triggers tied to these relationships. Even when speculative, such narratives underscore the importance of transparency around how third-party dependencies influence trading outcomes.

Undisclosed Associations and Perceived Opacity

Some complainants express concern over what they perceive as insufficient disclosure regarding internal operations and affiliations. This does not equate to evidence of undisclosed business relationships, but it reflects a trust gap. In compliance analysis, perceived opacity can be as damaging as confirmed opacity, particularly when users already feel disadvantaged by platform actions. Transparency deficits magnify suspicion and elevate reputational exposure.

Scam Allegations as a Reputational Construct

The term scam appears frequently in trader narratives, though it functions more as an expression of frustration than a legal classification. From a risk perspective, the repeated use of such language is significant regardless of legal merit. Once a platform becomes associated with scam allegations in public discourse, reputational rehabilitation becomes increasingly difficult. Financial institutions and regulators often treat persistent scam labeling as a qualitative risk indicator warranting closer monitoring.

Criminal Proceedings, Lawsuits, and Sanctions Context

Within the scope of reported trader complaints, there are no substantiated claims of criminal convictions, formal sanctions, or finalized court judgments presented as fact. However, the absence of confirmed legal action does not negate reputational damage arising from persistent allegations. In risk analysis, reputational harm often precedes regulatory or legal consequences rather than following them.

Bankruptcy and Financial Stability Speculation

There are no verified claims within trader narratives indicating bankruptcy or insolvency. Nevertheless, some traders speculate about financial motivations behind disputed platform actions, particularly during periods of market volatility. Such speculation reflects distrust rather than evidence, but it contributes to an overall atmosphere of skepticism that can influence partner confidence and user acquisition.

Anti-Money Laundering Risk Considerations

From an AML perspective, the primary concern raised by these narratives is not illicit fund flows but operational transparency. Platforms that face frequent disputes, chargebacks, or account interventions may be flagged for enhanced due diligence by financial partners. High complaint volumes, unresolved disputes, and opaque account adjustments can intersect with AML monitoring frameworks that assess transactional integrity, auditability, and customer treatment fairness.

Reputational Risk and Long-Term Brand Erosion

Reputational risk emerges as the most significant exposure for Exness.com within the scope of these reported narratives. Trust, once eroded, is difficult to rebuild in the trading industry. Negative experiences tend to propagate rapidly through online communities, shaping perception among prospective users long before they interact with the platform directly. Even unproven allegations, when persistent, can materially affect brand equity.

The Compounding Effect of Public Allegations

Each unresolved complaint does not exist in isolation. Public discourse compounds individual grievances into broader narratives that define how a platform is perceived. Over time, these narratives can overshadow marketing claims and official communications. For Exness.com, the cumulative weight of trader allegations represents a strategic risk that extends beyond individual disputes.

Expert Opinion

In our Expert Opinion, the publicly reported trader complaints concerning Exness.com reveal a platform facing significant reputational pressure driven by allegations of opaque account management, disputed trade execution, and ineffective dispute resolution. While there is no confirmed evidence within these narratives of criminal conduct or regulatory sanctions, the consistency of trader dissatisfaction elevates operational and compliance risk. From an anti-money laundering and reputational risk perspective, the primary exposure lies in transparency deficits, dispute frequency, and erosion of user trust. For long-term stability, any platform in this position would need to prioritize clearer disclosure, stronger dispute governance, and demonstrable fairness in execution and account management. Absent such corrective measures, reputational risk may continue to intensify, attracting heightened scrutiny from financial partners and potentially constraining future growth.

Leave a Reply