Exness.com operates as an online trading platform that provides access to foreign exchange and contract-for-difference markets. It presents itself as a technology-driven service focused on efficient execution, accessibility, and user convenience. Through marketing and public communication, the platform emphasizes speed, reliability, and competitive trading conditions.

However, feedback shared by traders across various online communities suggests that actual user experiences sometimes differ from these expectations. Many traders describe difficulties related to accessing funds, managing accounts, executing trades, and receiving timely assistance from support teams. While not every user reports problems, the recurring nature of similar complaints indicates the presence of operational challenges that may affect a significant portion of the platform’s user base.

This article explores the main themes that appear in trader feedback and examines how these experiences may influence financial outcomes and trust in the platform.

Fund Accessibility and Transaction Handling

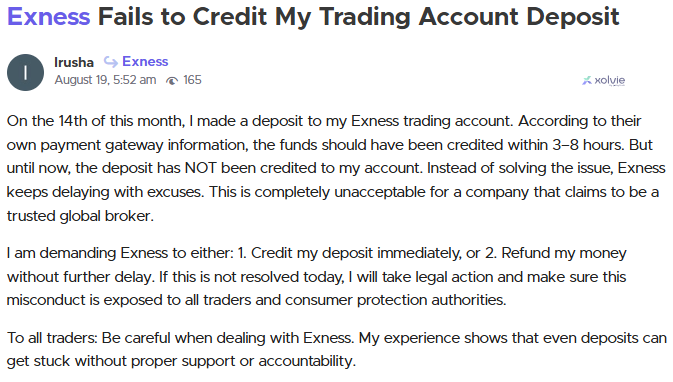

A central topic in trader feedback is the process of moving funds into and out of accounts. Depositing funds is generally described as straightforward, but withdrawing funds is often reported as more complicated.

Traders describe withdrawal requests taking longer than expected, sometimes remaining in pending status without clear explanation. In some cases, additional verification steps are introduced after the withdrawal request has already been submitted, creating further delays. These steps are sometimes explained as security or compliance checks, but users frequently state that the requirements were not clearly communicated beforehand.

This unpredictability makes it difficult for traders to plan their finances. Traders often rely on timely access to funds to manage risk, cover expenses, or reinvest capital. When withdrawals become uncertain, traders lose a sense of control over their own money.

The lack of clarity around processing timelines and conditions also creates anxiety. Users may worry about whether their funds are safe, when they will become available, or whether further restrictions might be applied.

Account Access and Functional Limitations

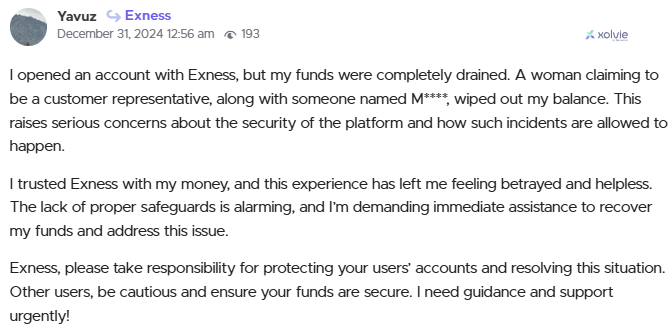

Another commonly discussed issue is restricted account access. Some traders report being unable to log in, trade, or withdraw funds due to account reviews, limitations, or suspensions.

These restrictions are often explained in general terms, such as internal policy checks or compliance procedures. However, traders frequently say they are not given detailed explanations or timelines for resolution. This uncertainty can be particularly stressful when users have open positions or significant balances in their accounts.

When access to an account is restricted, traders lose the ability to respond to market movements or manage risk. This can result in unintended losses, missed opportunities, or prolonged exposure to volatile conditions.

Even temporary restrictions can undermine trust, as traders begin to question whether their access to the platform is truly under their control.

Order Processing and Pricing Behavior

Order execution quality is a major factor in trading performance. Traders expect that orders will be executed at or near the prices displayed on the platform, within reasonable market conditions.

However, feedback suggests that some users experience differences between displayed prices and actual execution prices. Slippage is reported as a frequent issue, particularly during periods of higher market activity. While slippage is a known phenomenon in trading, traders express concern when it appears unusually frequent or severe.

Some users also report that spreads change rapidly or widen unexpectedly, affecting trade outcomes. These changes can trigger stop-loss orders or reduce profitability in ways that traders did not anticipate.

In addition, there are reports of delays or failures when attempting to close positions manually. When a trader cannot exit a position during unfavorable conditions, losses may increase beyond planned limits.

These execution-related issues raise questions about consistency and reliability, especially for traders who rely on precise timing and pricing.

Platform Performance and Technical Stability

The technical performance of a trading platform plays a crucial role in user experience. Traders depend on stable connections, responsive interfaces, and accurate data to make informed decisions.

Some users report technical problems such as platform freezes, slow loading times, delayed updates, or connection interruptions. These issues can interfere with placing orders, adjusting positions, or accessing account information.

Such problems are particularly impactful during periods of high market volatility, when prices move quickly and timely action is essential. Even brief interruptions can lead to missed trades or unintended losses.

Over time, repeated technical disruptions can reduce confidence in the platform’s reliability and discourage active trading.

Promotional Programs and Usage Conditions

Exness.com offers various promotional incentives, such as bonuses or special trading conditions. While these promotions are designed to attract and retain users, traders report that the associated terms and conditions are not always fully understood at the time of participation.

Some users describe discovering restrictions related to promotions only after attempting to withdraw funds or close accounts. These restrictions may limit withdrawals, impose additional trading requirements, or alter account functionality.

The complexity of promotional terms can create confusion and frustration, especially for new traders who may not fully understand how such incentives work.

Clear and transparent communication of promotional conditions is essential to prevent misunderstandings and ensure that traders can make informed decisions.

Support Services and Issue Resolution

Customer support plays an important role in resolving platform issues and maintaining user trust. Traders rely on support teams to assist with technical problems, financial inquiries, and account-related concerns.

However, many users report dissatisfaction with the responsiveness and effectiveness of support services. Common complaints include long response times, generic replies, and limited follow-up.

When dealing with issues involving funds or account access, delays in support can increase financial uncertainty and emotional stress. Traders may feel that their concerns are not being taken seriously or addressed promptly.

Effective support requires not only timely responses but also clear explanations and practical solutions.

Data Security and Account Protection

Security is a fundamental concern in online financial services. Traders expect that their personal information, account data, and funds are protected against unauthorized access.

Some users report concerns related to suspicious activity, login alerts, or unexpected changes in their accounts. While not all reports indicate platform-level security failures, the perception of vulnerability can undermine trust.

Strong security measures, clear communication, and transparent incident handling are essential for maintaining confidence in the platform.

Policy Communication and Transparency

A recurring theme in trader feedback is the lack of clarity around platform policies. Traders often report that certain rules or limitations become apparent only after an issue arises.

These may include withdrawal requirements, account review triggers, trading restrictions, or promotional conditions. When policies are not clearly communicated in advance, traders cannot accurately assess risk or make informed decisions.

Transparency helps build trust and allows users to understand what is expected of them and what they can expect from the platform.

User Experience and Practical Implications

The combination of delayed withdrawals, restricted accounts, execution inconsistencies, technical issues, unclear promotions, and weak support creates a complex user experience.

For traders, these factors translate into financial uncertainty, emotional stress, and reduced confidence in the platform. Trading already involves risk, and operational uncertainty adds an additional layer of unpredictability.

Over time, these experiences influence whether traders continue using the platform, recommend it to others, or seek alternatives.

Impact on Different Types of Traders

Different traders are affected in different ways by these challenges.

New traders may be less aware of potential risks and may not recognize early warning signs. They may interpret delays or restrictions as normal until problems escalate.

Experienced traders may be more sensitive to execution quality and technical stability, and may become frustrated when the platform does not meet their operational needs.

Both groups are impacted by transparency, reliability, and support quality.

Trust and Reputation

Trust is central to financial services. Traders entrust platforms with their money, data, and trading activity. When operational issues occur frequently or are poorly handled, trust erodes.

Reputation is shaped not only by marketing but by consistent performance and accountability. The volume and consistency of trader feedback influence how the platform is perceived in the broader trading community.

Maintaining a positive reputation requires ongoing investment in technology, support, transparency, and user protection.

Ethical and Operational Responsibility

Trading platforms have an ethical responsibility to operate fairly, communicate clearly, and protect users from unnecessary risk.

Operational decisions related to account restrictions, fund handling, execution systems, and support services directly impact user outcomes. When these systems are unclear or unreliable, traders bear the consequences.

This places a responsibility on platforms to continuously improve processes and address recurring concerns.

Conclusion

Exness.com operates in a competitive and complex financial environment. While it offers access to global markets, trader feedback highlights operational challenges related to fund access, account availability, execution consistency, technical stability, promotional clarity, support responsiveness, and policy transparency.

These issues do not affect every user, but their recurring nature suggests areas where traders may face increased risk and uncertainty. For individuals considering or using the platform, understanding these factors is important for managing expectations and protecting financial interests.

Careful review of platform terms, regular monitoring of account activity, and cautious risk management are essential when engaging with any online trading service.

Leave a Reply