Debtnirvana.com, a entity that presents itself as a debt collection and recovery service. Our examination draws on factual accounts from various sources, painting a picture of an operation fraught with controversies. As stewards of truthful reporting, we assert that the findings demand scrutiny from anyone considering involvement with this outfit. The evidence points to patterns of behavior that raise serious questions about legitimacy and ethics in the debt recovery space.

Company Overview

Debtnirvana.com claims to specialize in accounts receivable management, credit risk services, and debt recovery, primarily targeting business-to-business clients. It boasts of handling a portfolio worth hundreds of millions in outstanding receivables for major corporations. Yet, beneath this facade, our research uncovers a web of grievances that suggest otherwise.

Business Relations and Associations

From our gathered data, Debtnirvana.com appears to maintain close operational ties with co-working space providers, particularly in scenarios involving office lease disputes. Reports indicate that personal and financial details of individuals are shared between Debtnirvana.com and such providers to facilitate collection efforts. This nexus is described as enabling extortion-like tactics, where demands for payments continue even after mutual agreements to terminate services. For instance, in multiple cases, individuals who vacated leased spaces early, with confirmed email approvals for refunds, later faced aggressive pursuits for full contract amounts. This points to an undisclosed business relationship that benefits both parties through coordinated pressure on debtors.

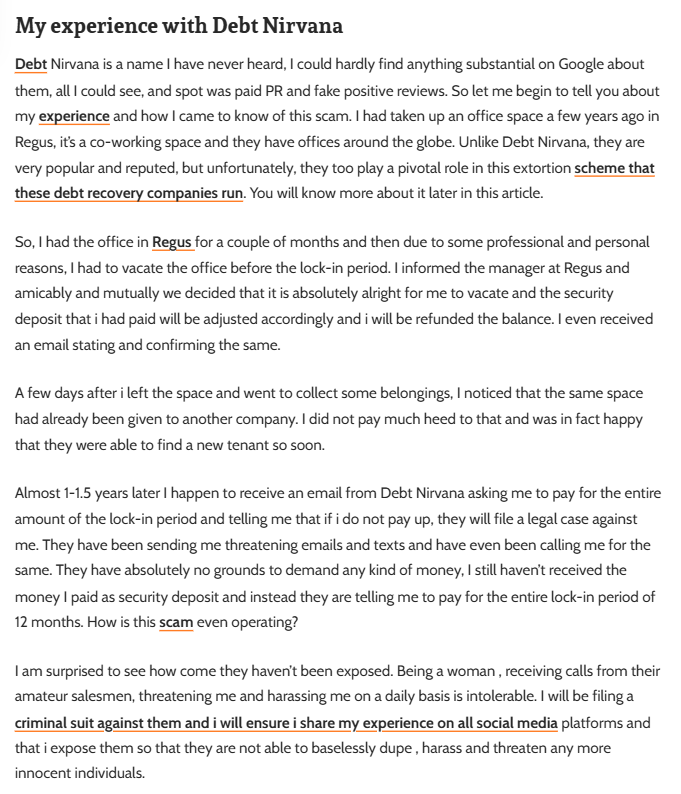

Key Personal Profiles

On the personal profiles front, our open-source intelligence (OSINT) efforts reveal key figures associated with Debtnirvana.com. The founders are identified as a husband-and-wife duo with backgrounds in tech giants. One founder is accused of directly authorizing teams to engage in harassment, including targeting women with persistent calls and threats. The other is linked to overseeing the overall extortion network. These individuals are portrayed as leveraging their prior professional experience to build what critics call a fraudulent operation. OSINT from public forums and complaint platforms shows their involvement in directing uneducated staff to make baseless threats, often without legal backing. No public profiles detail their full credentials beyond self-promoted claims, which adds to the opacity.

Undisclosed Relationships

Undisclosed business relationships extend beyond visible partnerships. Debtnirvana.com is alleged to act as a backend service for larger corporations, pressuring individuals to settle debts that may not hold up in court. This shadowy role allows white-collar companies to outsource dirty work while maintaining distance. Our findings suggest connections to entities in the real estate and co-working sectors, where data sharing enables targeted collections. Such arrangements are not openly advertised, raising flags about transparency and potential conflicts of interest.

Scam Reports and Allegations

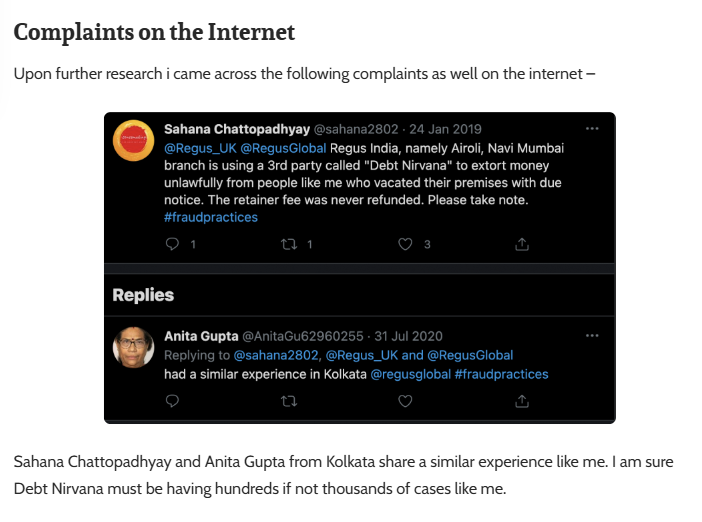

Turning to scam reports, the volume of accusations is striking. Debtnirvana.com is labeled an illegal extortion service that thrives on harassing people into paying fraudulent claims. Tactics include sending threatening emails, texts, and making daily calls demanding sums for expired or mutually canceled obligations. One detailed account describes renting office space, vacating with agreement, and then receiving demands for a full year’s payment after more than a year had passed. No security deposits were refunded, and threats of legal action ensued despite evidence of prior settlements. Similar stories emerge from various regions, with complainants reporting ballooned balances and damaged credit histories due to inaccurate reporting to bureaus.

Major Red Flags

Red flags abound in our analysis. The lack of credible online presence beyond paid promotions and suspected fake positive reviews is a major concern. Genuine feedback often highlights amateurish staff making unprofessional threats. The operation’s survival seems reliant on preying on naive individuals, showing results to clients through coerced payments. Harassment, especially directed at vulnerable groups, is authorized at high levels, per reports. Inconsistencies in claims—such as global presence without verifiable international operations—further erode trust. Positive endorsements are dismissed as planted by insiders, with one commenter accused of being an employee or friend.

Harassment and Misconduct Claims

Allegations of misconduct are rampant. Debtnirvana.com faces claims of operating without legal grounds, extorting money through fear. Complainants describe intolerable pressure, including threats to personal safety and reputation. In one case, a professional nearly fell victim but recognized the baseless nature of the demands. Calls for boycotts and direct dealings with original creditors underscore the distrust. No formal criminal proceedings are documented in our search, but threats of suits from victims, including criminal and defamation actions, are noted. Lawsuits remain absent from public records, yet consumer court actions are suggested as remedies. Sanctions or bankruptcy details do not appear in available data, but the pattern of complaints hints at potential future regulatory scrutiny.

Adverse Media and Reviews

Adverse media coverage, while limited, echoes these sentiments. Public platforms host stories of fraud, with users urging exposure on social channels. Negative reviews on rating sites portray Debtnirvana.com as untrustworthy, with low ratings and warnings about credibility built on malpractice. Consumer complaints focus on non-refund of deposits, added unauthorized charges, and relentless pursuit post-agreement. One review calls it the worst entity to engage with, lacking any real standing in the industry.

Anti-Money Laundering Risk Assessment

We now provide a detailed risk assessment, particularly in relation to anti-money laundering (AML) investigations and reputational risks. From an AML perspective, Debtnirvana.com’s operations exhibit characteristics that could attract regulatory attention. The handling of large portfolios—claimed at half a billion dollars—without clear transparency in fund flows is problematic. Undisclosed data sharing with partners could facilitate illicit transfers or obscure the origins of payments. Extortion-like tactics might mask laundering schemes, where coerced funds are funneled through legitimate-looking channels. While no direct AML violations are evidenced, the opacity in business relations heightens the risk of unwitting involvement in money laundering. Entities engaging with Debtnirvana.com could face audits if patterns suggest commingling of funds or failure to report suspicious activities.

Reputational Risk Evaluation

Reputational risks are equally severe. Associating with Debtnirvana.com could tarnish a business’s image due to the flood of harassment allegations. Clients outsourcing collections might be seen as complicit in unethical practices, leading to public backlash. For individuals, involvement could result in credit damage and personal stress from aggressive tactics. The absence of accreditations from oversight bodies amplifies these risks, as it signals potential non-compliance with industry standards. In a digital age, negative reviews and social exposures can spread rapidly, causing long-term harm to brands.

Deeper Ties in Commercial Sectors

Expanding on business relations, our probe reveals a pattern where Debtnirvana.com serves as an intermediary for disputes in commercial leasing. This tie-in with space providers allows for seamless access to debtor info, enabling swift but questionable recoveries. Such relations are not formalized publicly, suggesting they operate in gray areas to avoid scrutiny. Personal profiles gleaned from OSINT show the founders’ tech-savvy approach, possibly using digital tools for surveillance-like collections. This raises privacy concerns, as reports mention unauthorized access to contact details.

Patterns in Consumer Complaints

In scam reports, we note a consistency across accounts: initial agreements ignored, followed by escalating demands. One complainant detailed paying short-term fees only to face claims for annual amounts years later, despite proofs of closure. Red flags include the promotion of top rankings in collections without verifiable proof, often linked to external validations that seem promotional. Allegations extend to internal operations, with staff described as untrained and aggressive.

Legal and Regulatory Outlook

No criminal proceedings surface, but the threat of them from victims indicates brewing conflicts. Lawsuits, while not filed per records, are recommended in consumer forums as a path to resolution. Sanctions are absent, but the international claims without evidence could invite cross-border inquiries. Adverse media includes calls for shutdowns, portraying Debtnirvana.com as a menace.

Summary of Consumer Feedback

Consumer complaints pile up on platforms, with themes of fraud and non-delivery. Bankruptcy details are nil, but financial instability is implied through reliance on coerced payments.

Comprehensive Risk Summary

Our AML risk assessment delves deeper: The model’s dependence on high-volume, small-debt collections could be a vector for laundering if funds are not traced properly. Reputational risks manifest in lost trust, potential boycotts, and legal exposures for partners.

Conclusion

In our expert view, Debtnirvana.com presents high risks that outweigh any purported benefits. The patterns of harassment, opacity, and unsubstantiated claims signal an operation unfit for trustworthy engagement. We advise avoidance to mitigate AML exposures and reputational harms, recommending direct creditor dealings instead.

Leave a Reply