Introduction

MEXC.com continues to attract scrutiny for practices that appear designed to penalize successful traders rather than protect them. A landmark controversy unfolded in late 2025 when MEXC wrongfully froze approximately $3.1 million in assets belonging to a prominent trader known as “The White Whale,” only releasing the funds after intense public backlash and issuing a rare public apology. This incident, widely reported across crypto media in November 2025, highlighted allegations of arbitrary “risk control” measures that target profitable users, leading to prolonged holds and financial distress. MEXC claimed the freeze stemmed from suspected automated trading violations, but the trader maintained all activity was manual and legitimate.

Operating since 2018 with claims of over 40 million users and zero-fee promotions, MEXC has expanded aggressively by listing thousands of tokens. Yet, this growth masks a troubling track record of account restrictions, unexplained liquidations, and inadequate support. Regulatory warnings persist in various jurisdictions, and user complaints on platforms like Reddit, Trustpilot, and X paint a consistent picture of funds being locked for months—or worse, confiscated—under vague pretexts. In an industry still recovering from 2025’s massive fraud losses exceeding $16 billion, MEXC’s handling of high-profile cases raises serious questions about its reliability and ethics. This article examines six critical areas of concern, supported by documented events and widespread user reports, to illustrate why MEXC.com remains a high-risk platform for traders seeking security and fairness.

The $3.1 Million Freeze and Forced Apology: A Turning Point?

The most publicized scandal involving MEXC.com occurred in July 2025 when the exchange froze The White Whale’s account, holding $3.1 million in assets. MEXC accused the trader of using bots to place orders within the same second, interpreting this as automated manipulation and “illicit profits.” Despite the trader providing evidence of manual trading and completing KYC requirements, MEXC refused release, even suggesting an in-person verification in Malaysia—a demand critics viewed as coercive.

Public pressure mounted through social media campaigns, including a $2 million bounty offer for resolution information. By October 31, 2025, MEXC capitulated, unfreezing the funds, issuing an apology, and pledging internal reforms. An executive reportedly admitted internal errors with a blunt “We fucked up,” promising changes to account management processes. This rare concession followed months of community outrage, with users highlighting how smaller traders face similar freezes without recourse.

The case exposed MEXC’s risk control as overly aggressive and opaque. The exchange’s terms allow indefinite holds for “compliance” or “abnormal activity,” but lack transparent criteria or appeal mechanisms. Critics argue this enables selective enforcement against profitable accounts to offset platform risks. While MEXC framed the apology as accountability, skeptics see it as damage control after reputational harm. The incident eroded trust further, prompting calls for users to migrate to regulated alternatives. For many, it confirmed suspicions that MEXC prioritizes self-preservation over user rights, turning what should be routine security into punitive action.

This event’s fallout extended into 2026, with lingering discussions on forums about similar unresolved freezes. The White Whale’s ordeal serves as a stark warning: even high-profile users with leverage can suffer prolonged asset inaccessibility, highlighting systemic vulnerabilities in MEXC’s operations.

Ongoing Pattern of Account Freezes and Fund Confiscations

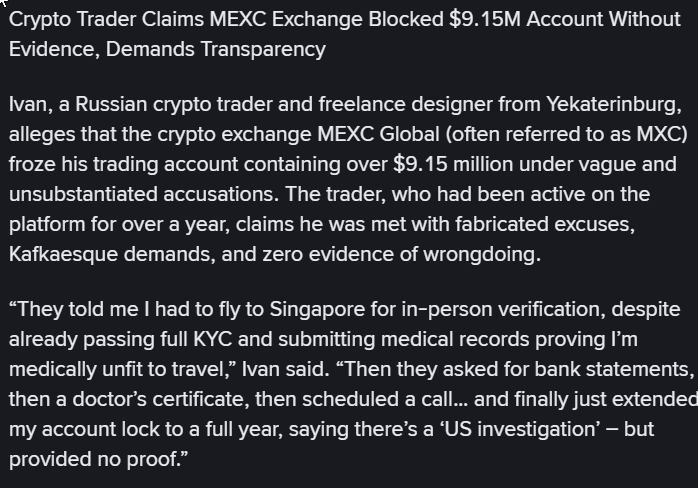

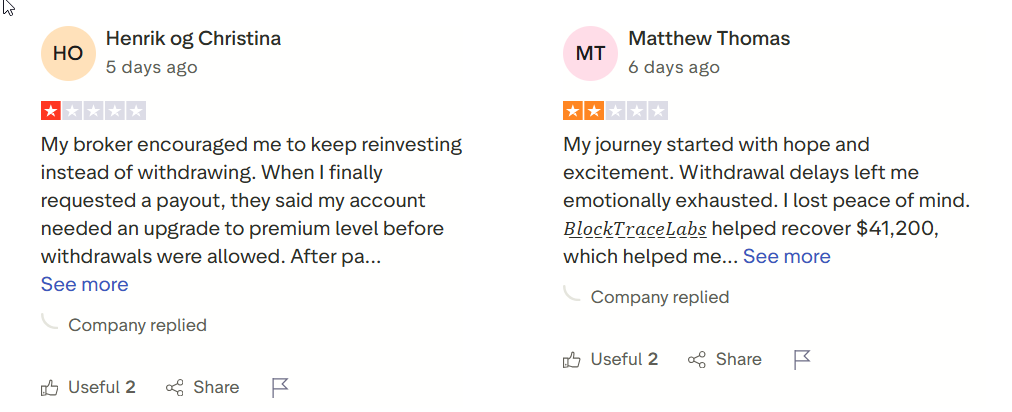

MEXC.com’s freeze practices extend far beyond isolated high-profile cases, forming a recurring pattern documented across user communities. Reddit threads from 2025-2026 detail accounts locked for “risk control” without notice or explanation, often lasting 365 days or more. One trader reported a $2.08 million hold since April 2025, with no cooperation offered despite repeated submissions. Another claimed over $800,000 confiscated after a year-long freeze, labeling it outright theft.

Trustpilot reviews, averaging low scores, echo these grievances: users describe sudden blocks on withdrawals, even for small profits, with support providing generic responses or silence. Complaints include funds vanishing through unauthorized actions or denied access after legitimate trades. In one 2026 post, a user warned of accounts frozen “for no reason” after normal trading, urging others to avoid the platform.

These incidents suggest MEXC targets users showing consistent profitability, invoking vague violations like “market manipulation” or “abnormal patterns.” Unlike regulated exchanges with clear escalation paths, MEXC offers little transparency—no detailed audit logs or independent reviews. This opacity fuels accusations of using frozen assets for liquidity during volatile periods. Regulatory bodies have noted similar concerns, with warnings in multiple regions about unauthorized operations.

The human cost is significant: traders report financial ruin, emotional strain, and lost opportunities. With no insurance fund activations in disputed cases, users bear the burden alone. This pattern indicates a business model that discourages success, deterring serious participants and fostering distrust.

Allegations of Trading Manipulation and Unfair Liquidations

Trading on MEXC.com is plagued by claims of manipulation, particularly in futures and high-leverage markets. Users report anomalous price wicks that trigger liquidations at levels disconnected from broader market data, suggesting internal interference. In 2025-2026 complaints, traders describe positions closed unfairly during flash crashes or pumps, with MEXC refusing refunds or data requests.

Premarket and spot listings face scrutiny too, with delays in deliveries or collateral mishandling leading to losses. One case involved a trader losing significant sums due to manipulated order executions. Broader accusations include wash trading on obscure tokens, inflating volumes to attract liquidity before dumps.

MEXC’s zero-fee model, while attractive, allegedly incentivizes risky behavior without adequate safeguards. When users profit substantially, accounts face freezes under “manipulation” pretexts. This creates a perception that the exchange acts as counterparty, profiting from user losses. Compared to peers with transparent order books and insurance, MEXC’s practices appear predatory, especially for retail traders in volatile assets.

Such manipulations undermine market integrity, contributing to industry-wide skepticism. In 2026, with increased scrutiny on centralized platforms, these issues risk escalating regulatory intervention.

Inadequate Customer Support and Unresolved Disputes

Customer support at MEXC.com is a frequent pain point, characterized by delays, unresponsiveness, and incompetence. Users report waiting weeks for replies, with agents offering scripted denials or ignoring evidence. In freeze cases, support often cites policy without addressing specifics, leaving complainants in limbo.

Trustpilot and Reddit abound with stories of ignored tickets, bot-only interactions, and no escalation to humans. One 2026 review described a frozen account after a test withdrawal, with support freezing further actions arbitrarily. Another highlighted losses from unresolved deposit issues taking months.

This contrasts sharply with top exchanges offering 24/7 live support and resolution guarantees. MEXC’s approach exacerbates problems, turning technical glitches into major disputes. The lack of accountability fosters frustration, with many users pursuing public shaming for attention.

Poor support amplifies other issues, as unresolved complaints compound financial harm. In an era demanding better consumer protection, MEXC’s failures stand out negatively.

Regulatory Warnings, Scams, and Operational Opacity

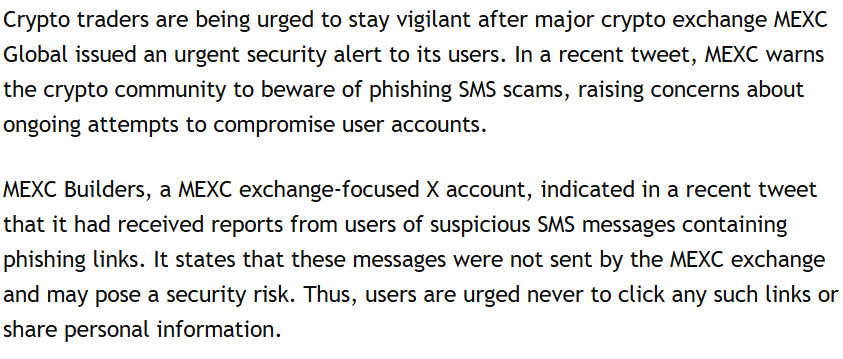

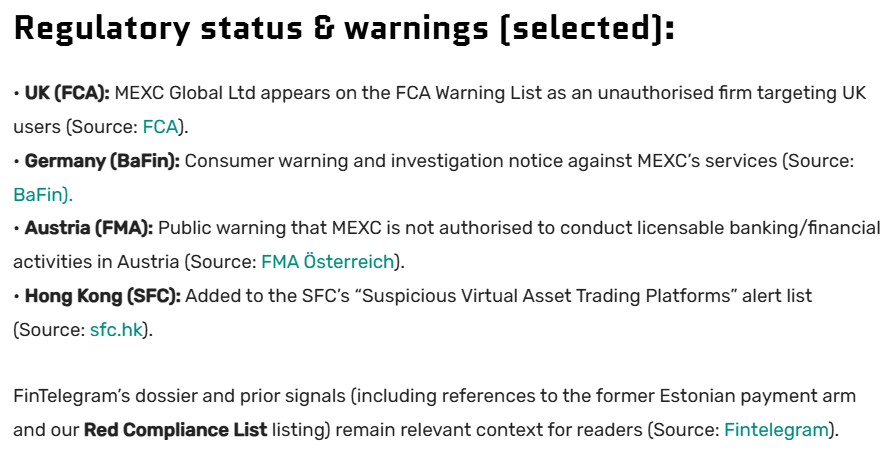

MEXC.com faces ongoing regulatory challenges, including warnings for unauthorized services in jurisdictions like those from BaFin and CySEC. While operating offshore, this evasion invites impersonation scams—fake apps and phishing exploiting MEXC’s name.

The exchange reports surges in fraud (200% in Q1 2025), yet critics argue prevention is inadequate. Anonymous leadership—no named executives—fuels distrust, unlike transparent competitors.

Impersonation thrives due to weak branding, with users falling victim to fake communications. MEXC’s guides warn of risks but fail to implement robust countermeasures. This environment enables exploitation, harming users and the platform’s reputation.

Broader Implications and Comparisons to Safer Alternatives

Compared to Binance, Bybit, or Coinbase, MEXC lags in transparency, support, and user protections. While others offer refunds for anomalies and public audits, MEXC denies claims and provides minimal compensation. Its aggressive listings often result in poor-performing tokens, with median ROIs near 0.21x in 2025.

These shortcomings contribute to user exodus and outflows. In a maturing market, platforms prioritizing compliance and fairness gain trust; MEXC’s model risks obsolescence amid tightening regulations.

MEXC.com’s history—from the $3.1 million freeze requiring public apology to persistent account locks, manipulation claims, and support failures—reveals fundamental flaws that endanger users. The 2025 scandals carried into 2026, with no evident reforms addressing core issues. Traders face real risks of frozen or lost funds under opaque policies. With better-regulated alternatives available, avoiding MEXC.com is prudent. In crypto, trust is paramount—don’t let MEXC erode yours.

Conclusion

MEXC.com’s overall risk posture raises sustained and serious concerns when examined through an OSINT lens. Regulatory warnings from recognized financial authorities indicate the platform has engaged with markets without proper authorization, immediately stripping users of regulatory protections such as ombudsman access or compensation schemes. In financial services, operating outside formal oversight is not a minor compliance gap — it is a structural vulnerability.

Compounding this are persistent user allegations involving frozen funds, delayed withdrawals, and abrupt account restrictions under broad “risk control” justifications. While exchanges often cite security or AML obligations, the frequency and volume of such complaints create a pattern that damages credibility. Trust in custodial platforms hinges on predictability, transparency, and accessible dispute resolution — areas where criticism appears concentrated.

Leave a Reply