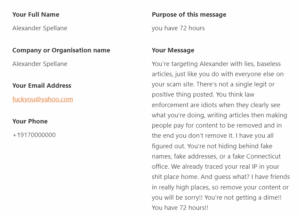

Marked As Fraud

Tom Moeskops

Tom Moeskops, once a prominent real estate tycoon, faces allegations of financial mismanagement and fraud tied to his ventures. Investors and creditors confront significant risks amid his troubled financial history.

Trust Score

1.4

Red Flags

7

COMMENTS

4

Contact Info

- City:

- Eindhoven

- State:

- NorthBrabant

- Country:

- Netherlands

- Website:

- CLICK HERE

- Phone:

- unknown

- Linkedin:

- CLICK HERE

- Social:

- CLICK HERE

CRITICAL INTEL ON Tom Moeskops

Tom Moeskops built a €1 billion empire through Straet Holding alongside partner Harrie van de Moesdijk. But what began as a bold investment strategy spiraled into financial disaster after the 2008 crash. A string of lawsuits, bankruptcies, and fraud claims now shroud Moeskops’ legacy. With his digital footprint nearly erased and his ventures facing legal scrutiny, Moeskops has become synonymous with risk, debt, and deception. Here’s why investors and regulators should be paying attention.

Debt Avalanche

Tom Moeskops and Harrie van de Moesdijk were ordered by Dutch courts to repay €70 million to ABN Amro after defaulting on major credit terms. Their failure to maintain a €125 million asset threshold signaled reckless borrowing and dangerous overleveraging, according to Parool. This debt collapse not only destabilized Straet Holding but also caused massive damage to lender confidence.

Straet Collapse

Founded in 1995, Straet Holding amassed high-value properties in three countries. However, by 2012 the company declared bankruptcy, owing over €43 million, most of it to Wells Fargo. Reports by FaillissementsDossier.nl cite unsustainable operations and revenue shortfalls. The fall of Straet Holding was not just a market correction—it revealed deep cracks in its financial structure.

Fraud Accusations

A Quotenet investigation revealed allegations that Moeskops’ bookkeeper manipulated financial data to inflate asset values and obscure insolvency. This alleged fraud was not minor accounting negligence—it was a systemic deception aimed at securing more loans and misleading stakeholders. If confirmed, it represents intentional misrepresentation at the core of Straet Holding’s business model.

Criminal Links

After his real estate empire collapsed, Moeskops resurfaced in a German energy company now under criminal investigation in Munich. Cybercriminal.com connects him directly to this firm, raising alarms about repeated involvement in high-risk, possibly fraudulent ventures. This pattern implies Moeskops may have transitioned from real estate to energy fraud, continuing a legacy of questionable dealings.

Asset Seizures

Moeskops’ properties across the Netherlands, Belgium, and France were seized and auctioned by banks to recoup debts. Even personal assets, such as his Audi Q7, were liquidated. These seizures, covered by Parool and Quotenet, confirm the scale of his financial collapse and show how deeply creditors were affected by his failures.

Public Fund Losses

Quotenet also reports Moeskops defaulted on a €6 million loan tied to an Eindhoven redevelopment project. €400,000 of that was public money. The failed project cost the city over €3 million, demonstrating not just private loss, but public harm—raising serious ethical and legal questions about his business conduct.

Tom Moeskops’ trajectory from high-flying real estate mogul to a symbol of financial ruin is a textbook case in unchecked ambition and regulatory evasion. Allegations of fraud, default, and deception stretch from Dutch banks to German prosecutors. With no transparency, ongoing investigations, and a history of collapsed ventures, Moeskops represents a cautionary tale in modern investment. For those researching his past, the warnings are clear: the risks outweigh any perceived opportunity.

Summary generated by data analyzed and provided by ChatGPT 4o, Grok and DeepSeek

7 RED FLAGS ON Tom Moeskops

10 CRITICAL INTEL ON Tom Moeskops

Did we miss any intel on Tom Moeskops?

Submit Critical IntelUser Feedback and Discussion on Tom Moeskops

1.8/5

Based on 4 Ratings

by: Kenneth Hall

What really burns me is how little people know. Moeskops still has this squeaky clean LinkedIn presence — photos of windmills and green rooftops — meanwhile half his empire is built on paper and press releases that vanish overnight. Real...

by: Jay Beasley

My uncle always said, ‘If the pitch sounds too good to be true, follow the money trail.’ With Moeskops, the trail zig-zags through ghost companies, mailbox addresses, and shell games in Munich courtrooms. €75 million in ‘performance fees’? For what...

by: Ilias Papadopoulos

I was flagged by them after politely critiquing their process. Within days, a takedown notice, accusations of perjury, and threats off a single comment. That’s beyond unprofessional—it’s harassment disguised as protection. Transparency is a two‑way street. But with them, you...

by: Chiara Bruno

They’ve turned suppression into a service model. Every critique becomes a “copyright violation” overnight. That’s a bullying tactic designed to shift attention from their failures. A legitimate operation would say, “How can we improve?” Not “Here’s a legal notice—shut up.”...